HEICO (HEI) Valuation Check After RBC Capital Downgrade to Hold and Recent Share Price Pullback

HEICO (HEI) just got bumped down to a Hold rating at RBC Capital, and that shift in sentiment is helping shape the stock’s latest pullback after a strong year long run.

See our latest analysis for HEICO.

The downgrade comes after a strong run, with HEICO’s year-to-date share price return near 29 percent and its five-year total shareholder return above 130 percent. However, recent weekly and monthly share price weakness suggests momentum is cooling as investors reassess near-term expectations.

If this pullback has you looking beyond one name, it could be a good moment to scan other aerospace and defense opportunities using our aerospace and defense stocks.

With shares still up strongly this year and trading at a modest discount to analyst and intrinsic value estimates, the key question now is whether HEICO is quietly undervalued or if markets have already priced in its next leg of growth.

Most Popular Narrative: 13.4% Undervalued

With HEICO closing at $305.71 against a narrative fair value of $353, the current pullback is being framed as an opportunity, not a peak.

The worldwide trend of aging commercial and military aircraft fleets, combined with increasing pressure for cost-effective maintenance solutions, strongly favors HEICO's business model. As airlines and governments seek alternatives to expensive OEM parts, HEICO's FAA-approved PMA parts and repairs continue to gain market share and drive margin expansion, as reflected in rising operating and EBITA margins.

Curious how steady mid single digit growth assumptions, richer margins, and a premium future earnings multiple still add up to upside from here? The full narrative unpacks the specific revenue trajectory, margin lift, and re rating needed to justify that higher fair value, and how long the aftermarket cycle has to run to support it.

Result: Fair Value of $353 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on disciplined acquisitions and a resilient aftermarket; tougher OEM competition or weaker integration could potentially pressure growth and margins.

Find out about the key risks to this HEICO narrative.

Another View: Rich On Earnings, Despite Fair Value

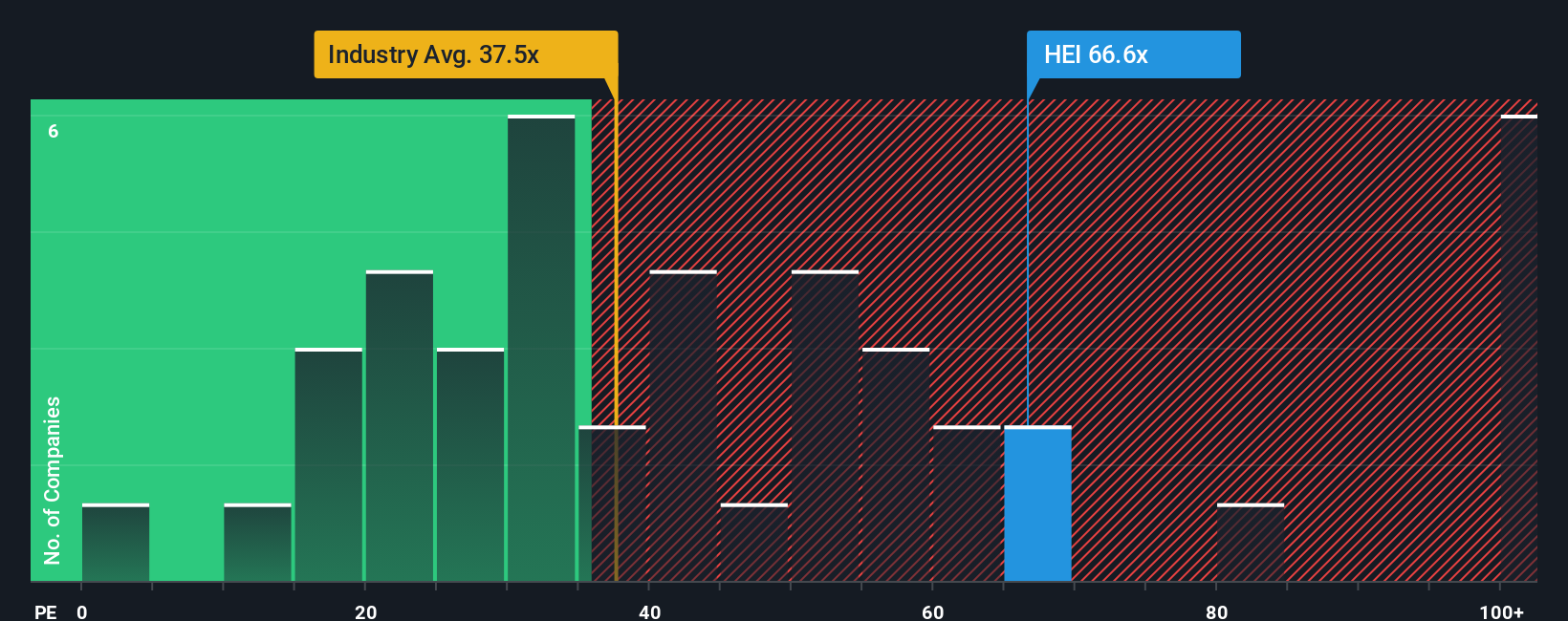

On earnings, the picture is less forgiving. HEICO trades at about 66 times earnings versus a 37 times average for US aerospace and defense peers, while our fair ratio suggests closer to 30 times. That premium implies little room for error if growth or margins disappoint. Does it still feel like a bargain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HEICO Narrative

If you see things differently, or would rather dig into the numbers yourself, you can quickly build a personalized HEICO storyline in minutes, Do it your way.

A great starting point for your HEICO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh opportunities using our powerful screeners so you are not relying on just one stock story.

- Unlock potential turnaround stories by targeting quality small caps with room to run using these 3591 penny stocks with strong financials.

- Focus on companies in automation, cloud, and machine learning by using these 27 AI penny stocks that may reshape entire industries.

- Explore income opportunities by screening for these 15 dividend stocks with yields > 3% offering yields supported by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com