Is Sezzle’s 2025 Rally Still Justified Amid Regulatory Scrutiny in Buy Now Pay Later?

- If you are wondering whether Sezzle is still a smart buy at today’s price, or if the big gains are already baked in, you are in the right place to unpack what the market might really be expecting from here.

- The stock has climbed about 7.6% over the last week, 19.5% over the past month, and is up 52.4% year to date, even though the 1-year return sits at 29.9%. This profile hints at shifting sentiment and possibly rising expectations.

- Recent headlines have focused on Sezzle’s role in the buy now, pay later space and how regulators and incumbents are treating that niche. This helps explain some of the volatility around its rapid share price moves. At the same time, coverage of partnerships, product enhancements, and competitive positioning has kept investors focused on whether Sezzle can sustain growth in a crowded, heavily scrutinized market.

- On our framework, Sezzle currently scores a 2 out of 6 valuation checks, suggesting that the market may already be pricing in a fair bit of optimism. We will break down what that looks like under different valuation lenses before finishing with a more holistic way to think about what the stock is really worth.

Sezzle scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sezzle Excess Returns Analysis

The Excess Returns model asks whether Sezzle is generating returns on shareholder equity that are higher than the return investors demand, and if so, how long that advantage can last. It builds value from the spread between Sezzle’s profitability and its cost of equity.

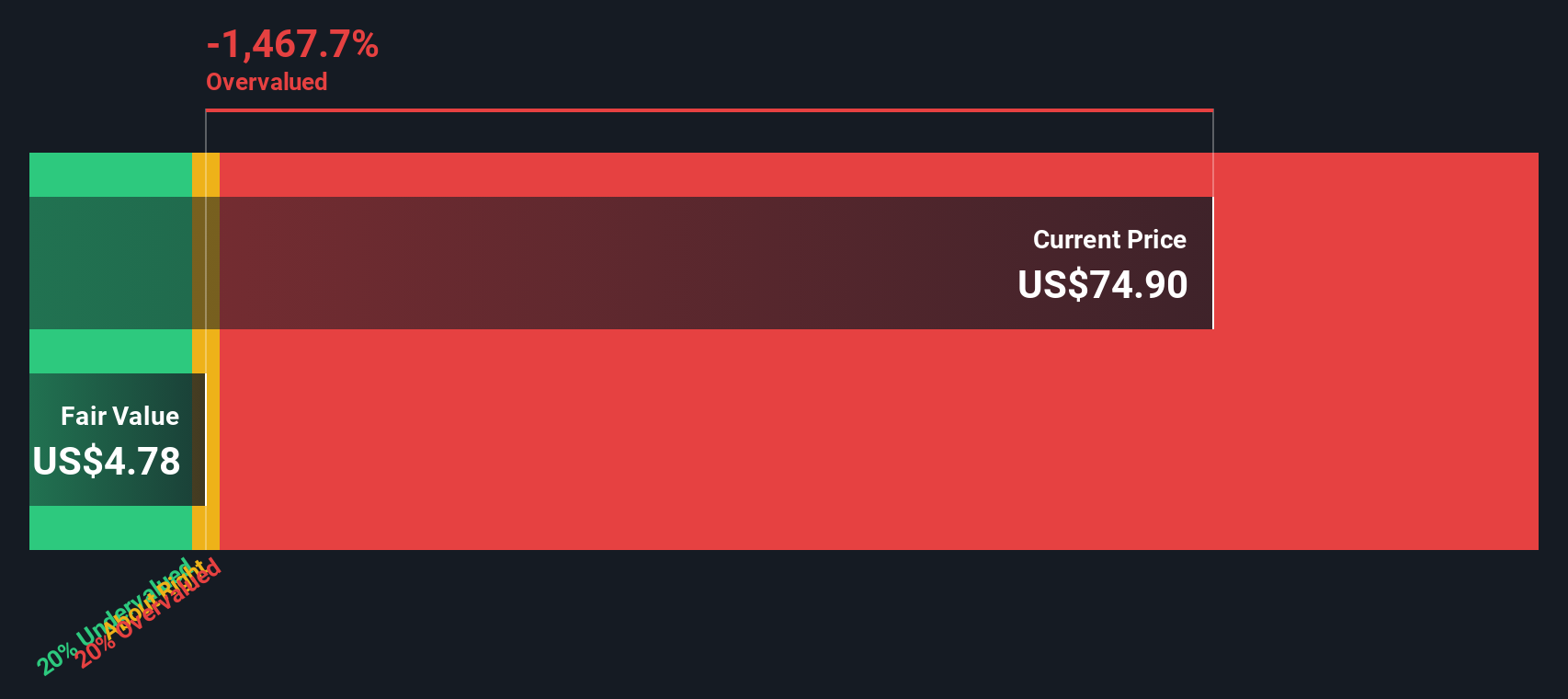

On this framework, Sezzle has a Book Value of $4.55 per share and a Stable EPS estimate of $0.40 per share, based on the median return on equity from the past 5 years. The Average Return on Equity sits at 45.18%, while the Cost of Equity is only $0.06 per share. That gap translates into an Excess Return of $0.33 per share, with a Stable Book Value of $0.88 per share, again anchored on historical medians.

