The Bull Case For PLS Group (ASX:PLS) Could Change Following Board Refresh And Global Strategy Shift

- PLS Group Limited recently changed its name from Pilbara Minerals Limited and announced that long‑serving Non‑Executive Director Steve Scudamore AM will retire from the Board on December 31, 2025, to be succeeded by experienced director Robert Nicholson on January 1, 2026, alongside refreshed Board committee memberships.

- This combination of a new corporate identity and the addition of a mergers-and-acquisitions specialist with extensive Asian market experience signals a broader, more globally focused direction for the business.

- With Robert Nicholson joining the Board as a non-executive director, we’ll now examine how this governance shift shapes PLS Group’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

PLS Group Investment Narrative Recap

To hold PLS Group, you need to believe that lithium demand and pricing will eventually support a recovery in revenue and margins, despite recent losses and heavy CapEx. The name change and Robert Nicholson’s appointment refine the global growth story but do not materially alter the near term catalyst, which remains lithium price stability, or the key risk of sustained price weakness pressuring cash flows and funding plans.

The recent name change from Pilbara Minerals to PLS Group, following the Latin Resources acquisition, is the clearest signal that the company is repositioning around a broader international portfolio. That shift makes the execution risk on undeveloped assets like Colina, and any delays or cost overruns, even more relevant as investors weigh future earnings potential against a period of weaker pricing and higher capital commitments.

Yet behind the global growth pitch, investors still need to be aware that if lithium prices stay subdued for longer than expected, then...

Read the full narrative on PLS Group (it's free!)

PLS Group's narrative projects A$1.4 billion revenue and A$247.0 million earnings by 2028.

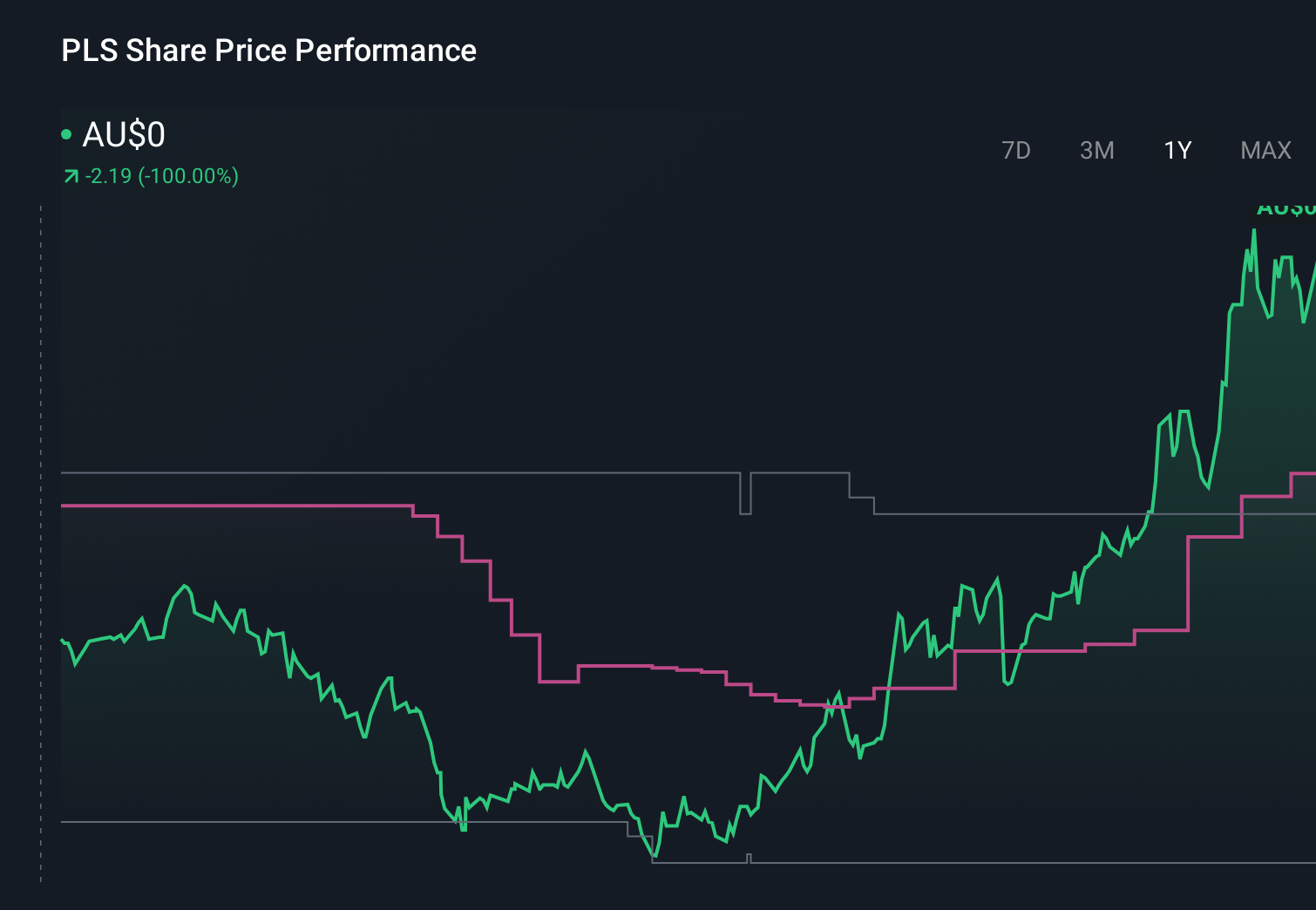

Uncover how PLS Group's forecasts yield a A$3.00 fair value, a 26% downside to its current price.

Exploring Other Perspectives

Sixteen members of the Simply Wall St Community value PLS Group anywhere between A$0.23 and A$3.17 per share, underscoring how far apart individual views can be. Against that spread, concerns about sustained lithium price weakness and high ongoing CapEx remind you to weigh several viewpoints on how quickly earnings and cash flows might recover.

Explore 16 other fair value estimates on PLS Group - why the stock might be worth as much as A$3.17!

Build Your Own PLS Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PLS Group research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free PLS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PLS Group's overall financial health at a glance.

No Opportunity In PLS Group?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com