TSX Value Picks Estimated To Be Trading Up To 49% Below Intrinsic Value

As we approach the end of 2025, Canadian markets have shown impressive resilience with the TSX posting a robust 27% gain year-to-date, while investors keenly observe potential catalysts such as central bank meetings and labor market reports. In this environment of cautious optimism, identifying undervalued stocks becomes crucial for investors seeking to capitalize on opportunities that may be trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$123.65 | CA$222.74 | 44.5% |

| Pan American Silver (TSX:PAAS) | CA$67.05 | CA$131.48 | 49% |

| Neo Performance Materials (TSX:NEO) | CA$16.92 | CA$31.57 | 46.4% |

| NanoXplore (TSX:GRA) | CA$2.19 | CA$3.59 | 39% |

| GURU Organic Energy (TSX:GURU) | CA$4.99 | CA$8.91 | 44% |

| EQB (TSX:EQB) | CA$97.91 | CA$183.12 | 46.5% |

| Dexterra Group (TSX:DXT) | CA$11.84 | CA$22.89 | 48.3% |

| Decisive Dividend (TSXV:DE) | CA$7.14 | CA$14.22 | 49.8% |

| Constellation Software (TSX:CSU) | CA$3341.58 | CA$5810.40 | 42.5% |

| 5N Plus (TSX:VNP) | CA$19.10 | CA$31.32 | 39% |

Let's explore several standout options from the results in the screener.

Aya Gold & Silver (TSX:AYA)

Overview: Aya Gold & Silver Inc., along with its subsidiaries, focuses on the exploration, evaluation, and development of precious metals projects in Morocco and has a market capitalization of CA$2.67 billion.

Operations: The company's revenue is primarily derived from the production at the Zgounder Silver Mine in Morocco, totaling $136.12 million.

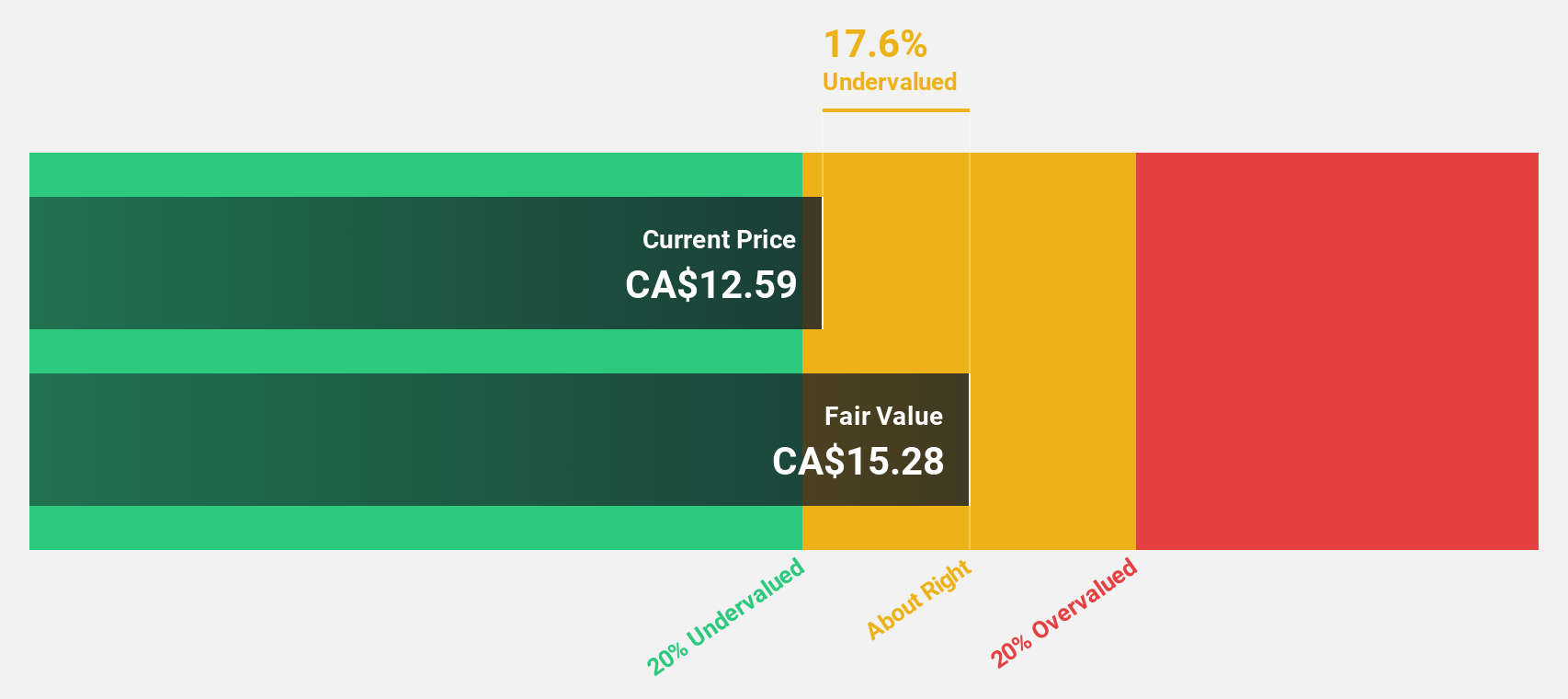

Estimated Discount To Fair Value: 33%

Aya Gold & Silver is trading at CA$18.85, significantly below its estimated fair value of CA$28.11, suggesting it may be undervalued based on cash flows. The company forecasts robust revenue growth at 27% annually, outpacing the Canadian market average of 5.1%. Recent announcements highlight successful resource expansion and high-grade mineral discoveries in Morocco, which could enhance future cash flows and support valuation improvements as the Boumadine project scales up operations.

