Is Tradeweb Markets Stock Price Justified After Expansion of Electronic Trading Footprint?

- Wondering if Tradeweb Markets at around $107 is a bargain or a bubble? Let us break down what the market is really pricing in and whether that lines up with the underlying business.

- The stock is down about 1% over the last week, 2.3% over the past month, and roughly 18.5% year to date, but it is still up around 68.6% over three years and 65.3% over five years. Long term holders are still sitting on solid gains.

- Recent headlines have focused on Tradeweb expanding its electronic trading footprint and deepening partnerships with major institutions. This reinforces its role at the center of bond and derivatives markets. At the same time, chatter around shifting liquidity patterns and regulatory scrutiny of market structure has kept investors rethinking what a fair price for that positioning should be.

- Despite its strategic strengths, Tradeweb currently scores just 0/6 on our valuation checks, suggesting limited traditional undervaluation signals. Next we will unpack what different valuation approaches say about the stock and then look at a more nuanced way to think about its true worth.

Tradeweb Markets scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tradeweb Markets Excess Returns Analysis

The Excess Returns model looks at how much profit Tradeweb generates above the return that investors demand on its equity, then capitalizes that stream of excess value per share.

For Tradeweb, the starting point is a Book Value of $29.43 per share and a Stable EPS of $4.07 per share, based on weighted future Return on Equity estimates from 4 analysts. With an Average Return on Equity of 12.78% and a Cost of Equity equivalent to $2.59 per share, the model estimates an Excess Return of $1.48 per share, meaning earnings are comfortably above the required return. Stable Book Value is projected at $31.86 per share, using estimates from 3 analysts.

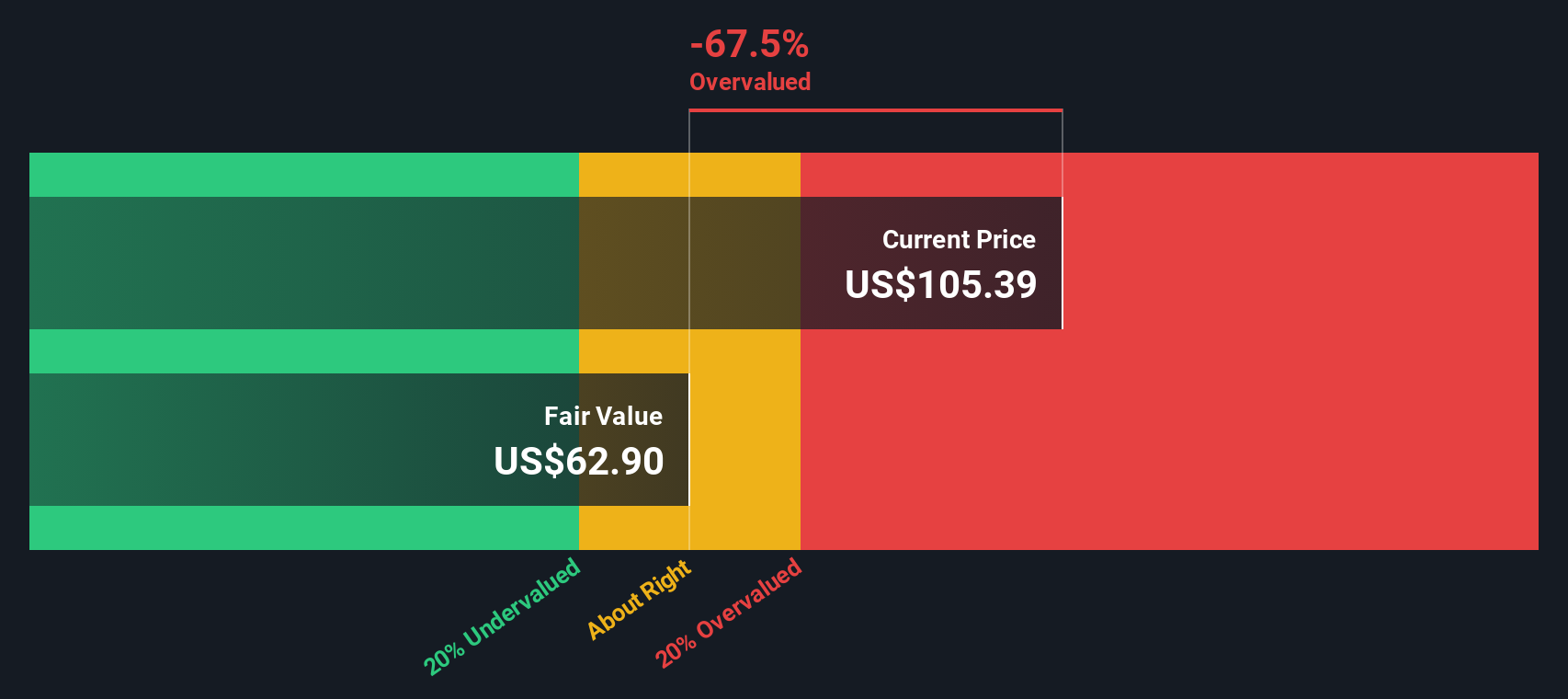

Combining these inputs, the Excess Returns framework arrives at an intrinsic value of about $62 per share. With Tradeweb trading around $107, this implies the stock is roughly 72.0% overvalued on this basis. This indicates that investors may currently be paying a steep premium for the company’s future prospects and perceived quality.

