Exploring Undervalued Small Caps With Insider Activity In December 2025

As the U.S. market approaches a pivotal Federal Reserve decision on interest rates, small-cap stocks have shown resilience, with the Russell 2000 index recently reaching a new record high. This environment highlights the importance of identifying companies that not only demonstrate solid fundamentals but also exhibit insider activity, which can be an indicator of confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Blue Bird | 12.6x | 1.1x | 46.37% | ★★★★★★ |

| Shore Bancshares | 10.5x | 2.8x | 40.64% | ★★★★★☆ |

| Wolverine World Wide | 16.5x | 0.8x | 39.50% | ★★★★★☆ |

| First United | 10.2x | 3.0x | 44.37% | ★★★★★☆ |

| Peoples Bancorp | 10.5x | 1.9x | 44.53% | ★★★★★☆ |

| Merchants Bancorp | 8.0x | 2.7x | 48.38% | ★★★★★☆ |

| New Peoples Bankshares | 9.2x | 2.1x | 42.88% | ★★★☆☆☆ |

| Omega Flex | 17.6x | 2.8x | 4.99% | ★★★☆☆☆ |

| S&T Bancorp | 11.7x | 4.0x | 35.82% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -13.93% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Citizens Financial Services (CZFS)

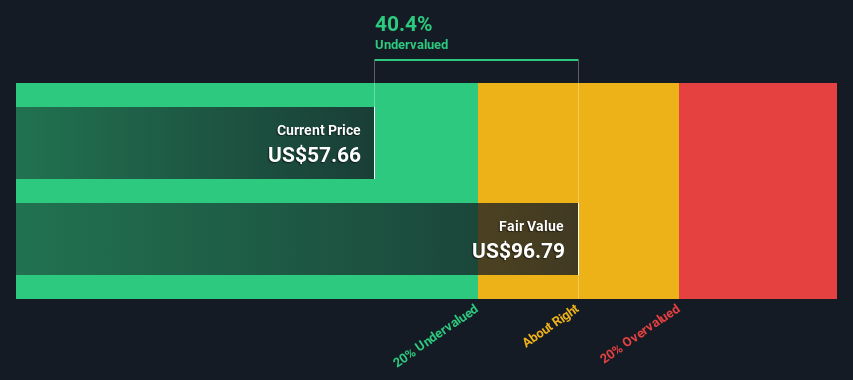

Simply Wall St Value Rating: ★★★★☆☆

Overview: Citizens Financial Services operates primarily in community banking, with a focus on providing financial services and products, and has a market capitalization of $0.42 billion.

Operations: The company's primary revenue stream is from community banking, generating $107.40 million. Over time, operating expenses have increased significantly, reaching $62.97 million in the latest period. The net income margin has shown variability, currently standing at 31.72%.

PE: 8.6x

Citizens Financial Services is catching attention with its strong financial performance and insider confidence, as evidenced by share purchases. From July to September 2025, the company repurchased 1,215 shares for US$0.08 million. Third-quarter results showed net interest income rising to US$25.14 million from US$21.32 million the previous year, and net income increasing to US$10.01 million from US$7.54 million a year ago. A quarterly dividend of $0.50 per share was recently affirmed for December 2025, reflecting stability in shareholder returns amidst a dynamic market environment.

