Revenues Working Against Northern Graphite Corporation's (CVE:NGC) Share Price Following 27% Dive

The Northern Graphite Corporation (CVE:NGC) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The last month has meant the stock is now only up 6.7% during the last year.

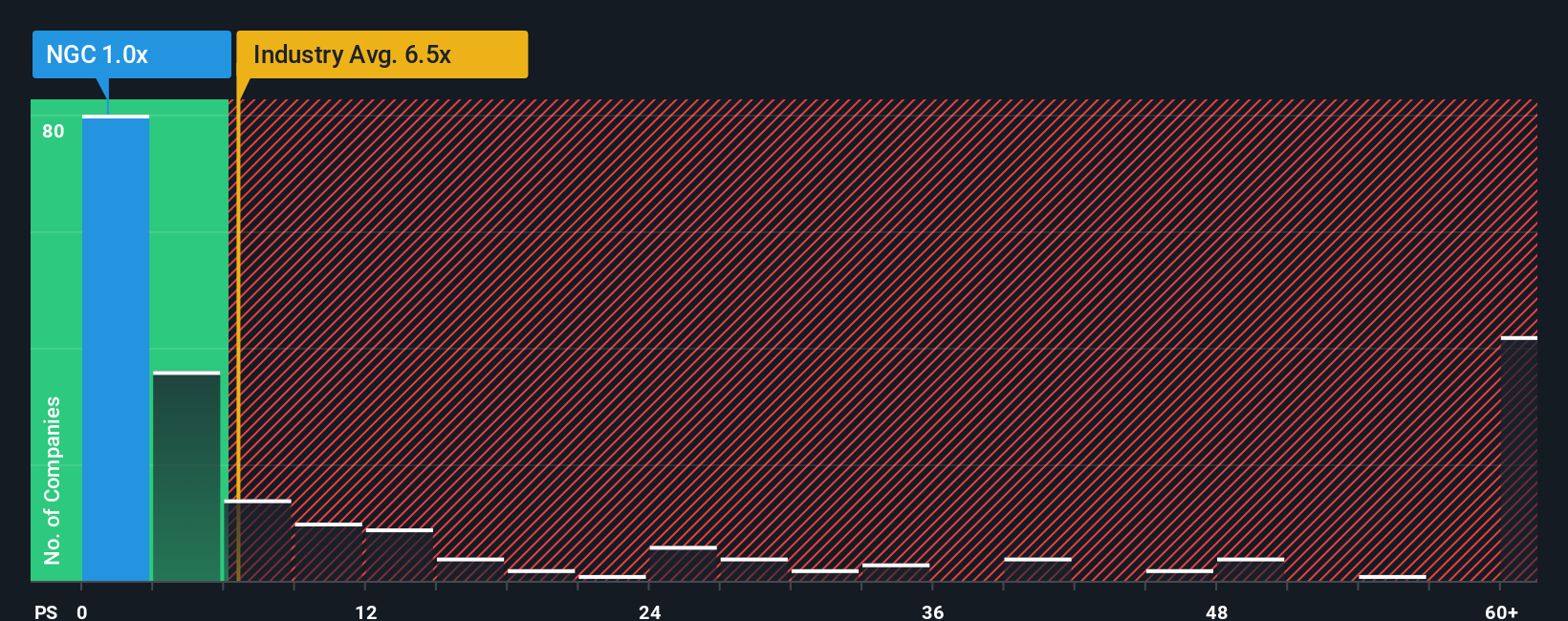

After such a large drop in price, Northern Graphite's price-to-sales (or "P/S") ratio of 1x might make it look like a strong buy right now compared to the wider Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 6.5x and even P/S above 42x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Northern Graphite

How Has Northern Graphite Performed Recently?

The recent revenue growth at Northern Graphite would have to be considered satisfactory if not spectacular. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Northern Graphite's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Northern Graphite would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 2.8%. The latest three year period has also seen an excellent 175% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 52% shows it's noticeably less attractive.

With this information, we can see why Northern Graphite is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Northern Graphite's P/S?

Shares in Northern Graphite have plummeted and its P/S has followed suit. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

In line with expectations, Northern Graphite maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Northern Graphite (including 2 which make us uncomfortable).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.