Airbnb (ABNB): Revisiting Valuation After Recent Outperformance and Longer-Term Shareholder Returns

Airbnb (ABNB) has quietly outperformed the broader market over the past week, with the stock edging higher as investors reassess its earnings trajectory, profitability and long term role in global travel demand.

See our latest analysis for Airbnb.

That recent 7 day share price return of 4.38 percent comes after a softer year to date share price return of negative 4.63 percent. However, a 3 year total shareholder return of 33.49 percent suggests longer term momentum is still broadly intact.

If Airbnb has you rethinking growth stories in travel and tech, it could be worth exploring fast growing stocks with high insider ownership as a source of the market’s next potential outperformers.

With shares still trading below analyst targets yet showing solid revenue and profit growth, the key question now is whether Airbnb is undervalued or if the market has already priced in the next leg of its expansion.

Most Popular Narrative Narrative: 23.4% Undervalued

Airbnb's most followed narrative places fair value well above the recent 125.39 dollars close, framing the current share price as a potential discount on future growth.

They’ve launched long-term rentals, made over 500 product improvements, and are going all in on AI to make the platform smoother. It’s easier now to find the right stay without scrolling for 20 minutes.

Curious how a lifestyle pivot, rising profitability and a rich future earnings multiple combine into that higher value? Want to see the exact growth and margin playbook driving it?

Result: Fair Value of $163.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter regulations in key markets and unresolved tax disputes could quickly change sentiment and put pressure on both growth expectations and the perceived valuation discount.

Find out about the key risks to this Airbnb narrative.

Another Lens on Valuation

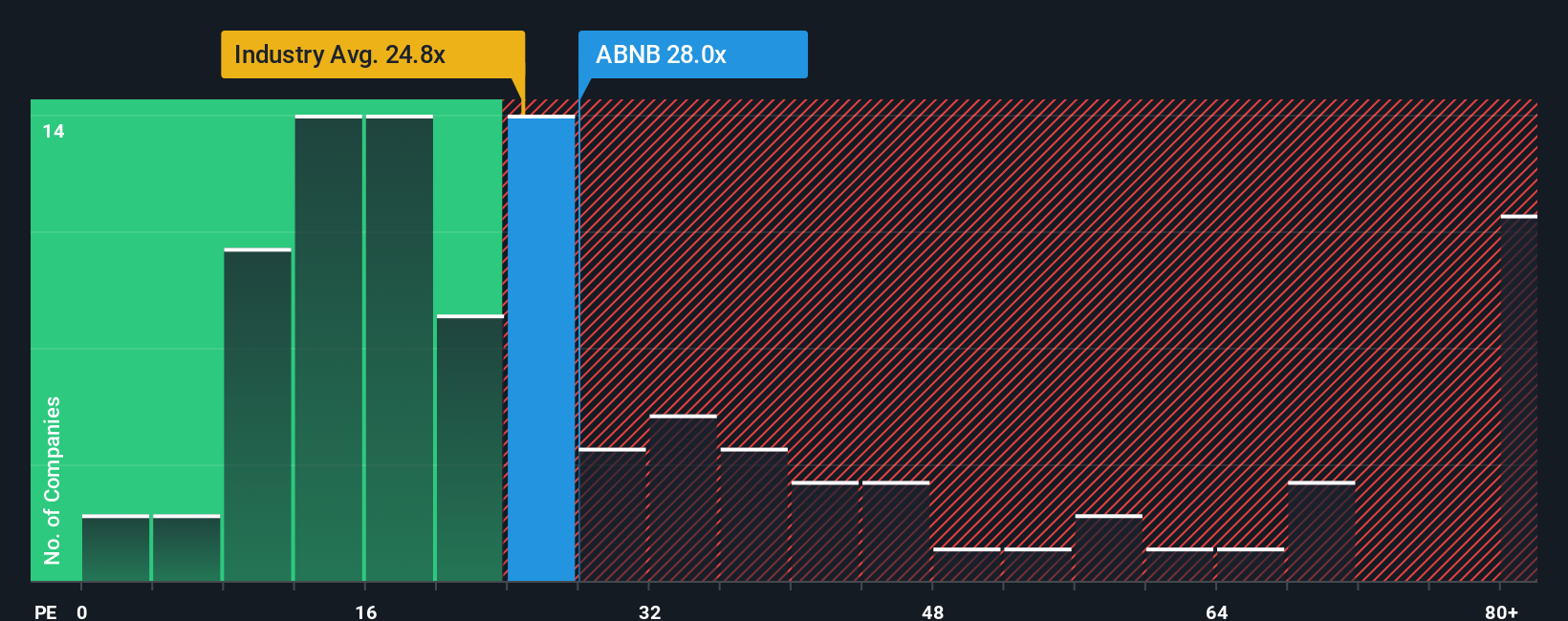

Step away from narratives and you get a mixed picture. At 28.9 times earnings, Airbnb trades richer than the US hospitality average of 23.1 times but roughly in line with peers at 29.2 times and only slightly below our fair ratio of 30.3 times. This suggests limited multiple upside if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Airbnb Narrative

If you are not fully aligned with this perspective or simply want to dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Airbnb.

Looking for your next investment edge?

Do not stop at one opportunity. Use the Simply Wall St Screener to hunt for stocks that match your strategy before the market fully catches on.

- Capitalize on mispriced opportunities by targeting companies that look cheap on future cash flows through these 893 undervalued stocks based on cash flows.

- Seek income opportunities by focusing on companies with a history of consistent payments using these 15 dividend stocks with yields > 3%.

- Explore the fast-evolving digital asset theme with forward-looking names in these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com