- Our growth report here indicates Aya Gold & Silver may be poised for an improving outlook.

- Click here to discover the nuances of Aya Gold & Silver with our detailed financial health report.

Pan American Silver (TSX:PAAS)

Overview: Pan American Silver Corp. is involved in the exploration, development, extraction, processing, refining, and reclamation of mines across Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil with a market cap of approximately CA$28.30 billion.

Operations: The company's revenue is derived from its mining operations in various countries, including Canada - Timmins ($331.30 million), Mexico - Dolores ($206.40 million) and La Colorada ($243.10 million), Peru - Huaron ($193.30 million) and Shahuindo ($429.60 million), Brazil - Jacobina ($597.50 million), Chile - El Peñon ($501 million), Bolivia - SAN Vicente ($117.60 million), and Argentina - Cerro Moro ($321.80 million).

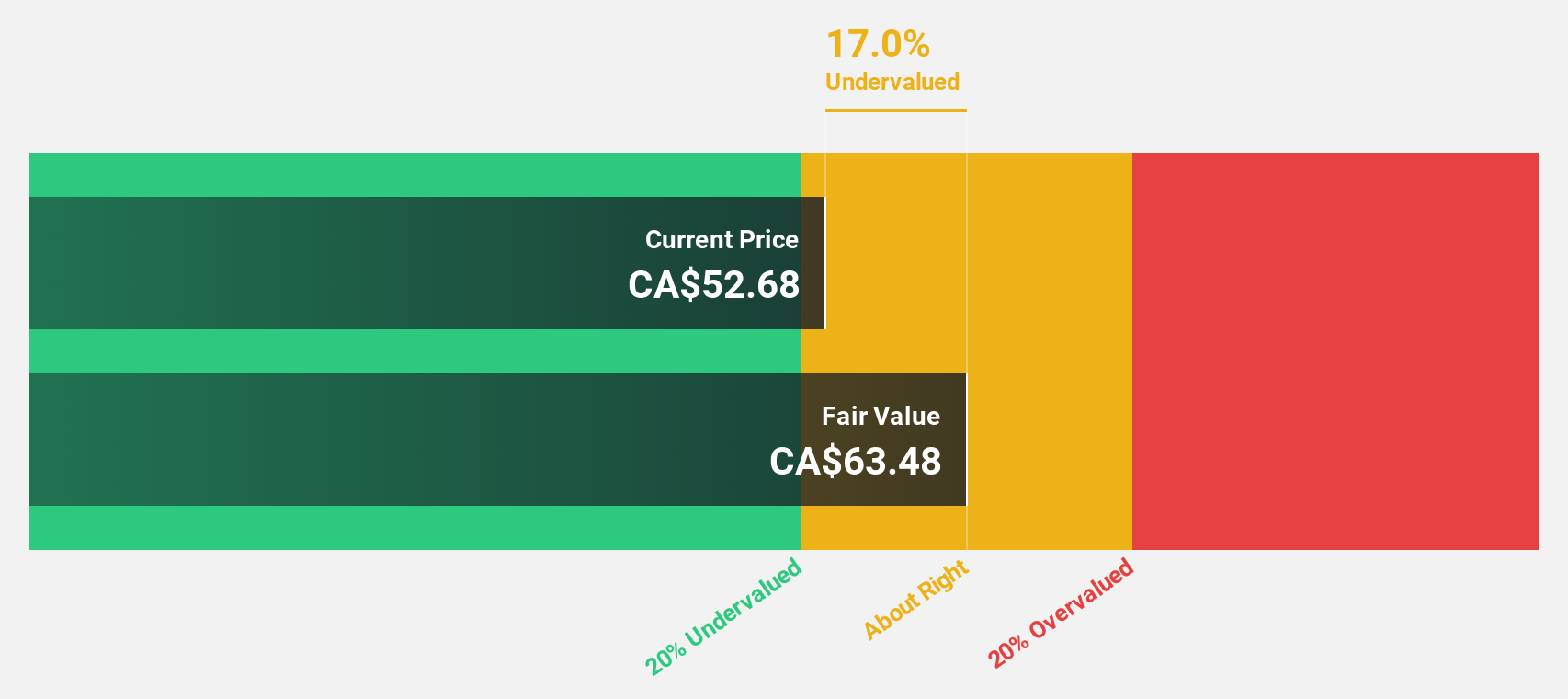

Estimated Discount To Fair Value: 49%

Pan American Silver is trading at CA$67.05, notably below its estimated fair value of CA$131.48, indicating potential undervaluation based on cash flows. The company's earnings are forecasted to grow significantly at 29.8% annually, surpassing the Canadian market average of 12.2%. Recent exploration updates reveal promising mineral resource expansions across multiple mines, enhancing future cash flow potential and supporting valuation improvements as these resources are developed further.