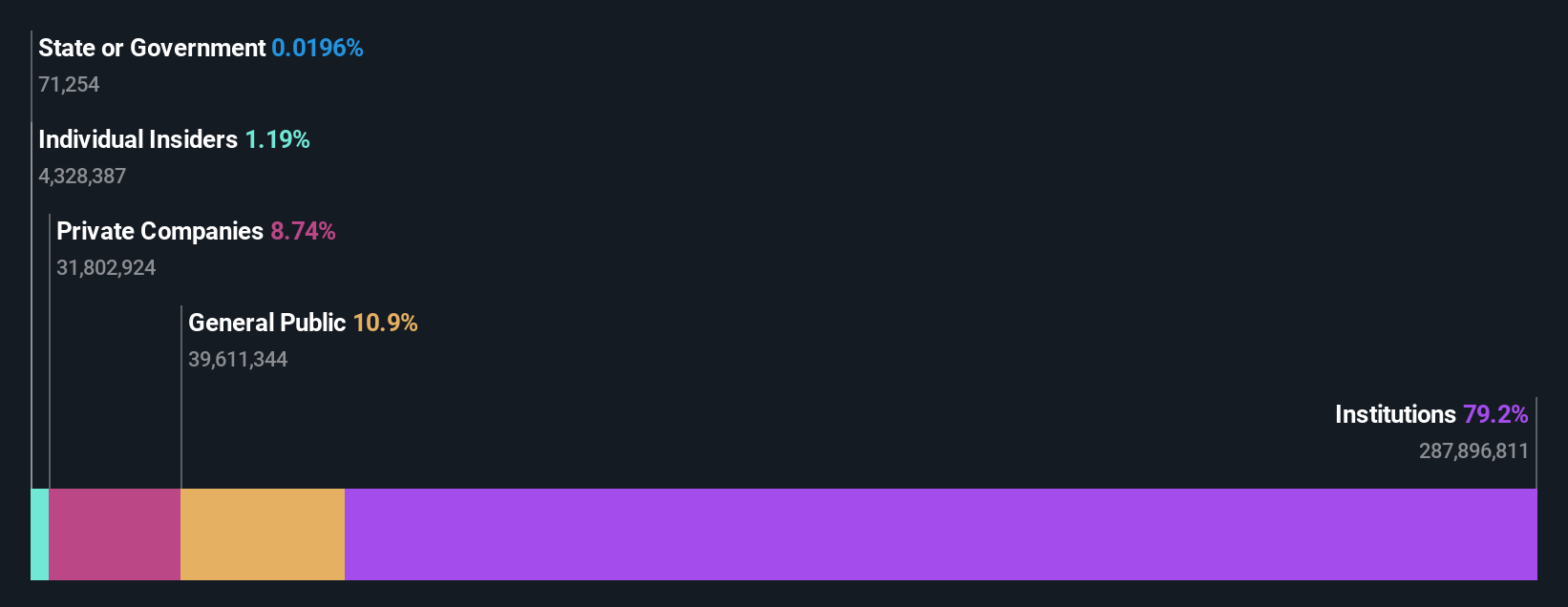

JetBlue Airways (JBLU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: JetBlue Airways is a major American low-cost airline primarily engaged in providing air transportation services, with a market capitalization of approximately $2.31 billion.

Operations: JetBlue Airways' primary revenue stream is Air Transportation Services, generating $9.10 billion. The company's cost of goods sold (COGS) significantly impacts its gross profit margin, which was 23.22% as of the latest period. Operating expenses and non-operating expenses further influence net income, with recent periods showing a negative net income margin, indicating challenges in achieving profitability despite strong revenue figures.

PE: -3.8x

JetBlue Airways, a prominent player in the airline sector, is expanding its network with new routes and services, including plans for spring break flights from Fort Lauderdale. Despite reporting a net loss of US$143 million for Q3 2025, insider confidence is bolstered by Nikhil Mittal's purchase of 100,000 shares worth approximately US$614K. This insider activity suggests belief in JetBlue's growth potential as it continues to enhance its presence across key markets like Florida and New York.

- Navigate through the intricacies of JetBlue Airways with our comprehensive valuation report here.

Gain insights into JetBlue Airways' past trends and performance with our Past report.

