Is Coloplast’s New Board Leadership And Dividend Policy Altering The Investment Case For Coloplast (CPSE:COLO B)?

- At Coloplast’s Annual General Meeting on 4 December 2025, shareholders approved a year-end dividend of DKK 18.00 per DKK 1 share, alongside significant board changes including the election of Niels B. Christiansen and the appointment of Jette Nygaard-Andersen as Chairman and Niels Peter Louis-Hansen as Deputy Chairman.

- These moves combine refreshed board leadership with a continued dividend payout, signaling ongoing governance renewal alongside confidence in Coloplast’s cash-generation capacity.

- Next, we’ll explore how the new chairmanship and board composition could influence Coloplast’s investment narrative and longer-term positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Coloplast Investment Narrative Recap

To own Coloplast, you need to believe in its ability to grow user-focused Chronic Care and premium wound solutions while managing regulatory and pricing pressures. The AGM outcome does not materially change the near term focus, which still centers on executing the Chronic/Acute reorganization and handling U.S. competitive bidding risk, while the biggest near term threat remains margin pressure from pricing and regulatory frictions.

The most relevant development here is the election of Jette Nygaard-Andersen as Chairman, which caps a broader governance refresh after several leadership transitions. For investors, this matters mainly in how effectively the board oversees execution on the Chronic Care and Acute Care split and the integration of acquisitions like Kerecis, both of which are central to supporting earnings resilience in the face of pricing and regulatory risks.

Yet while Coloplast is reinforcing its governance, investors should be aware of how potential U.S. competitive bidding could...

Read the full narrative on Coloplast (it's free!)

Coloplast's narrative projects DKK34.4 billion revenue and DKK7.3 billion earnings by 2028. This requires 7.3% yearly revenue growth and an earnings increase of about DKK3.2 billion from DKK4.1 billion today.

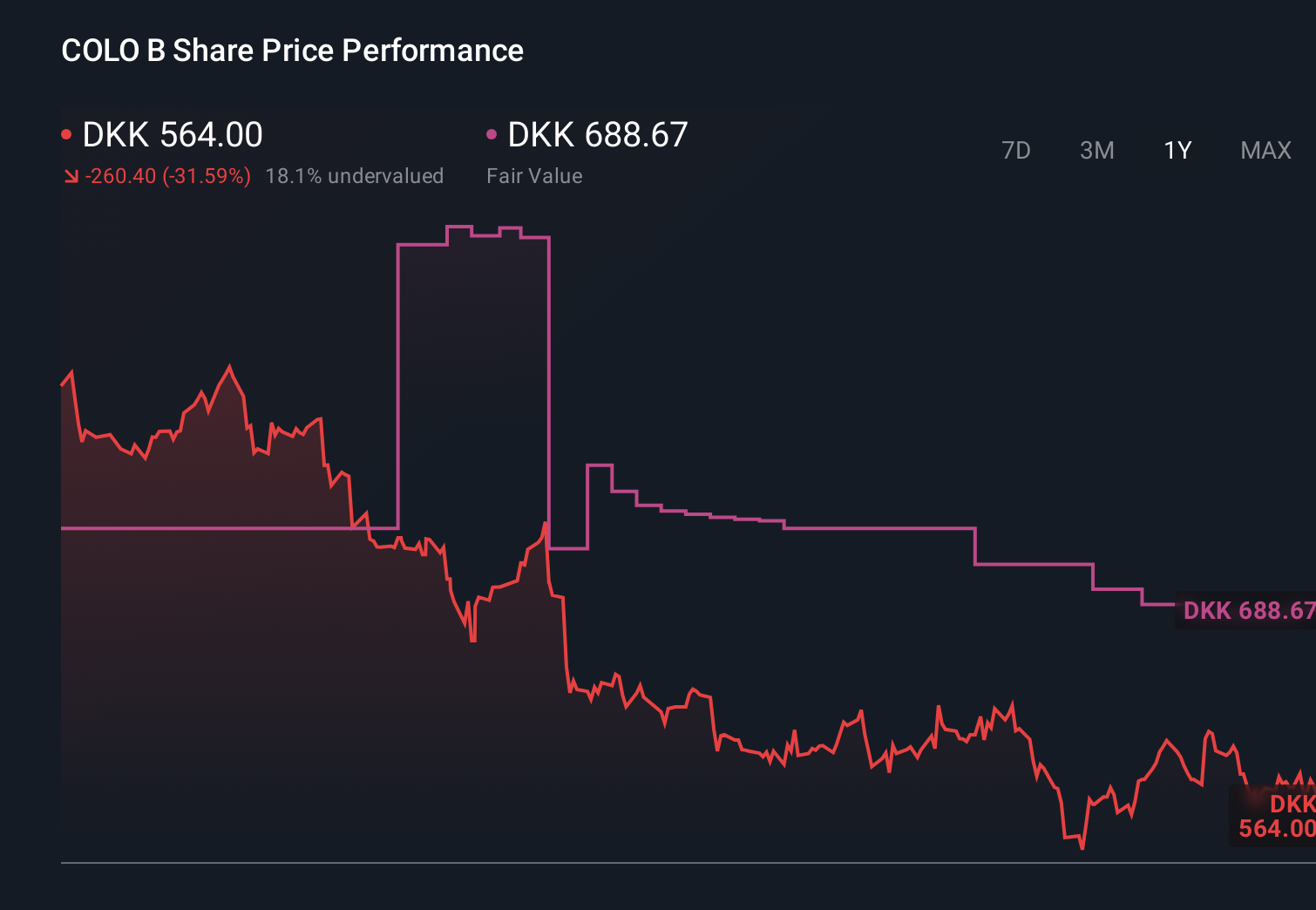

Uncover how Coloplast's forecasts yield a DKK688.67 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see Coloplast’s fair value between DKK 620.50 and DKK 1,065.99, underlining how far views can diverge. When you weigh those opinions against the risk of future U.S. competitive bidding pressure on margins, it becomes even more important to compare several viewpoints before forming your own view on the company’s prospects.

Explore 5 other fair value estimates on Coloplast - why the stock might be worth as much as 89% more than the current price!

Build Your Own Coloplast Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coloplast research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Coloplast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coloplast's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com