Assessing Dow (DOW) Valuation After a Sharp Year-to-Date Share Price Decline

Dow (DOW) shares edged higher today as investors revisited the chemicals giant’s mixed track record, characterized by modest revenue growth alongside a sharp rebound in annual net income, shaping expectations for where the stock could go next.

See our latest analysis for Dow.

The latest 1 month share price return of 3.7% has been overshadowed by a steep year to date share price decline of about 41.6%, signalling that any recent momentum is still battling a longer stretch of weak total shareholder returns.

If Dow’s trajectory has you rethinking your exposure to cyclicals, this could be a useful moment to scan for contrast and discover fast growing stocks with high insider ownership.

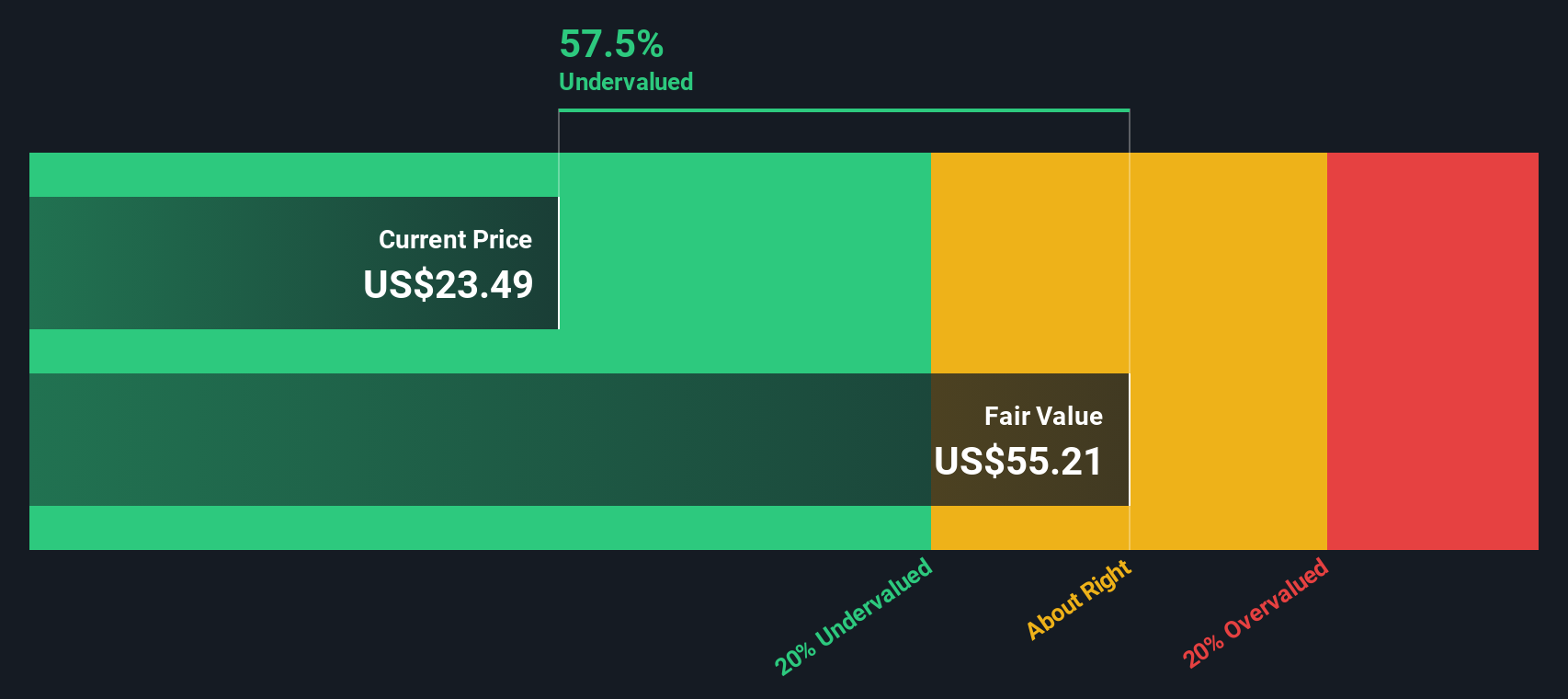

With shares down sharply over the past year and trading at a notable discount to analyst targets, the key question now is whether Dow is undervalued or if the market is already pricing in any future recovery.

Most Popular Narrative: 16.9% Undervalued

With Dow last closing at $23.11 against a narrative fair value near $27.82, the story hinges on whether cost discipline can unlock that upside.

Dow is targeting at least $1 billion in annual cost reductions by 2026, focusing on areas such as purchased services and contract labor. These cost cutting measures aim to improve net margins and bolster earnings despite a challenging macroeconomic environment.

Curious how modest revenue growth, rising margins, and a re rated earnings multiple could justify a higher value for a cyclical chemicals player? See how those moving parts fit together in the narrative’s full valuation blueprint.

Result: Fair Value of $27.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still hinges on easing energy and feedstock costs, as well as a steadier global demand backdrop than recent data imply.

Find out about the key risks to this Dow narrative.

Another Angle on Value

Our DCF model tells a different story, pointing to a fair value closer to $13.86, which would make Dow look overvalued at today’s $23.11 price. If cash flows disappoint or prove more cyclical than hoped, this more cautious view could end up closer to reality.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dow for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 893 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dow Narrative

If you see the story differently, or simply want to stress test these assumptions against your own research, you can build a custom view in minutes, Do it your way.

A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing edge?

Before you move on, consider a few fresh ideas from the Simply Wall Street Screener so you are not relying on just one stock’s story.

- Explore potential multi baggers early by scanning these 3591 penny stocks with strong financials that show improving fundamentals and rising investor attention.

- Follow structural shifts in technology by targeting these 27 AI penny stocks that combine strong balance sheets with scalable artificial intelligence products and platforms.

- Build a growing income stream by focusing on these 15 dividend stocks with yields > 3% that offer solid yields alongside sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com