Armstrong World Industries (AWI): Assessing Valuation After a Recent Pullback in the Share Price

Armstrong World Industries (AWI) has quietly pulled back over the past month, with shares down roughly 4% and about 7% over the past 3 months, even as year to date gains remain strong.

See our latest analysis for Armstrong World Industries.

Even with the recent dip, Armstrong World Industries’ share price is still up strongly for the year, and its multi year total shareholder return suggests the latest pullback looks more like cooling momentum than a broken trend.

If AWI’s run has you thinking about what else could surprise on the upside, it might be worth scanning fast growing stocks with high insider ownership as a source of fresh ideas.

With earnings still growing and the share price trading below analyst targets, investors now face a key question: Is Armstrong World Industries undervalued after this pullback, or is the market already pricing in its future growth?

Most Popular Narrative: 12.1% Undervalued

With Armstrong World Industries last closing at $182.08 versus a narrative fair value of $207.10, the current pullback sits against a backdrop of upgraded long term optimism.

The acceleration of TEMPLOK and other energy efficient ceiling solutions, supported by the inclusion of phase change materials in key tax credits and major design software, positions Armstrong to benefit from increasing building decarbonization and energy savings requirements, potentially driving higher future sales volumes and AUV, and enhancing gross margins.

Curious how steady revenue growth, expanding margins, and a premium future earnings multiple can still point to upside from here? The most popular narrative lays out the full financial roadmap behind that fair value call. Want to see which specific earnings and valuation assumptions have to land for this gap to close?

Result: Fair Value of $207.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained softness in commercial construction and rising input costs could pressure volumes and margins, which may challenge the upbeat growth and valuation narrative.

Find out about the key risks to this Armstrong World Industries narrative.

Another Angle On Valuation

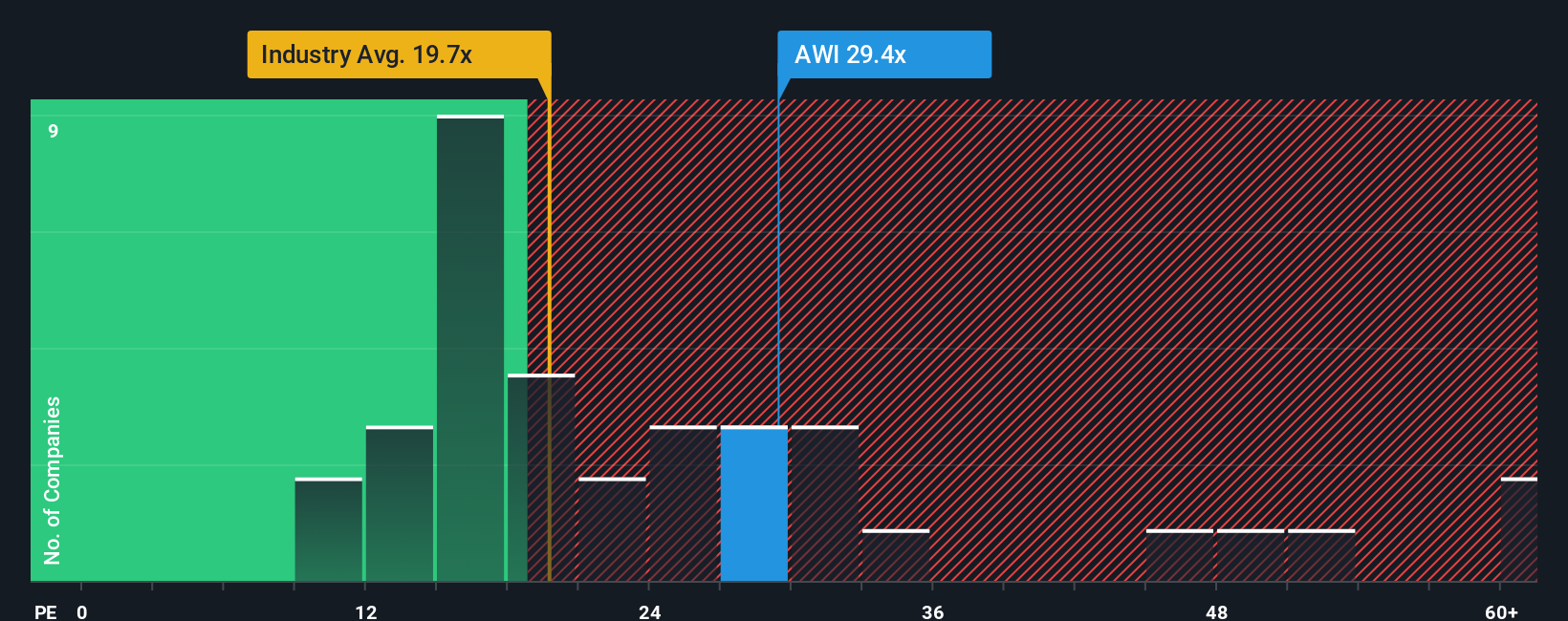

There is a catch though. On a price to earnings basis, Armstrong trades at 25.7 times earnings, above both the US Building industry at 19.3 times and its own fair ratio of 22.2 times. This hints at less margin for safety if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Armstrong World Industries Narrative

If you see the numbers differently or want to dive deeper into the data yourself, you can build a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Armstrong World Industries.

Ready for more high conviction ideas?

Before you move on, lock in your next watchlist upgrades with a quick scan through targeted screeners that surface quality opportunities many investors overlook.

- Capture potential value rebounds by running through these 893 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

- Target powerful secular trends by zeroing in on these 27 AI penny stocks positioned to benefit from accelerating adoption of intelligent automation.

- Strengthen your income strategy by reviewing these 15 dividend stocks with yields > 3% that combine meaningful yields with underlying business resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com