The Bull Case For Air Water (TSE:4088) Could Change Following Leadership Power Consolidation Around New CEO

- Air Water Inc. recently announced that Chairman and Representative Director Kikuo Toyoda resigned from his roles on December 3, 2025, transitioning to Senior Advisor while Ryosuke Matsubayashi became the sole Representative Director as President, CEO, and COO.

- This consolidation of top leadership into a single Representative Director marks a meaningful shift in the company’s governance structure and decision-making center.

- We’ll now examine how concentrating leadership authority in Ryosuke Matsubayashi’s hands could influence Air Water’s investment narrative and future direction.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Air Water's Investment Narrative?

To own Air Water, you need to be comfortable with a slower growing but profitable industrial that offers reasonable value on earnings, solid albeit modest profit growth, and an ongoing dividend stream that is not perfectly backed by free cash flow. Near term, the key catalysts still sit around delivering on FY2026 guidance, managing its high debt load, and how effectively it executes corporate actions like the planned company split and any M&A. The move to concentrate authority in Ryosuke Matsubayashi as sole Representative Director likely affects tone and speed of decision making more than fundamentals, and recent share price volatility does not yet suggest the market sees this as a major break in the story. Still, with board turnover already high, some investors may treat governance stability as a bigger watchpoint than before.

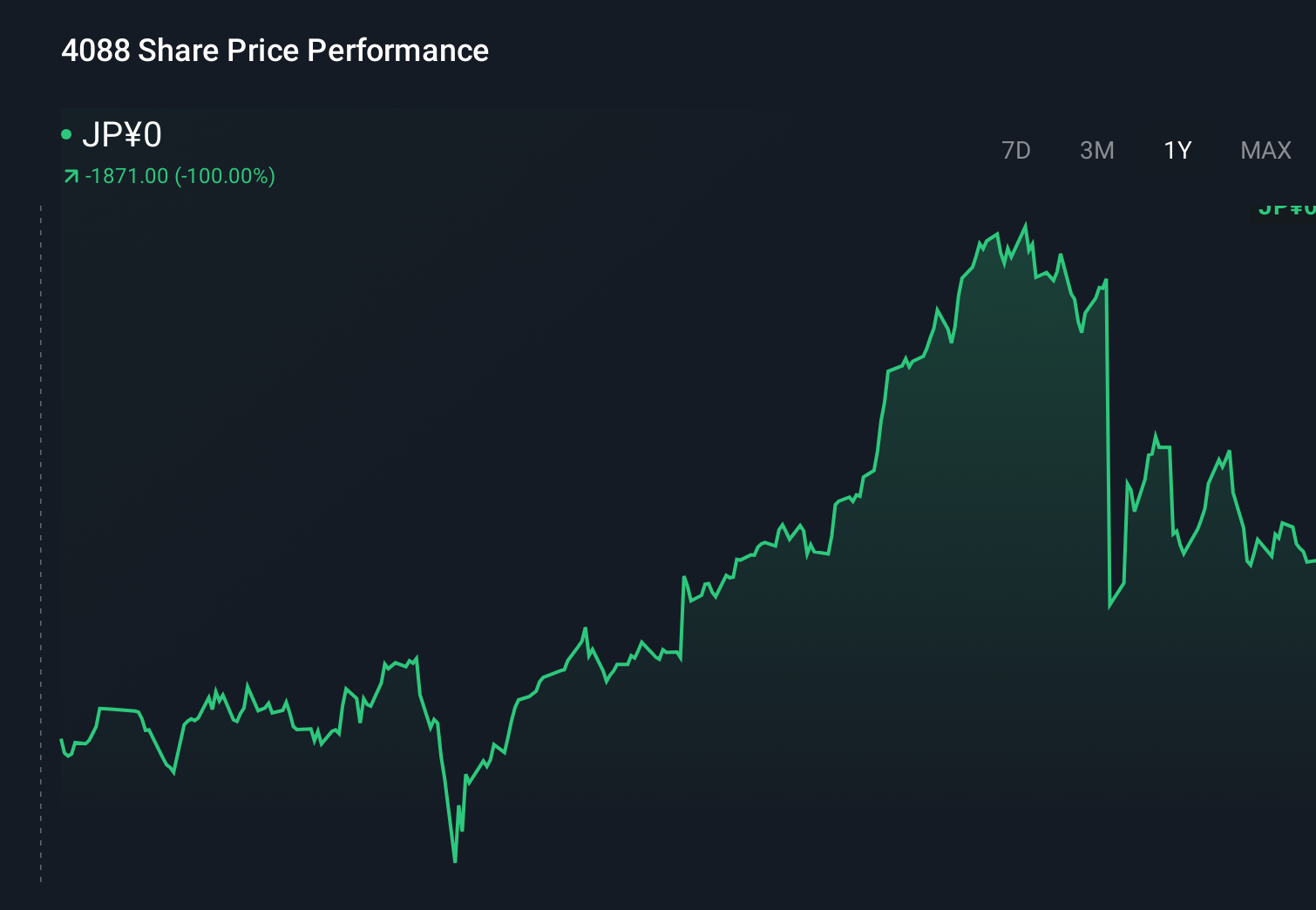

However, one governance risk in particular is something investors should not ignore. Air Water's shares are on the way up, but they could be overextended by 31%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on Air Water - why the stock might be worth 24% less than the current price!

Build Your Own Air Water Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Water research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Air Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Water's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com