Ollamani, S.A.B.'s (BMV:AGUILASCPO) Business Is Yet to Catch Up With Its Share Price

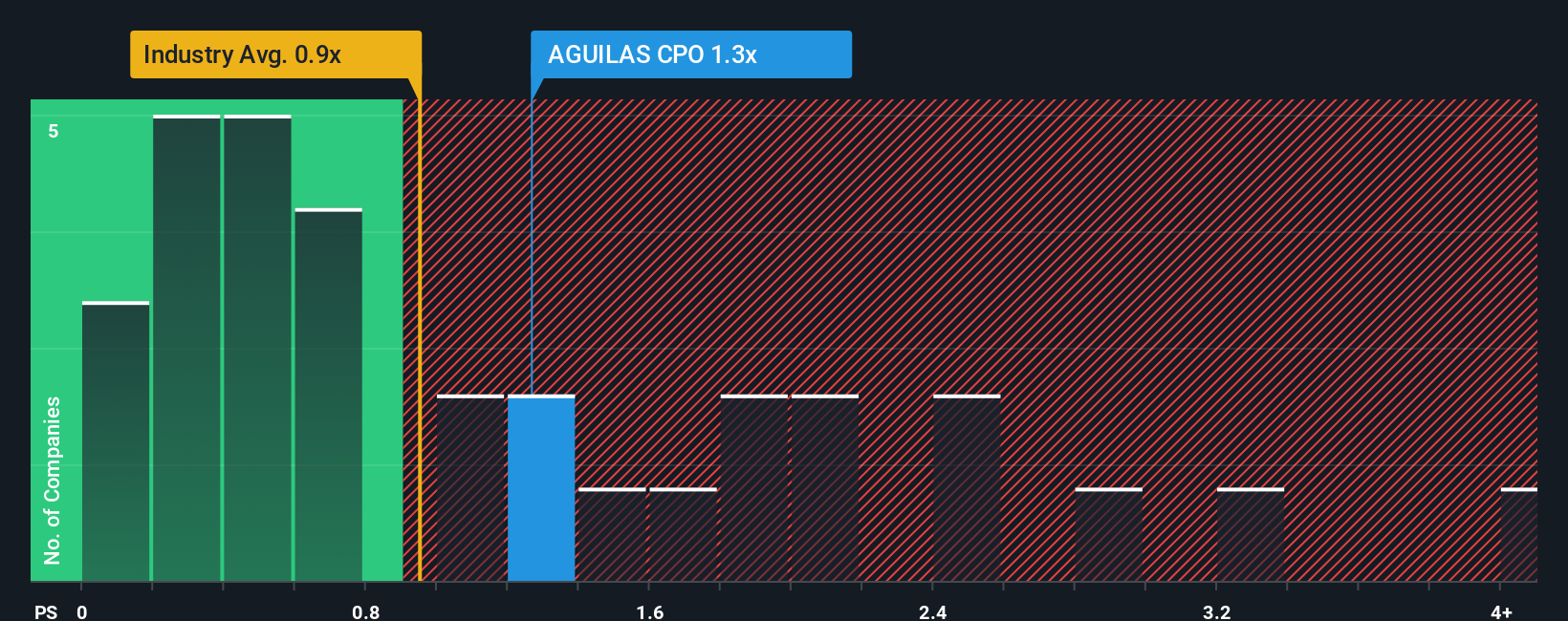

When you see that almost half of the companies in the Hospitality industry in Mexico have price-to-sales ratios (or "P/S") below 0.7x, Ollamani, S.A.B. (BMV:AGUILASCPO) looks to be giving off some sell signals with its 1.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Ollamani

How Ollamani Has Been Performing

With revenue growth that's inferior to most other companies of late, Ollamani has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Ollamani will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ollamani?

The only time you'd be truly comfortable seeing a P/S as high as Ollamani's is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.5% last year. The solid recent performance means it was also able to grow revenue by 19% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 11% as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 17% growth forecast for the broader industry.

With this information, we find it concerning that Ollamani is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Ollamani's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Ollamani, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Ollamani with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Ollamani, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.