Sun Art Retail Group (SEHK:6808) Same-Store Sales Slump Challenges Recovery Narrative

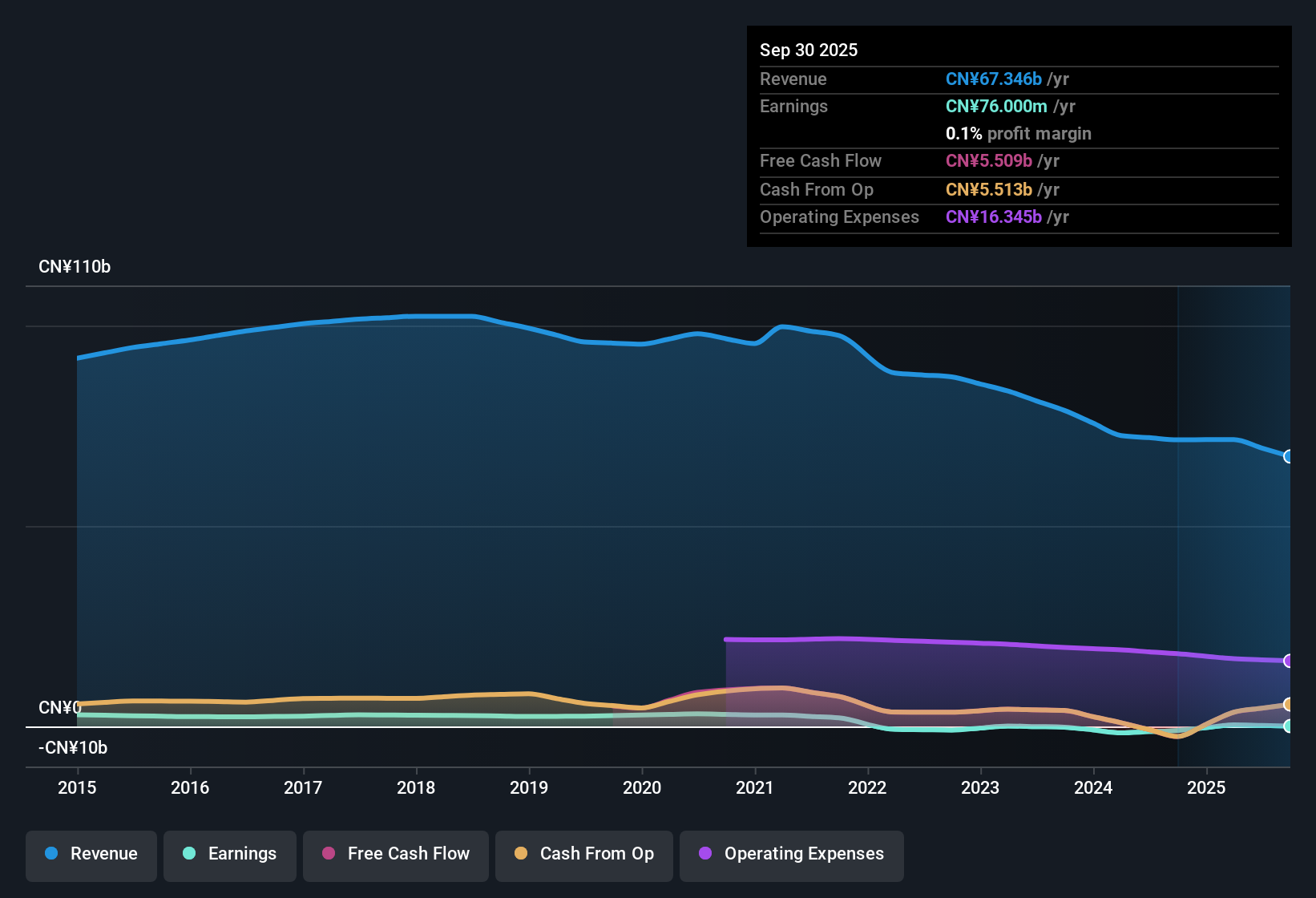

Sun Art Retail Group (SEHK:6808) has just posted a tough set of H1 2026 numbers, with revenue of about CN¥30.5 billion, basic EPS of CN¥-0.0129 and net income excluding extra items of CN¥-123 million alongside an 11.7% same store sales contraction. The company has seen revenue slip from roughly CN¥34.7 billion in H1 2025 to CN¥30.5 billion this half. Meanwhile, the trailing twelve month picture shows revenue at about CN¥67.3 billion and net income excluding extra items at CN¥76 million, hinting at thinner margins despite a move back into profit over the last year.

See our full analysis for Sun Art Retail Group.With the headline figures on the table, the next step is to see how these results line up with the dominant narratives around Sun Art's recovery prospects and where the numbers start to challenge those stories.

Curious how numbers become stories that shape markets? Explore Community Narratives

CN¥76 million profit masks weak current half

- Over the last 12 months Sun Art generated about CN¥67.3 billion of revenue and CN¥76 million of net income excluding extra items, even though H1 2026 on its own showed a CN¥123 million loss on CN¥30.5 billion of revenue.

- What stands out for a bullish view is that trailing EPS of CN¥0.007966 and a return to profit contrast with the latest half year loss,

- Supporters can point to the move from a CN¥1,040 million loss in H1 2025 to a positive CN¥405 million in H2 2025 and a positive trailing result as evidence that the business can be profitable.

- At the same time, the swing back to a CN¥123 million loss in H1 2026 challenges the idea that profitability is yet on a stable footing and highlights how dependent the recent turnaround has been on specific periods.

Forecast 78.9% earnings growth versus 1.9% sales

- Analysts are forecasting earnings to grow about 78.9% per year while revenue is only expected to rise around 1.9% annually, which is below the Hong Kong market revenue growth forecast of 8.5%.

- Consensus narrative style thinking that focuses on strong earnings growth looks both supported and tested by these figures,

- The move from a CN¥1,040 million loss in H1 2025 to a CN¥76 million profit over the last 12 months gives a numerical base for expecting faster earnings growth than the wider market.

- However, with forecast revenue growth at just 1.9% compared with the market’s 8.5%, the idea of rapid earnings expansion sits against a backdrop of relatively slow top line progress.

Low 0.2x sales multiple and uncovered 9.66% yield

- The shares trade on a price to sales ratio of roughly 0.2 times compared with about 1.6 times for peers and 0.6 times for the Hong Kong Consumer Retailing industry, while a reported 9.66% dividend yield is not covered by current earnings.

- For investors weighing a bullish angle around value and income, the combination of these numbers sends mixed signals,

- On the one hand, a DCF fair value of roughly HK$5.04 versus a current price near HK$1.76 suggests substantial upside on valuation grounds.

- On the other hand, the fact that the high dividend yield is not well supported by earnings and that reported profitability was helped by a CN¥161 million one off gain raises questions about how durable that yield and low multiple really are.

Investors trying to make sense of these mixed signals may want a fuller walk through of how the numbers feed into both optimistic and cautious cases for the stock. 📊 Read the full Sun Art Retail Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sun Art Retail Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Sun Art's uneven profitability, shrinking same store sales and uncovered dividend suggest its recovery story remains fragile and heavily dependent on specific periods.

If that volatility makes you cautious, use our stable growth stocks screener (2092 results) to focus on businesses with steadier revenue and earnings trajectories that can better withstand changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com