3 Promising Penny Stocks With Market Caps Under $300M

As the U.S. stock market navigates a mixed landscape, with major indices showing varied performances ahead of key Federal Reserve decisions, investors remain keenly focused on opportunities for growth. Penny stocks, often overlooked due to their historical connotations, continue to offer intriguing prospects for those willing to explore smaller or newer companies with robust financials. In this article, we examine three penny stocks that stand out for their potential to deliver substantial returns while maintaining a solid foundation in today's market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.03 | $447.9M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.70 | $614.83M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8833 | $151.06M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.23 | $543.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.30 | $1.39B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.53 | $593.26M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.54 | $369.07M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.860255 | $6.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.62 | $104.67M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 338 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Outdoor Holding (POWW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Outdoor Holding Company operates an online marketplace business with a market cap of $234.22 million.

Operations: The company generates revenue of $46.63 million from its online marketplace segment.

Market Cap: $234.22M

Outdoor Holding Company, with a market cap of US$234.22 million, has shown financial improvement by reporting a net income of US$1.4 million for the recent quarter compared to a significant loss last year. The company maintains a stable revenue stream from its online marketplace segment, generating US$46.63 million annually. Recent executive changes include the resignation of COO Elizabeth Cross and EVP Tod Wagenhals, which may impact operations temporarily but are not due to internal conflicts. Additionally, Outdoor Holding's strategic relocation to Atlanta aims at cost reduction without incurring relocation expenses for remote-working employees in Arizona.

- Click here and access our complete financial health analysis report to understand the dynamics of Outdoor Holding.

- Learn about Outdoor Holding's future growth trajectory here.

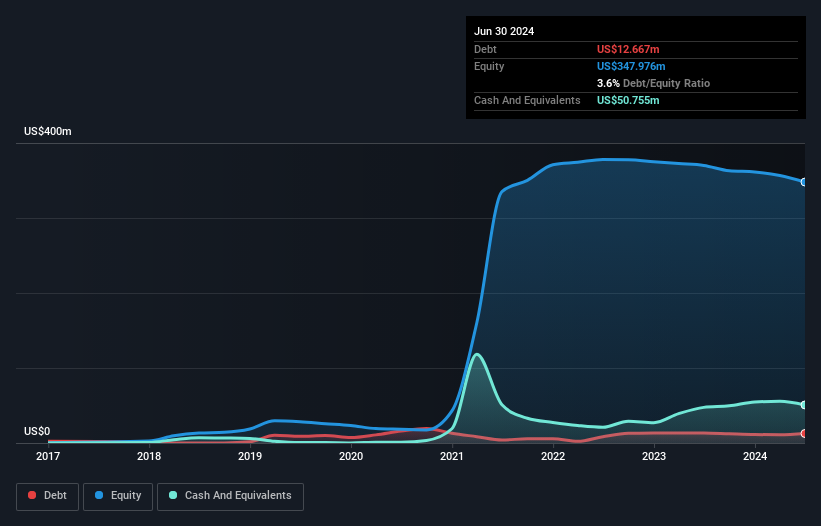

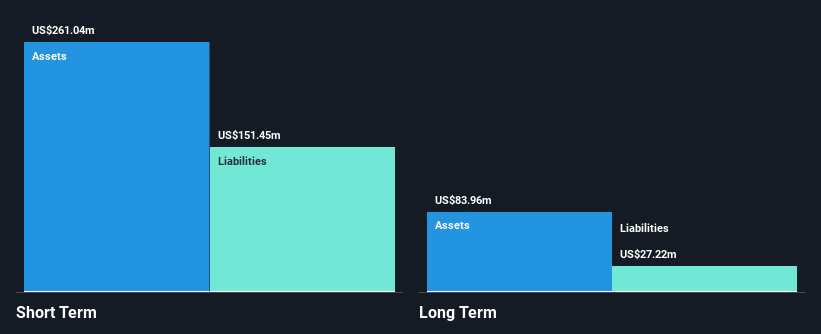

Ceragon Networks (CRNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across multiple regions, with a market cap of approximately $190.57 million.

Operations: The company generates $363.33 million from its role as a global innovator and leading solutions provider of wireless transport.

Market Cap: $190.57M

Ceragon Networks, with a market cap of approximately US$190.57 million, recently announced a two-year managed services contract in Colombia worth US$2.7 million, enhancing its presence in Latin America. Despite generating significant revenue from wireless transport solutions, the company's recent financial performance showed declining sales and net income compared to last year. Ceragon's short-term assets comfortably exceed its liabilities, and it maintains more cash than total debt. However, profit margins have decreased significantly over the past year due to large one-off losses impacting earnings quality while management remains experienced with stable leadership tenure.

- Take a closer look at Ceragon Networks' potential here in our financial health report.

- Review our growth performance report to gain insights into Ceragon Networks' future.

