Assessing Copa Holdings (NYSE:CPA) Valuation After Strong Multi‑Year Share Price Gains

Copa Holdings (NYSE:CPA) has quietly rewarded patient investors, with shares up about 41% over the past year and roughly 68% over three years. This performance is prompting a fresh look at its valuation today.

See our latest analysis for Copa Holdings.

At around $117.47 per share, Copa’s recent pullback over the past month contrasts with its strong year to date share price return. This suggests investors are pausing to reassess growth prospects rather than abandoning the longer term total shareholder return story.

If Copa’s move has you rethinking opportunities in transport and travel, it could be worth scanning aerospace and defense stocks for other names showing durable momentum and operational strength.

With earnings still rising and the share price sitting at a sizable discount to analyst targets, is Copa a rare value play in a cyclical sector, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 25.2% Undervalued

With Copa’s shares last closing at $117.47 versus a narrative fair value of about $157.13, the story centers on resilient growth at a discounted price.

The company's disciplined cost management, ongoing seat densification, and delivery of more fuel efficient Boeing 737 MAX aircraft enable Copa to maintain industry leading net and operating margins, giving it resilience and earnings growth potential even in a competitive environment with downward pressure on yields.

Want to see how this margin strength translates into future earnings power? The narrative leans on rising revenues, expanding profitability, and a valuation multiple that assumes investors keep faith with that growth runway. Curious which specific performance milestones are baked into that fair value? Dive in to uncover the assumptions driving this upside case.

Result: Fair Value of $157.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent yield pressure from rising regional competition, along with any disruption at Copa’s Panama hub, could quickly challenge the current growth and valuation narrative.

Find out about the key risks to this Copa Holdings narrative.

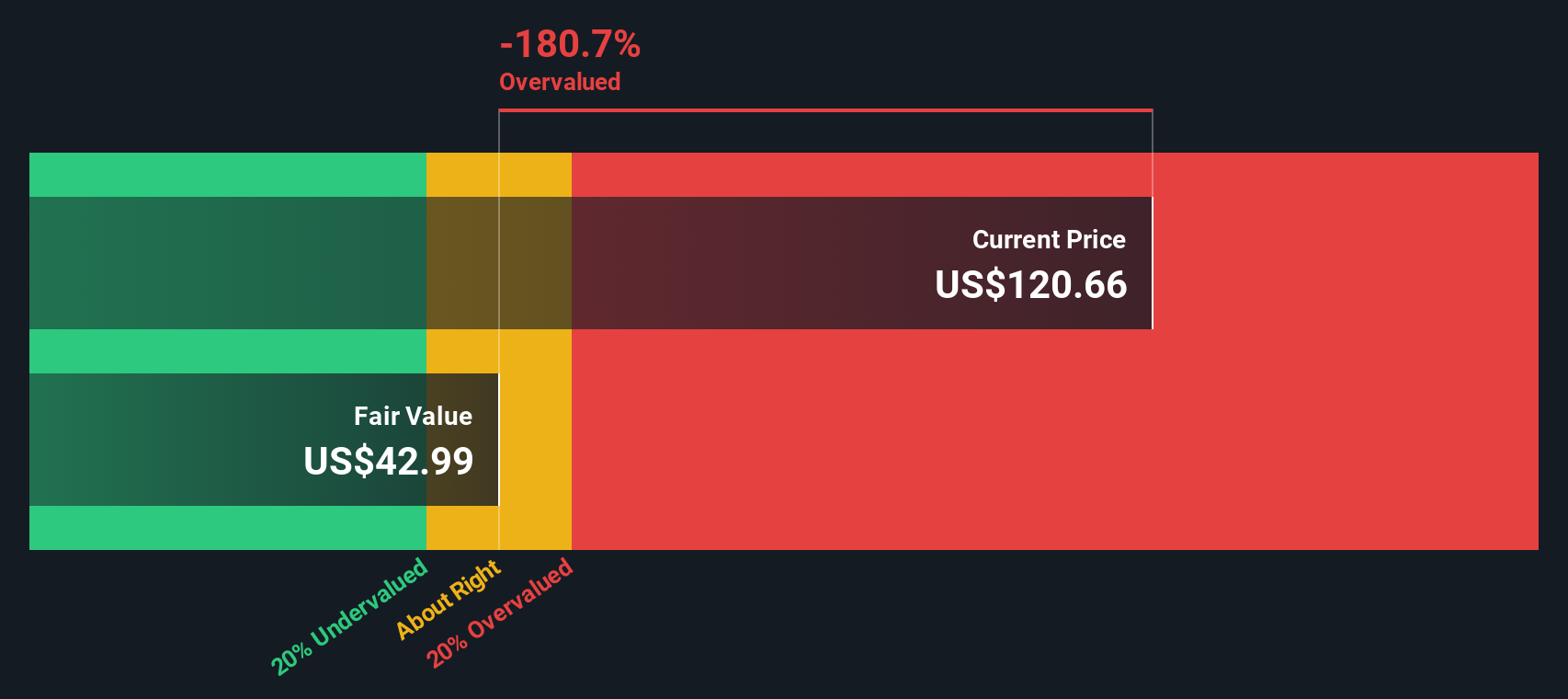

Another View: DCF Flags Overvaluation Risk

While the narrative fair value suggests upside, our DCF model points the other way, putting fair value closer to $44.76, well below the current $117.47 share price. If cash flow assumptions are closer to reality than earnings multiples, investors could be overpaying for growth stability.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Copa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Copa Holdings Narrative

If you see Copa’s story differently, or want to dig into the data on your own terms, you can build a custom view in minutes: Do it your way.

A great starting point for your Copa Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next opportunity by using our powerful screener tools to uncover stocks that match your strategy and risk appetite.

- Capture potential multibaggers early by scanning these 3590 penny stocks with strong financials that pair tiny price tags with surprisingly solid fundamentals.

- Position yourself at the heart of the AI revolution by targeting these 27 AI penny stocks shaping automation, data intelligence, and next generation software.

- Strengthen your portfolio’s income stream by focusing on these 15 dividend stocks with yields > 3% that can help support long term returns through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com