How Investors May Respond To BridgeBio Pharma (BBIO) Strong Attruby Sales, Wider Losses, And CEO Stock Sale

- BridgeBio Pharma recently reported a mixed third-quarter 2025 update, with revenue beating expectations on strong U.S. demand for its genetic disease drug Attruby while losses came in wider than anticipated, alongside CEO Neil Kumar selling US$5.9 million of stock under a pre-arranged Rule 10b5-1 plan.

- Despite the heavier loss and insider share sale, analysts largely reiterated positive views on BridgeBio, emphasizing Attruby’s momentum and the company’s late-stage rare disease pipeline as key drivers for its long-term story.

- With Attruby’s strong U.S. performance now clearer, we’ll explore how this shapes BridgeBio’s late-stage pipeline-driven investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

BridgeBio Pharma Investment Narrative Recap

To own BridgeBio, you need to believe Attruby can anchor a growing rare disease franchise while the late stage pipeline turns that early traction into a broader business. The mixed third quarter, wider loss and CEO stock sale do not appear to change the key near term catalyst, which remains continued U.S. uptake of Attruby, nor the main risk around Attruby concentration and ongoing cash burn.

The most relevant recent update is BridgeBio’s third quarter 2025 earnings, where revenue of US$120.7 million beat expectations on strong U.S. demand for Attruby despite a US$182.7 million net loss. That combination reinforces how tightly the current story is tied to Attruby’s performance and leaves the company still exposed to future clinical, competitive and pricing outcomes as its pipeline advances.

Yet behind Attruby’s early success, investors should also be aware of the risk that continued high operating expenses and potential future dilutive financing could...

Read the full narrative on BridgeBio Pharma (it's free!)

BridgeBio Pharma's narrative projects $1.7 billion revenue and $297.7 million earnings by 2028.

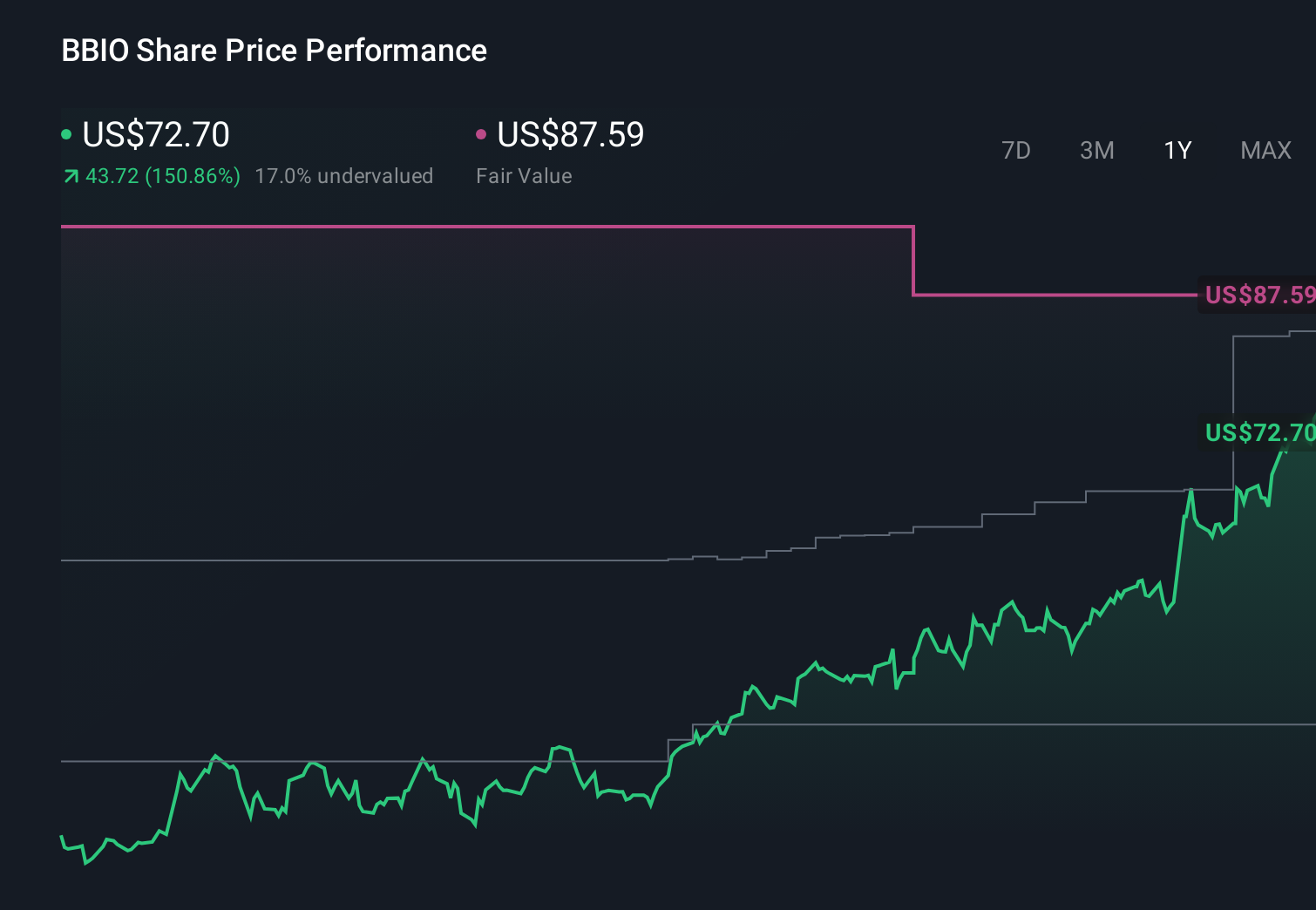

Uncover how BridgeBio Pharma's forecasts yield a $84.65 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community place BridgeBio’s fair value between US$14.28 and US$331.52, showing very different expectations for upside. Against that spread, BridgeBio’s reliance on Attruby for most current revenue and its persistent losses highlight why you may want to compare several viewpoints before deciding how its story could play out.

Explore 8 other fair value estimates on BridgeBio Pharma - why the stock might be worth over 4x more than the current price!

Build Your Own BridgeBio Pharma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free BridgeBio Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BridgeBio Pharma's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com