- Our earnings growth report unveils the potential for significant increases in Pan American Silver's future results.

- Navigate through the intricacies of Pan American Silver with our comprehensive financial health report here.

ShaMaran Petroleum (TSXV:SNM)

Overview: ShaMaran Petroleum Corp. is involved in oil and gas exploration and production through its subsidiaries, with a market cap of CA$718.86 million.

Operations: The company's revenue is primarily derived from the exploration and development of oil and gas assets, amounting to $134.96 million.

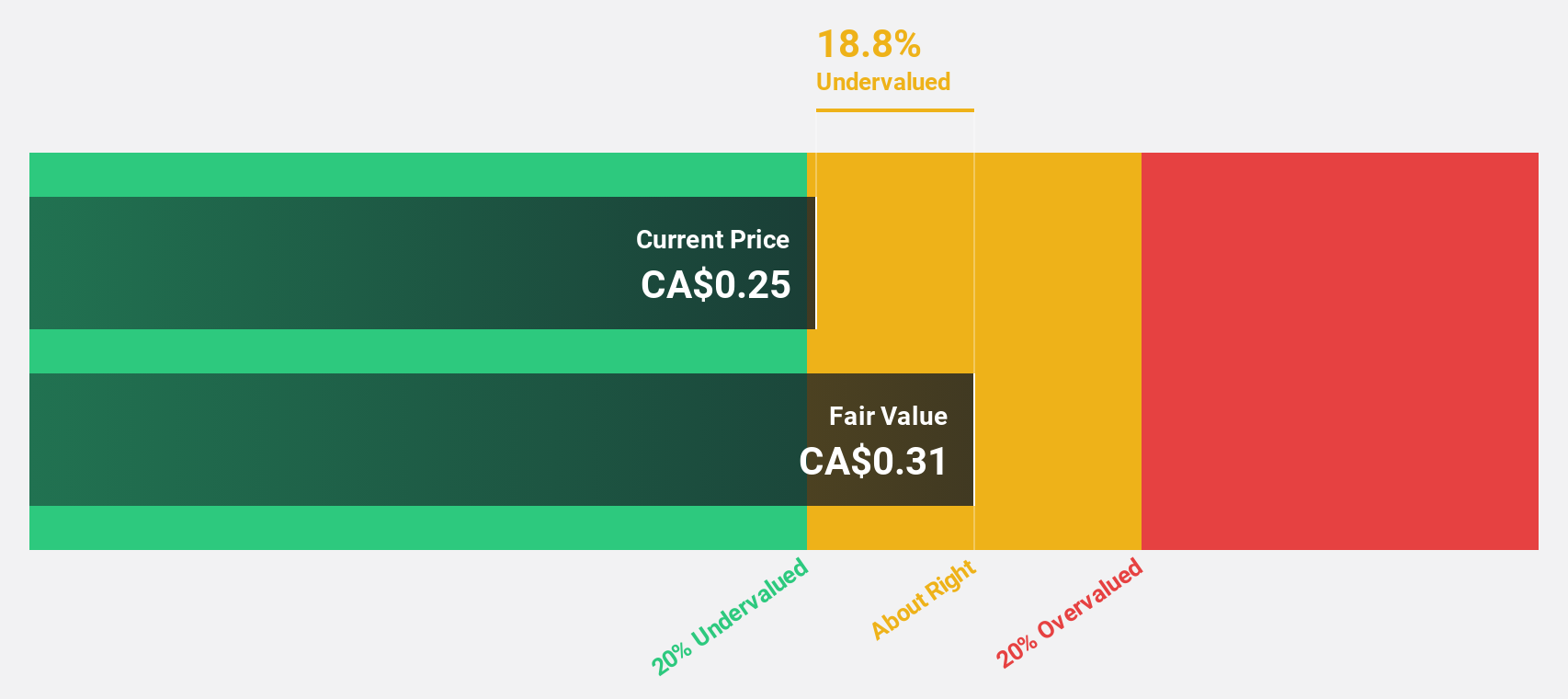

Estimated Discount To Fair Value: 19.3%

ShaMaran Petroleum, with a share price of CA$0.25, trades below its estimated fair value of CA$0.31, suggesting it may be undervalued based on cash flows. Despite a sharp decline in profit margins from 77.1% to 9.2%, earnings are forecasted to grow significantly at 23.4% annually over the next three years, outpacing the Canadian market average growth rate of 12.2%. Recent agreements facilitate resumed international oil exports, potentially stabilizing cash flows further.

- The analysis detailed in our ShaMaran Petroleum growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of ShaMaran Petroleum stock in this financial health report.

Make It Happen

- Get an in-depth perspective on all 27 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com