When these excess returns are projected forward and discounted, the model implies an intrinsic value that is far below the current share price. On this basis, Sezzle is estimated to be about 684.3% overvalued.

Result: OVERVALUED

Our Excess Returns analysis suggests Sezzle may be overvalued by 684.3%. Discover 893 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Sezzle Price vs Earnings

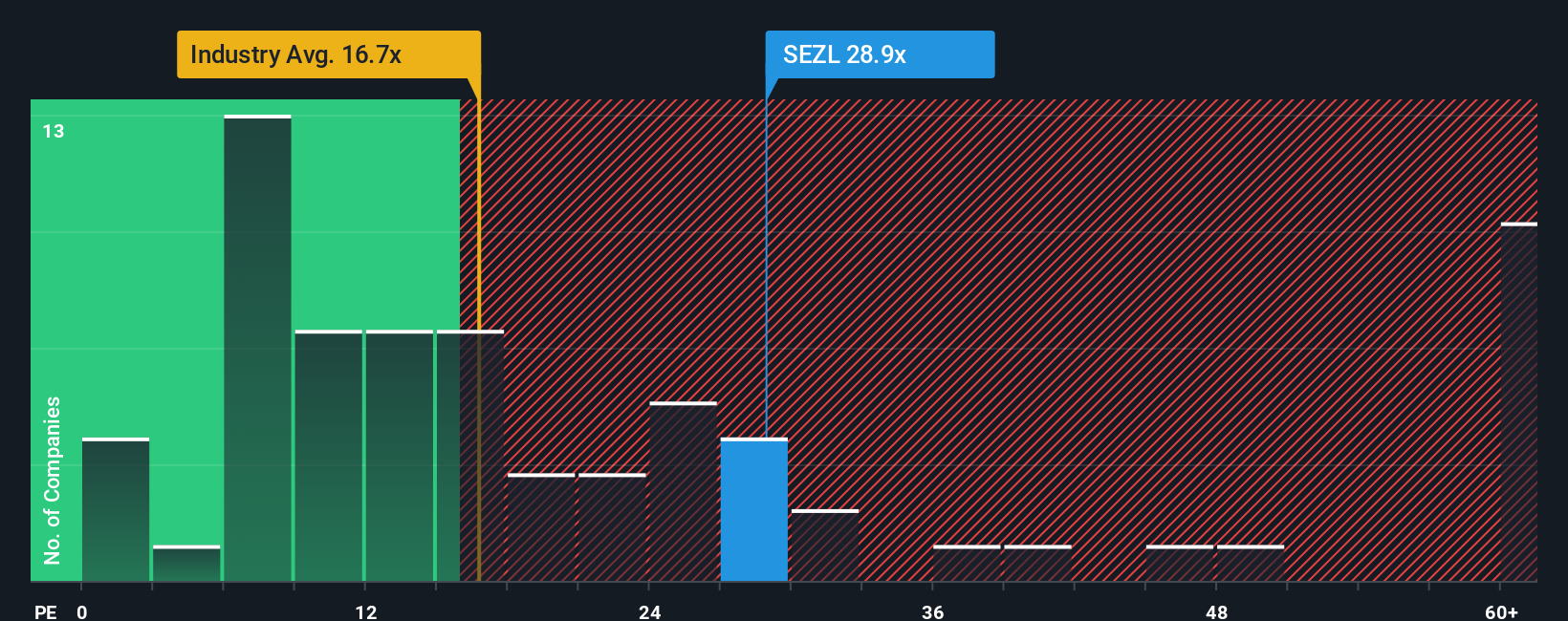

For a profitable fintech like Sezzle, the price to earnings ratio is a practical way to gauge whether investors are paying a sensible price for each dollar of profit. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower growth or higher risk typically call for a lower, more conservative PE.

Sezzle currently trades on a PE of about 20.4x. That sits above the broader Diversified Financial industry average of around 13.4x, but well below the peer group average near 51.4x. This suggests the market is acknowledging Sezzle’s growth, yet not awarding it a full high growth fintech premium. To refine this view, Simply Wall St uses a proprietary Fair Ratio for Sezzle of 30.6x, which estimates what PE makes sense after accounting for its earnings growth profile, profitability, industry context, size, and risk factors.

This Fair Ratio is more insightful than a simple industry or peer comparison because it adjusts for Sezzle’s specific strengths and vulnerabilities rather than assuming that all financial companies deserve similar multiples. Comparing the Fair Ratio of 30.6x with the current 20.4x PE implies that, on this lens, Sezzle looks undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1451 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sezzle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company linked directly to a financial forecast and a fair value estimate. Instead of just accepting a single target price, a Narrative lets you spell out how you think Sezzle’s revenue, earnings, and margins will evolve, and then ties those assumptions to a fair value you can compare with the current share price to help inform a decision. Narratives live inside the Simply Wall St Community page, where millions of investors can create and share their views, and they update dynamically as new news, earnings, or guidance comes in, so your story and valuation stay current. For Sezzle, for example, one investor might build a bullish Narrative around rapid user growth, improving unit economics, and a fair value above the most optimistic 150 dollar target. Another could focus on credit risk, legal uncertainty, and slower growth, landing closer to or even below the most cautious 111 dollar view, and both perspectives are made explicit and testable through their Narratives.

Do you think there's more to the story for Sezzle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com