Assessing Aris Mining’s (TSX:ARIS) Valuation After Its 277% Year-to-Date Share Price Surge

Aris Mining (TSX:ARIS) has quietly turned into one of the stronger performers on the TSX this year, with the stock up nearly 280% year-to-date and roughly 240% over the past year.

See our latest analysis for Aris Mining.

With the share price now at $19.86 and a powerful 30 day share price return of 31.44 percent capping off a 277.57 percent year to date share price move, momentum looks firmly on the side of investors, supported by robust recent revenue and earnings growth that hint the market is steadily reassessing Aris Mining’s risk and long term potential.

If Aris Mining’s run has you thinking about what else could be setting up for strong performance, it might be worth exploring fast growing stocks with high insider ownership as your next hunting ground.

With analysts still seeing upside to the current share price and earnings growth accelerating, the key question now is simple: Is Aris Mining still trading below its true potential, or are markets already pricing in all that future growth?

Most Popular Narrative: 25.3% Undervalued

With Aris Mining last closing at CA$19.86 against a narrative fair value of roughly CA$26.59, the implied upside rests on aggressive growth playing out as forecast.

The ongoing expansion at the Segovia operations, with the new second ball mill increasing processing capacity by 50% and a targeted production ramp up to 300,000 ounces in 2026, is set to drive sustained revenue growth and structurally higher operating margins as fixed costs are leveraged over larger output.

Curious how rising volumes, fatter margins, and a compressed future earnings multiple can still add up to a sizeable upside gap? The narrative’s roadmap blends rapid top line expansion with a dramatic profit shift and a surprisingly restrained valuation peg on those future earnings. Want to see which assumptions really carry the weight in that fair value math and how sensitive the outcome is to just a few key inputs? Dive in to unpack the full projection stack behind this target.

Result: Fair Value of $26.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on delivering complex Colombian expansions on time and on budget in an environment of volatile gold prices that could quickly squeeze margins.

Find out about the key risks to this Aris Mining narrative.

Another View: Market Multiple Sends a Different Signal

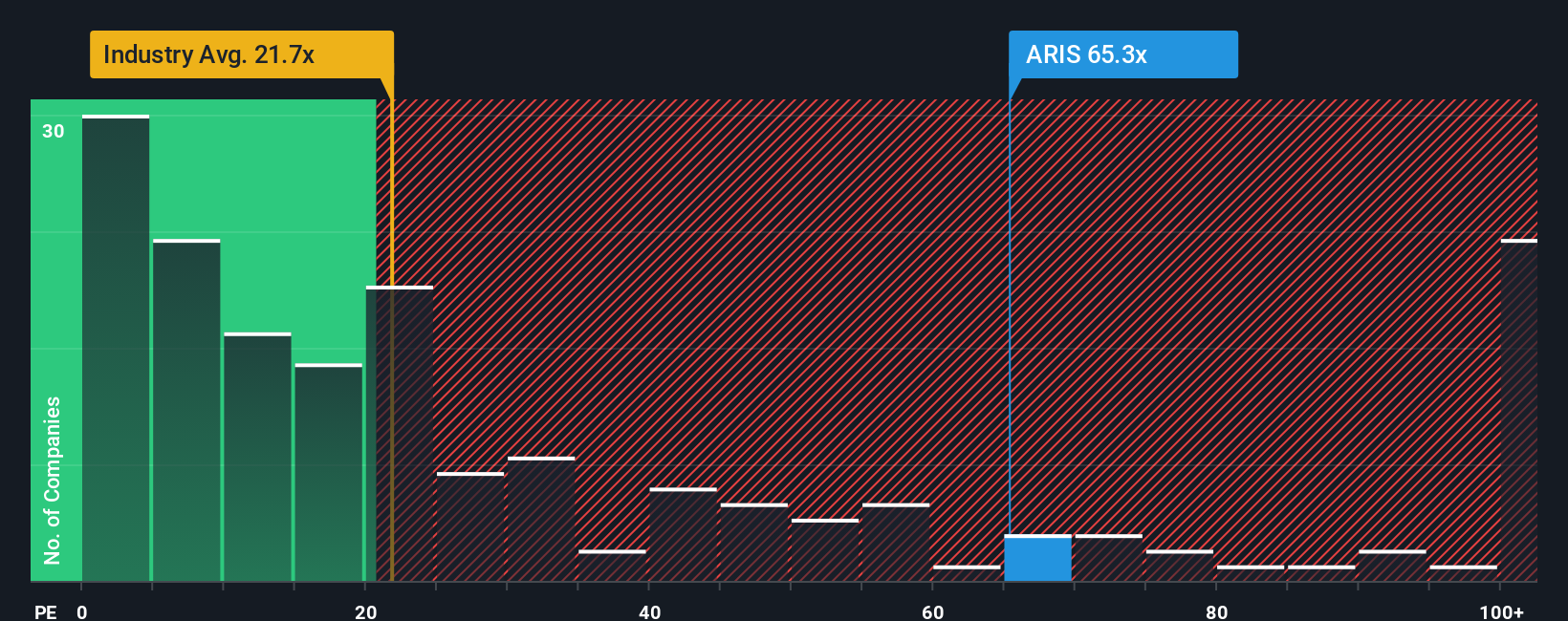

While the narrative fair value points to upside, the current share price already embeds a rich earnings tag. Aris Mining is trading on a 59.6x price to earnings ratio versus 21.2x for the Canadian metals and mining industry and a fair ratio of 52.7x, suggesting limited margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aris Mining Narrative

If you see the story differently or want to stress test the assumptions for yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your Aris Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next investing move?

Before momentum shifts again, lock in fresh ideas with the Simply Wall St Screener so you are not watching the next big winner from the sidelines.

- Capture underpriced potential by targeting these 894 undervalued stocks based on cash flows that pair compelling fundamentals with attractive valuations built on cash flows.

- Ride the next wave of innovation by zeroing in on these 27 AI penny stocks positioned at the heart of artificial intelligence growth.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that aim to balance yield with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com