Fifth Third Bancorp (FITB): Assessing Valuation After Steady Multi‑Year Shareholder Returns

Fifth Third Bancorp (FITB) has quietly outperformed many regional peers this month, with shares edging higher as investors reward its steady revenue and net income growth while still pricing in some macro uncertainty.

See our latest analysis for Fifth Third Bancorp.

Zooming out, Fifth Third’s roughly 7 percent year to date share price return and strong three year total shareholder return near 60 percent signal that underlying momentum is still very much intact, even if the latest move has been modest.

If this kind of steady bank performance has you thinking about what else to watch, it might be worth exploring fast growing stocks with high insider ownership as a source of fresh ideas beyond financials.

With revenue and earnings still climbing and the shares trading at a visible discount to analyst and intrinsic value estimates, the central question is whether this represents a buying opportunity or whether the market has already priced in future growth.

Most Popular Narrative Narrative: 10.5% Undervalued

With Fifth Third Bancorp last closing at $45.18 against a narrative fair value near $50.50, the story positions current pricing as materially conservative.

Fair Value has risen slightly, edging up from $50.25 to $50.50 per share.

Future P/E has risen modestly, increasing from about 7.96x to approximately 8.01x forward earnings.

Want to see why this bank is being modeled with richer future earnings power and only a small tweak in discount rate assumptions, despite sector noise?

Result: Fair Value of $50.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if commercial loan demand remains sluggish or if fintech competitors gain share faster than Fifth Third adapts.

Find out about the key risks to this Fifth Third Bancorp narrative.

Another Angle on Value

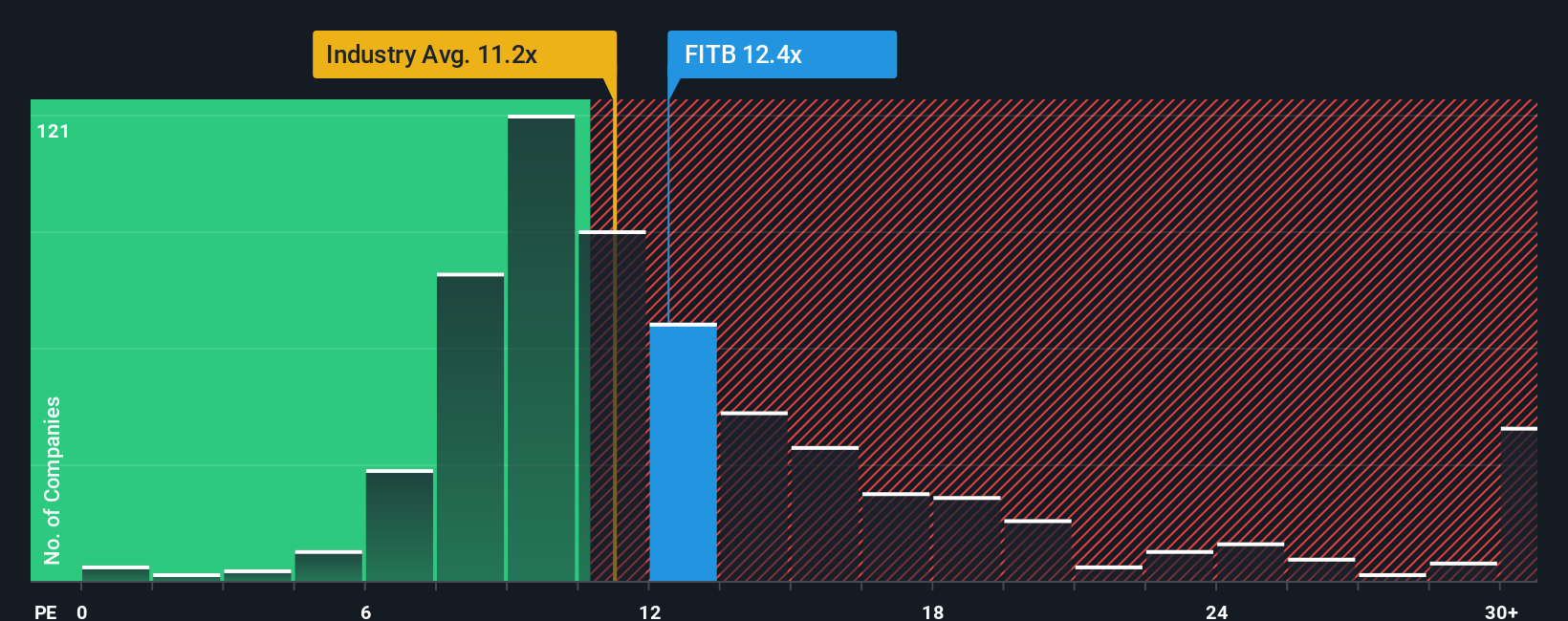

While the fair value narrative suggests only about 10.5 percent upside, market based pricing paints a more stretched picture. Fifth Third trades on roughly 13.2 times earnings, above the US banks average of 11.6 times yet still below a 19.4 times fair ratio our work implies.

That gap hints at a stock already priced richer than many peers but still potentially cheap if the market ever moves closer to the fair ratio. This leaves investors to decide whether this represents a margin of safety or a sign expectations are running ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fifth Third Bancorp Narrative

If you see the story differently or want to dig into the numbers yourself, you can spin up a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fifth Third Bancorp.

Looking for more investment ideas?

Do not stop at one opportunity when a whole universe of potential winners is just a few clicks away on the Simply Wall St Screener.

- Explore opportunities in companies trading below their estimated cash flow potential using these 894 undervalued stocks based on cash flows as your hunting ground.

- Focus on businesses involved in intelligent automation through these 27 AI penny stocks and consider their earnings potential.

- Filter for reliable payers via these 15 dividend stocks with yields > 3% with yields that can contribute to total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com