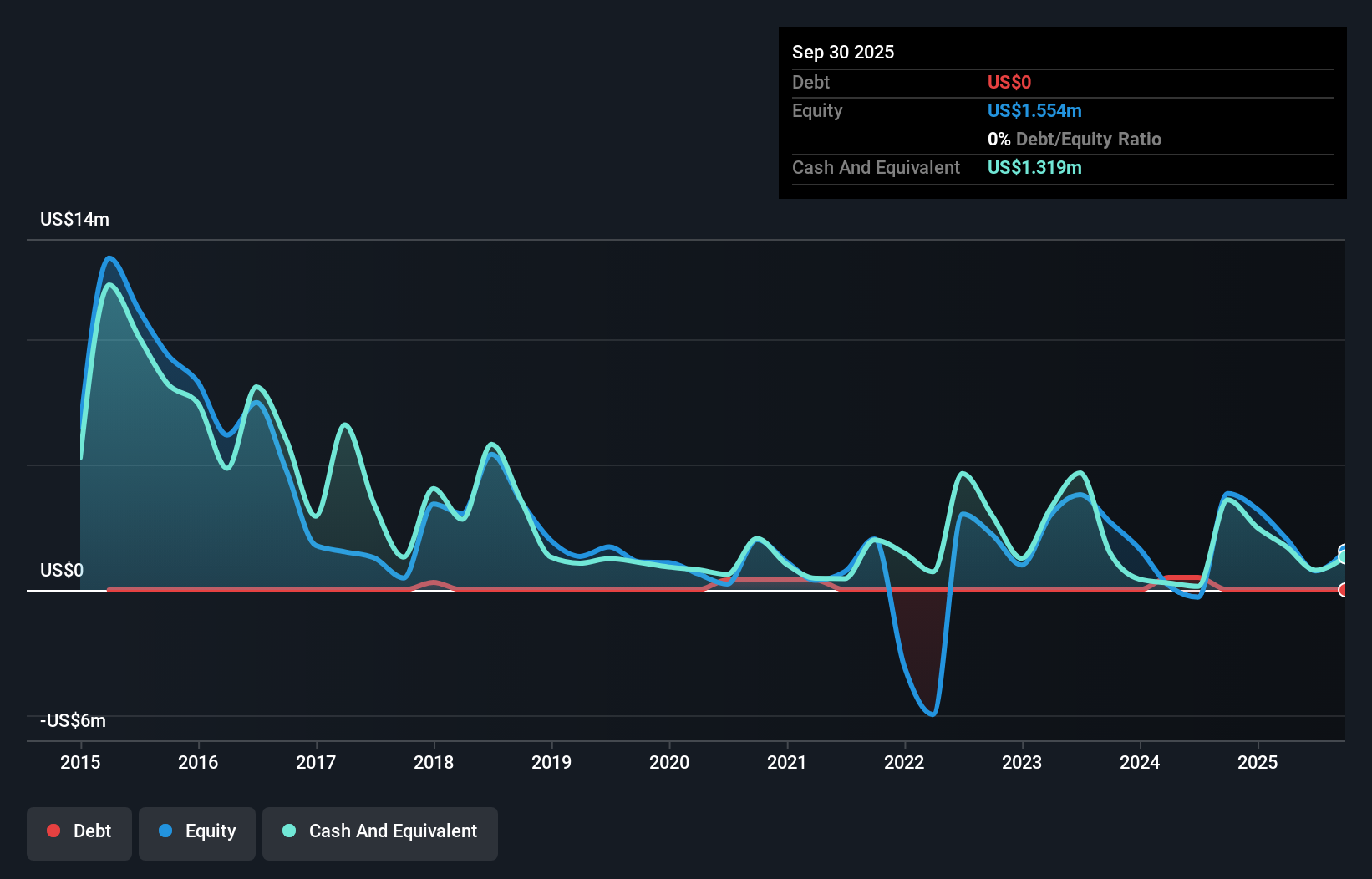

Harvard Apparatus Regenerative Technology (HRGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Harvard Apparatus Regenerative Technology Inc. is a clinical-stage biotechnology company developing regenerative-medicine treatments for gastro-intestinal and other organ disorders, with a market cap of $38.12 million.

Operations: The company generates revenue from its Consumer Health Products segment, totaling $0.74 million.

Market Cap: $38.12M

Harvard Apparatus Regenerative Technology, with a market cap of US$38.12 million, is a pre-revenue biotechnology firm focused on regenerative medicine for organ disorders. Despite its unprofitability and increasing losses over the past five years, the company remains debt-free and has experienced management and board members. Short-term assets of US$1.6 million surpass both short- and long-term liabilities, yet it faces less than a year of cash runway if current cash flow trends persist. Recent earnings announcements showed reduced net losses compared to the previous year but highlighted ongoing financial challenges in achieving profitability.

- Jump into the full analysis health report here for a deeper understanding of Harvard Apparatus Regenerative Technology.

- Evaluate Harvard Apparatus Regenerative Technology's historical performance by accessing our past performance report.

Next Steps

- Click this link to deep-dive into the 338 companies within our US Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com