Is Capital One (COF) Still Undervalued After Its Strong Recent Share Price Performance?

Capital One Financial (COF) has been quietly rewarding patient shareholders, with the stock climbing over the past month and year as earnings and income growth outpace many traditional banks in a higher rate environment.

See our latest analysis for Capital One Financial.

With the share price now around $230.81, a strong year to date share price return of 29.15% and a striking five year total shareholder return of 172.43% suggest that momentum is still very much on Capital One Financial's side.

If Capital One's run has you thinking about where else compounding returns might be building, this could be a good moment to explore fast growing stocks with high insider ownership.

Yet even after a near 30 percent year to date surge and analysts pencilling in more upside, Capital One still trades at a discount to some valuation models. This leaves investors to ask whether this is a buying opportunity or if future growth is already priced in.

Most Popular Narrative: 11.3% Undervalued

Using a fair value estimate of about $260 per share versus the last close at $230.81, the most popular narrative argues that the market is still not fully crediting Capital One Financial's long term earnings power and capital return story.

The analysts have a consensus price target of $236.758 for Capital One Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $265.0, and the most bearish reporting a price target of just $160.0.

Want to see what justifies paying more for a bank that recently reported sharply lower margins, yet is projected to ramp profits and revenue at unusually fast rates? The narrative leans on a bold transformation in earnings, margin expansion, and a valuation multiple that looks more like a high growth disruptor than a traditional lender. Curious how those moving parts add up to that fair value? Dive in to unpack the assumptions behind this upgraded outlook.

Result: Fair Value of $260.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, hefty Discover integration costs, along with rising competitive spending on rewards and technology, could erode the margin expansion and earnings growth that this narrative depends on.

Find out about the key risks to this Capital One Financial narrative.

Another Lens on Value

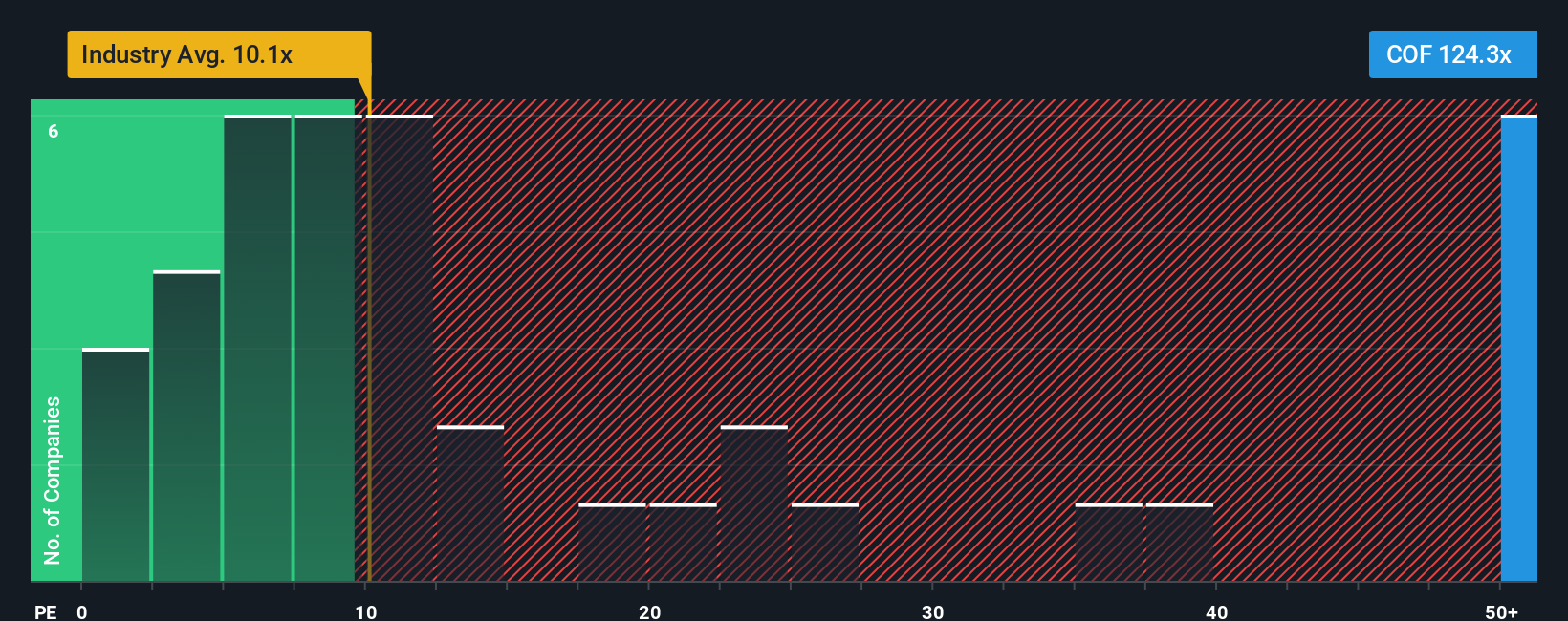

Not every model sees Capital One as a bargain. Its current price to earnings ratio of about 127.5 times looks steep next to both peers at 27.5 times and a fair ratio of 30.8 times, suggesting the share price could fall if sentiment or growth expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes with Do it your way.

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Capitalize on your momentum now and scan the market for fresh opportunities with the Simply Wall Street Screener before the next wave of winners moves without you.

- Capture potential bargains early by targeting quality companies that look mispriced through these 895 undervalued stocks based on cash flows before the wider market catches on.

- Ride innovation trends by focusing on next generation automation and intelligent platforms with these 27 AI penny stocks that are positioned for growth.

- Strengthen your portfolio income by filtering for resilient businesses offering payouts via these 15 dividend stocks with yields > 3% that can support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com