Result: OVERVALUED

Our Excess Returns analysis suggests Tradeweb Markets may be overvalued by 72.0%. Discover 894 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Tradeweb Markets Price vs Earnings

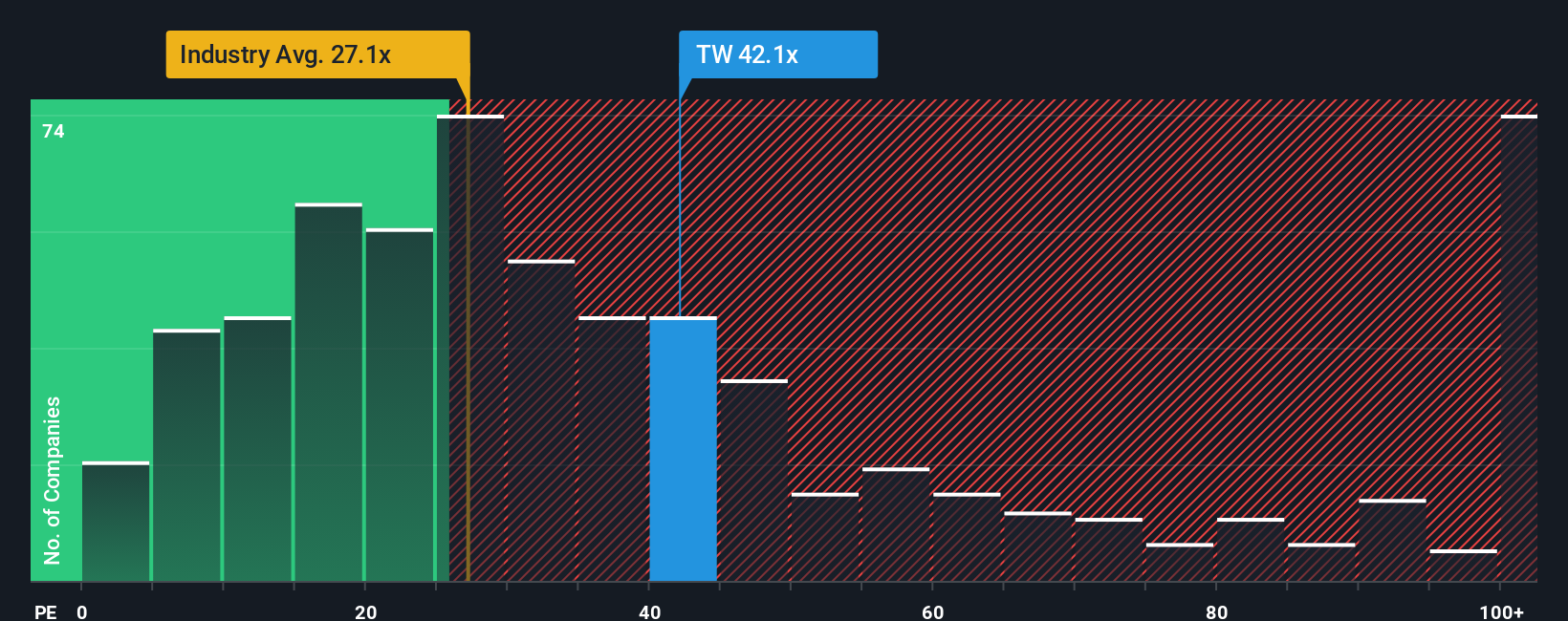

For a consistently profitable business like Tradeweb, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster earnings growth and lower perceived risk justify a higher PE ratio, while slower growth or higher uncertainty call for a lower, more conservative multiple.

Tradeweb currently trades on a PE of about 36.3x. That is well above the Capital Markets industry average of roughly 25.3x and also higher than the peer group average of around 27.5x, suggesting investors are already paying a premium for its growth profile and competitive position. To refine this comparison, Simply Wall St calculates a proprietary Fair Ratio of 16.5x, which estimates the PE that would make sense given Tradeweb’s specific mix of earnings growth, profitability, industry, market cap and risk characteristics.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for the company’s own fundamentals and risk profile rather than assuming all Capital Markets firms deserve similar valuations. Set against the current 36.3x PE, the 16.5x Fair Ratio points to Tradeweb being richly priced on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tradeweb Markets Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an approach where you tell a simple story about Tradeweb Markets, translate that story into your own forecasts for revenue, earnings and margins, and then see what fair value that story implies. On Simply Wall St’s Community page, Narratives make this process accessible by guiding you to connect your view of the business, for example how electronification, digital assets and global expansion might play out, to a financial forecast and then to a clear fair value estimate. Once you have created or chosen a Narrative, the platform compares its Fair Value to the live share price to help you decide whether Tradeweb looks like a buy, a hold or a sell right now, and updates that view dynamically whenever new earnings, news or guidance is released. For instance, one Tradeweb Narrative might take a more optimistic view and explore a scenario where the share price moves toward around $210 if volumes, margins and PE multiples all expand. A more conservative Narrative might anchor closer to about $118 if growth slows and the market applies a lower multiple. This gives you a transparent way to decide which story you find more believable.

Do you think there's more to the story for Tradeweb Markets? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com