Assessing Advanced Energy Industries (AEIS) Valuation After a 92% Year-to-Date Share Price Surge

Advanced Energy Industries (AEIS) has quietly delivered a strong run, with the stock up roughly 92% year to date and nearly 88% over the past year, driven by solid revenue and earnings growth.

See our latest analysis for Advanced Energy Industries.

At a share price of $221.27, the stock’s strong 90 day share price return of 38.71 percent and powerful three year total shareholder return of 138.12 percent signal momentum that investors are increasingly willing to pay up for.

If AEIS’s run has you thinking about what else could surprise to the upside, now is a good time to explore high growth tech and AI stocks for other fast moving opportunities.

With the shares now hovering just shy of analyst targets after such a powerful run, the key debate is whether Advanced Energy remains undervalued or if the market has already priced in its next leg of growth.

Most Popular Narrative: 1.7% Undervalued

With Advanced Energy trading just above its narrative fair value of $225 and last closing at $221.27, the story hinges on whether future growth can keep powering this tight gap.

Continuous acceleration in the global adoption of advanced semiconductor manufacturing (including leading edge logic and memory), combined with the proliferation of digitization and IoT, is leading to strong customer pull for AE's new technology platforms (eVoS, eVerest, NavX). Revenue from these platforms is expected to double in 2025 and ramp further as fabs move to volume production, supporting both future revenue and margin expansion.

Curious how this doubling effect, rising margins and a reset in future earnings multiples all fit together? The narrative builds a bold roadmap using compounding revenue, expanding profitability and a very specific profit multiple years from now. Want to see which assumptions carry the most weight in that calculation?

Result: Fair Value of $225 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated hyperscale demand and semiconductor cyclicality, including tariff and China risks, could quickly cool growth expectations and compress today’s premium narrative.

Find out about the key risks to this Advanced Energy Industries narrative.

Another Angle on Valuation

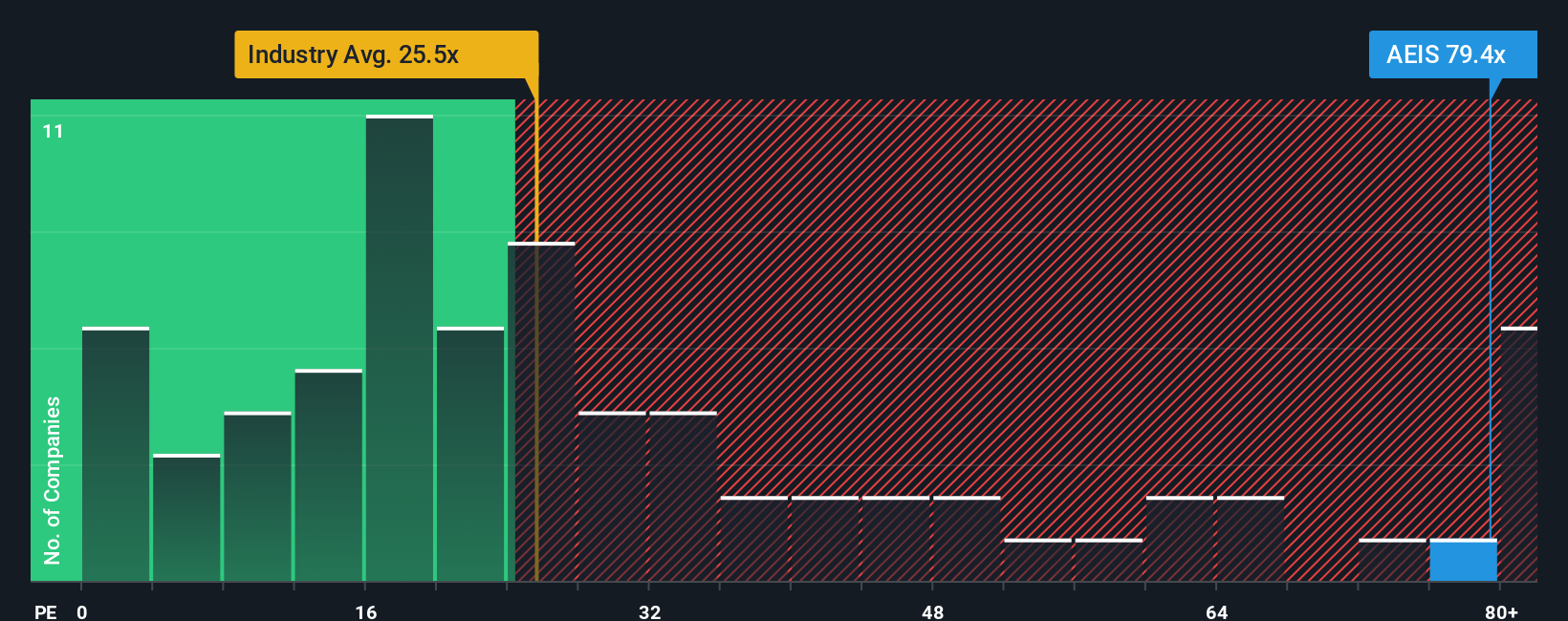

While the narrative suggests AEIS is only 1.7 percent undervalued, its 57.3 times earnings multiple looks stretched next to the US Electronic industry at 24.7 times, peers at 30.4 times, and a fair ratio of 38.3 times, implying meaningful downside if sentiment cools. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Energy Industries Narrative

If you see things differently or want to stress test the assumptions with your own inputs, you can build a personalized narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Advanced Energy Industries.

Looking for more investment ideas?

Put your momentum from Advanced Energy to work and lock in your next move with data backed stock ideas that many investors overlook until it is too late.

- Capture early stage potential with these 3590 penny stocks with strong financials that pair tiny share prices with robust balance sheets and improving fundamentals.

- Position for the next productivity wave by targeting these 30 healthcare AI stocks transforming diagnostics, drug discovery, and hospital efficiency.

- Secure income streams through these 15 dividend stocks with yields > 3% that focus on sustaining payouts without assuming any particular level of capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com