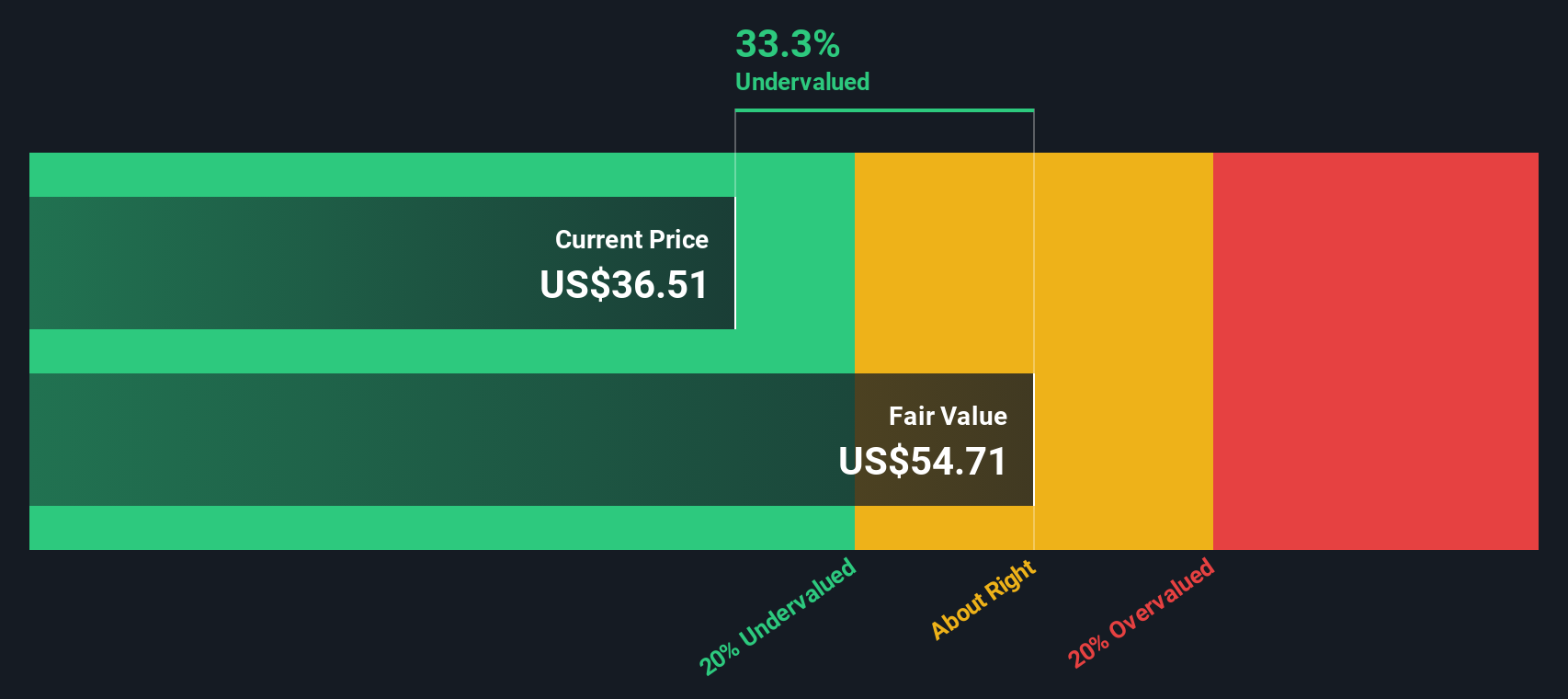

Pursuit Attractions and Hospitality (PRSU)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pursuit Attractions and Hospitality operates in the tourism and hospitality industry, focusing on providing unique travel experiences, with a market cap of $2.35 billion.

Operations: PRSU generates revenue primarily from its Pursuit segment, with recent figures showing $441.14 million. The company's cost structure is heavily influenced by the cost of goods sold, which was $328.60 million in the latest period, contributing to a gross profit margin of 25.51%. Operating expenses and non-operating expenses further impact profitability, with net income reflecting a negative trend at -$97.31 million for the same period.

PE: -10.1x

Pursuit Attractions and Hospitality, a small company in the U.S., recently reported strong third-quarter results with revenue of US$241.02 million, up from US$182.26 million the previous year, and net income rising to US$73.85 million. Despite having less than a year of cash runway, they increased their revolving credit facility by US$100 million to bolster financial flexibility. The company raised full-year earnings guidance for 2025, projecting approximately 24% revenue growth compared to 2024 levels.

Key Takeaways

- Navigate through the entire inventory of 76 Undervalued US Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com