Onto Innovation (ONTO) Valuation Check as Investors Eye KeyBanc Strategic Outlook Meeting

Onto Innovation (ONTO) is back on investors radar after confirming it will join a KeyBanc virtual meeting to walk through its strategic roadmap and market outlook in semiconductor process control.

See our latest analysis for Onto Innovation.

The timing is interesting, because while Onto Innovation’s 90 day share price return of just over 50% suggests momentum is clearly building again, its one year total shareholder return remains slightly negative. This reminds investors how quickly sentiment can swing.

If this kind of setup has your attention, you might also want to see which other chip related names are gaining traction through high growth tech and AI stocks as investors position for the next upcycle.

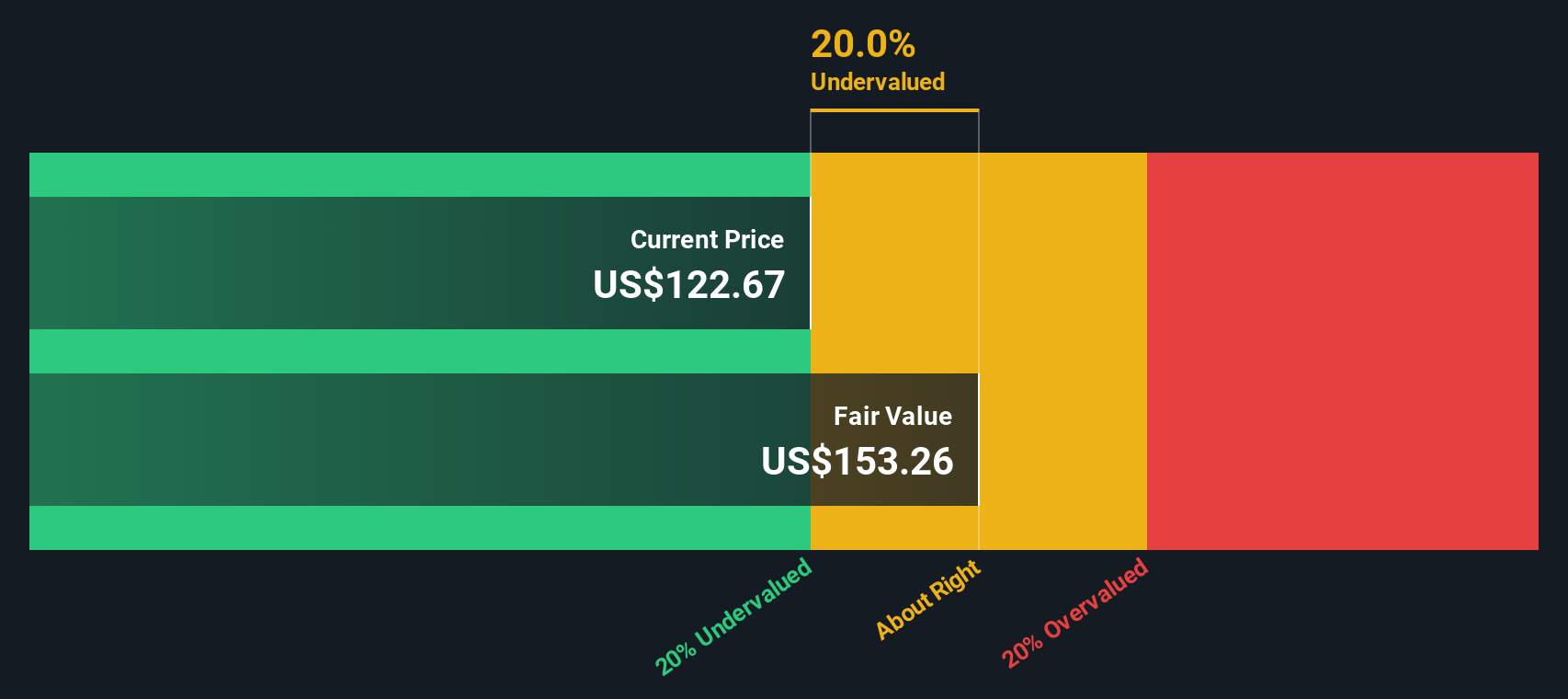

With shares now trading near record highs but only a modest intrinsic discount showing on valuation models, the real question is whether Onto Innovation still offers upside, or if markets are already pricing in its future growth.

Most Popular Narrative Narrative: 4% Overvalued

With Onto Innovation closing at $162.61 against a most popular narrative fair value of around $157, the storyline leans toward modest optimism already reflected in the price.

The pending Semilab acquisition will immediately expand Onto's product portfolio into electrical surface metrology and materials analysis capabilities, specifically in demand as industry transitions to exotic materials and heterogeneous integration. This is expected to enable both direct revenue accretion (~$130M annualized) and gross/operating margin uplift, further increasing earnings per share by 10%+ in the first year post-deal.

Curious how a single acquisition, layered on accelerating chip demand and richer margins, can still justify a premium price tag, even after the recent surge? Dive in to see which growth levers and profitability assumptions have to click perfectly for that fair value to hold together.

Result: Fair Value of $157 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this outlook could unravel if AI packaging demand underwhelms or if Semilab integration stumbles, which could delay expected margin gains and derail those premium valuation assumptions.

Find out about the key risks to this Onto Innovation narrative.

Another Angle on Valuation

Our SWS DCF model actually points to Onto Innovation trading about 2% below its fair value of $165.87, even as narrative based pricing flags a small premium to $157. If cash flows hint at slight upside while sentiment screens as full, which signal would you lean on?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Onto Innovation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Onto Innovation Narrative

If you see the story differently or want to pressure test your own assumptions against the data, you can build a personalized view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Onto Innovation.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh stock ideas tailored to your strategy before the next wave of returns moves on.

- Capture potential multi-baggers early by focusing on these 3591 penny stocks with strong financials that already back their tiny market caps with real financial strength.

- Ride the AI infrastructure boom by targeting these 27 AI penny stocks positioned at the heart of data, automation, and intelligent software trends.

- Consider quality at sensible prices with these 895 undervalued stocks based on cash flows that screen as attractive based on their future cash flows, not just recent headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com