KKR (KKR): Valuation Check After Major AI Security and Data Center Investments

KKR (KKR) has jumped back onto investors radar after leading a $700 million round in identity security firm Saviynt and striking a multibillion dollar data center deal with Compass Datacenters, both tightly linked to accelerating AI demand.

See our latest analysis for KKR.

The flurry of AI infrastructure and cybersecurity deals seems to be resonating with investors, with KKR’s 1 month share price return of 13.05 percent lifting the stock off its year to date and 1 year lows. This comes even though the 1 year total shareholder return of negative 13.24 percent contrasts sharply with a powerful 3 year total shareholder return of 181.56 percent that still speaks to strong long term wealth creation.

If you like the AI and infrastructure angle behind KKR’s latest moves, you might also want to explore other high growth tech and AI names using high growth tech and AI stocks.

With the shares still trading at a mid-teens discount to analyst targets, despite a powerful three-year run, investors now face a key question: Is KKR undervalued at this level, or already pricing in its next leg of AI-fueled growth?

Most Popular Narrative: 14% Undervalued

With KKR last closing at $135.78 against a narrative fair value near $158, the storyline leans toward upside if its earnings engine delivers.

Large embedded unrealized carried interest ($17B+ in gains, a record high) and a highly marked-up portfolio mean KKR is well-placed for significant future monetization activities, which could drive realized performance revenue and EPS as exits occur over the next several quarters and years.

Want to see how shrinking revenues can still support a richer valuation? This narrative leans on explosive profit expansion and a bold future earnings multiple. Curious which assumptions make that math work?

Result: Fair Value of $157.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, these upside assumptions could unravel if fundraising slows amid tougher competition or if credit and asset based finance exposures trigger unexpected write downs.

Find out about the key risks to this KKR narrative.

Another Lens on Value

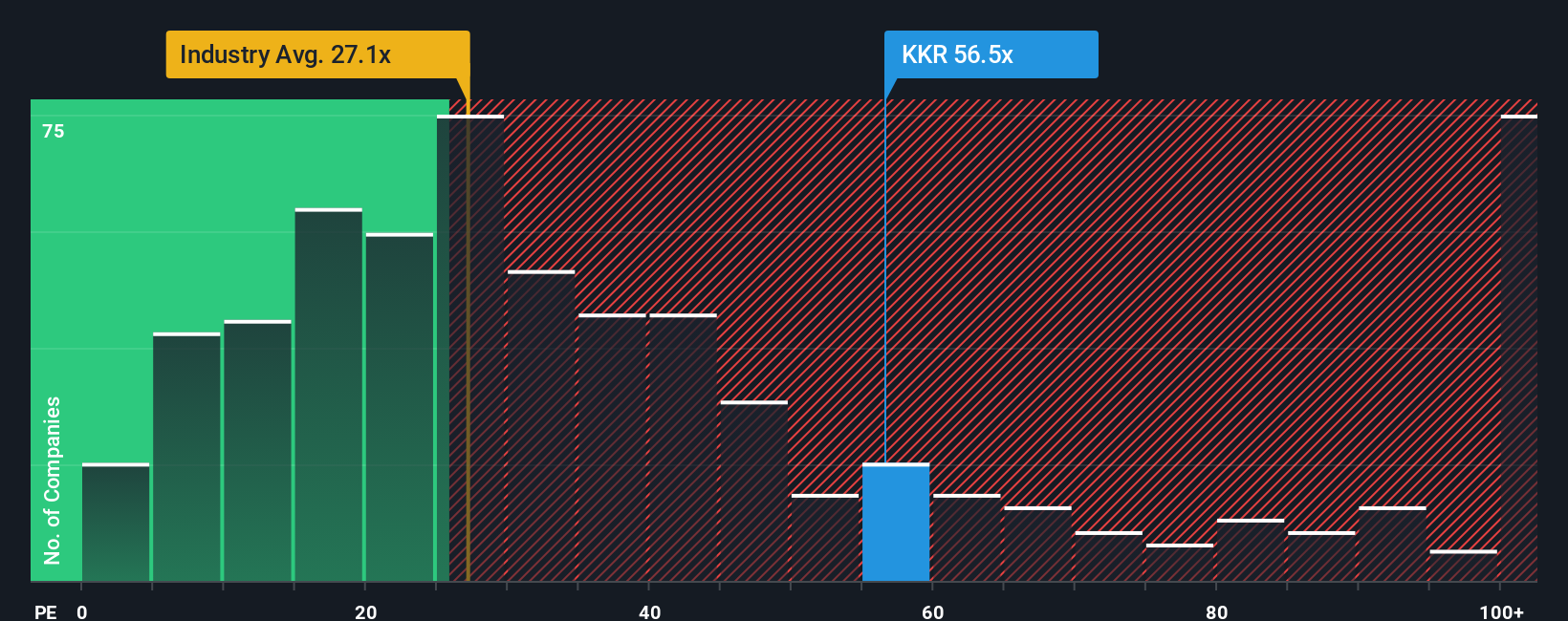

Step away from the optimistic narrative of fair value and the earnings forecast, and the picture looks harsher. On a simple price-to-earnings basis, KKR trades at about 53 times earnings versus 25 times for the US Capital Markets industry and a fair ratio of roughly 27 times. This suggests the market is already paying up heavily for the growth story. If sentiment cools or earnings stumble, that gap could close the hard way, not the easy way, so how much volatility are you really comfortable underwriting?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KKR Narrative

If you would rather test the numbers yourself and challenge these assumptions, you can build a personalized KKR story in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding KKR.

Looking for more investment ideas?

Before you move on, secure your next potential winner by scanning focused stock shortlists built to surface opportunities you might otherwise miss.

- Target potential bargains early by reviewing these 3589 penny stocks with strong financials that pair low share prices with strengthening fundamentals and improving business momentum.

- Capitalize on structural growth trends by tracking these 27 AI penny stocks positioned at the heart of algorithmic breakthroughs, automation, and intelligent software.

- Lock in value driven opportunities by using these 894 undervalued stocks based on cash flows that highlight companies trading below what their cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com