SoftBank (TSE:9434) Valuation Check as It Joins Nvidia-Led Skild AI Funding Talks

SoftBank (TSE:9434) is back in the AI spotlight, reportedly joining Nvidia in talks to fund Skild AI in a billion dollar plus round that could reshape how investors view SoftBank’s tech exposure.

See our latest analysis for SoftBank.

All of this comes as SoftBank’s ¥217.3 share price has delivered a solid year to date, with a 10.75% year to date share price return and a 12.63% one year total shareholder return. This builds on a 110.85% five year total shareholder return that signals momentum in its broader turnaround narrative, even as short term share price returns have cooled slightly.

If this kind of AI driven story has your attention, it is a good moment to explore other high growth tech names through high growth tech and AI stocks and see what else could be setting up for a similar rerating.

Yet with the shares already up strongly over three and five years and trading at only a modest discount to analyst targets, the real question now is whether SoftBank still offers mispriced upside or whether the market is already discounting future growth.

Most Popular Narrative: 7.5% Undervalued

SoftBank’s most followed narrative sees fair value modestly above the ¥217.3 last close, framing the current price as leaving some upside on the table.

Planned rollout of homegrown large language models (LLMs) and commercial GPU as a service targeting Japan-based enterprises capitalizes on surging enterprise AI adoption, which is set to accelerate recurring revenues and support margin expansion from higher-value digital infrastructure services.

Want to see what kind of revenue runway and profit uplift this AI build out is actually baking in, and how that feeds into a future earnings multiple the narrative claims still looks reasonable for a telecom anchored platform, not just a pure tech play? The full story breaks down the growth curve behind that fair value, and the assumptions that quietly turn a traditional carrier into a digital infrastructure compounder.

Result: Fair Value of ¥234.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent price competition and rising network and labor costs could squeeze margins and undermine AI driven growth assumptions baked into the current valuation.

Find out about the key risks to this SoftBank narrative.

Another Way to Look at Value

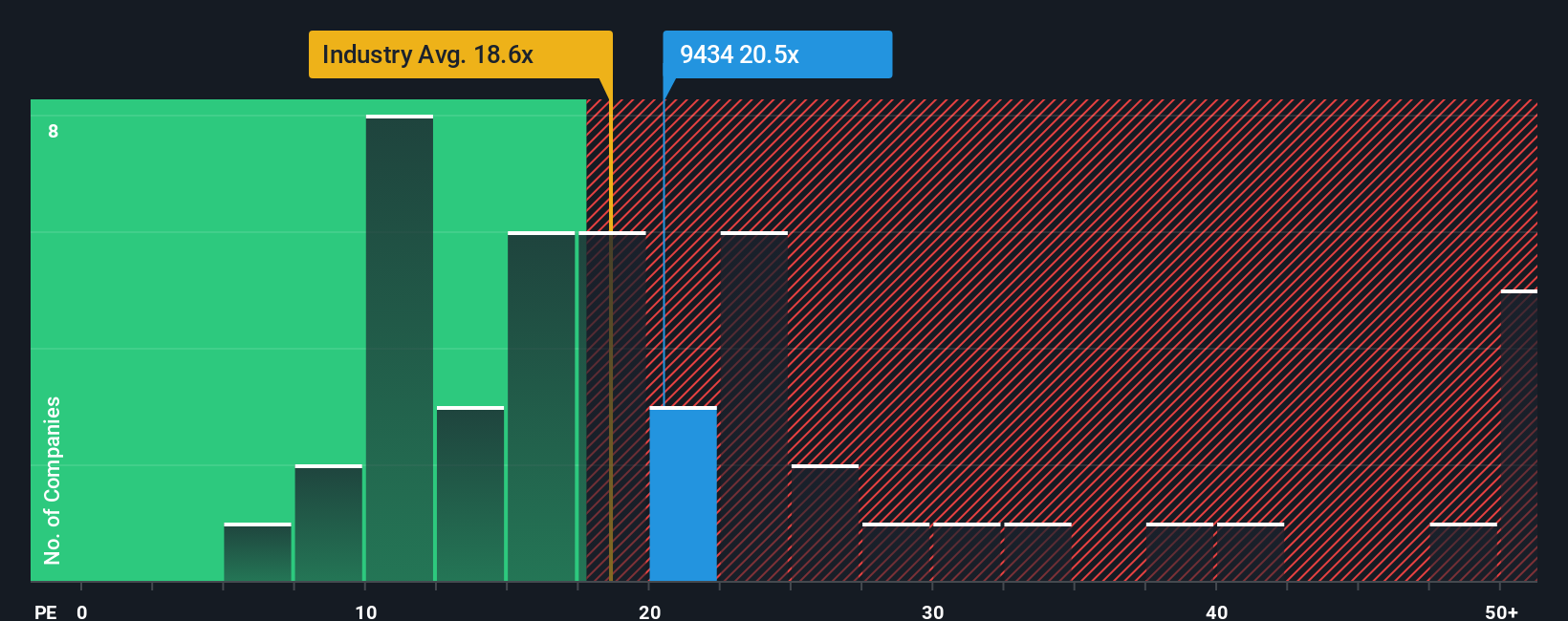

On earnings multiples, SoftBank looks a little stretched. Its P/E of 19.2 times is richer than peer averages at 13.9 times and sits slightly above its own 19.1 times fair ratio, suggesting limited margin of safety if growth expectations slip. Is the market already paying up for the AI story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SoftBank Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your SoftBank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at just one opportunity. Use the Simply Wall St Screener to quickly surface fresh stock ideas before the market fully recognizes their potential.

- Capitalize on mispriced potential by targeting companies trading below cash flow estimates through these 893 undervalued stocks based on cash flows to position yourself ahead of a possible rerating.

- Harness the structural tailwinds of automation and machine learning with these 27 AI penny stocks and focus your attention on businesses building real, scalable AI revenue streams.

- Supercharge your income strategy by scanning for solid cash generators in these 15 dividend stocks with yields > 3% to find yields that could strengthen long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com