Strathcona Resources (TSX:SCR) Valuation After Vawn Thermal Acquisition and Court‑Approved Special Cash Distribution

Strathcona Resources (TSX:SCR) just closed its Vawn thermal acquisition and secured court approval for a CA$10 per share special cash distribution, a one two punch that directly reshapes both its growth runway and near term shareholder returns.

See our latest analysis for Strathcona Resources.

Even after a small pullback, with the share price at CA$41.90 and a 30 day share price return of 3.46 percent contributing to a year to date share price return of 34.42 percent and a 1 year total shareholder return of 45.68 percent, the market clearly sees these deals as adding long term value rather than just a one off cash splash.

If this kind of capital allocation story has you thinking more broadly about where to find the next opportunity, it could be worth exploring fast growing stocks with high insider ownership.

But with the stock now trading above consensus price targets and its intrinsic value estimate, even as growth accelerates from Vawn and other thermal expansions, is there still a buying opportunity here, or has the market already priced in the next leg of growth?

Most Popular Narrative: 8.1% Overvalued

With Strathcona Resources closing at CA$41.90 versus a narrative fair value of about CA$38.78, expectations are clearly stretching beyond that intrinsic mark.

The analysts have a consensus price target of CA$37.1 for Strathcona Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$42.0, and the most bearish reporting a price target of just CA$34.0.

Want to see how modest growth, thinner margins, and a much richer future earnings multiple still add up to this valuation call? The tension sits in a single set of forward profit assumptions and the price investors are expected to pay for them. Curious how that math works out, line by line?

Result: Fair Value of $38.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Strathcona delivers its targeted 8 percent production growth and carbon capture projects unlock ESG capital, margins and valuation multiples could increase.

Find out about the key risks to this Strathcona Resources narrative.

Another Angle On Value

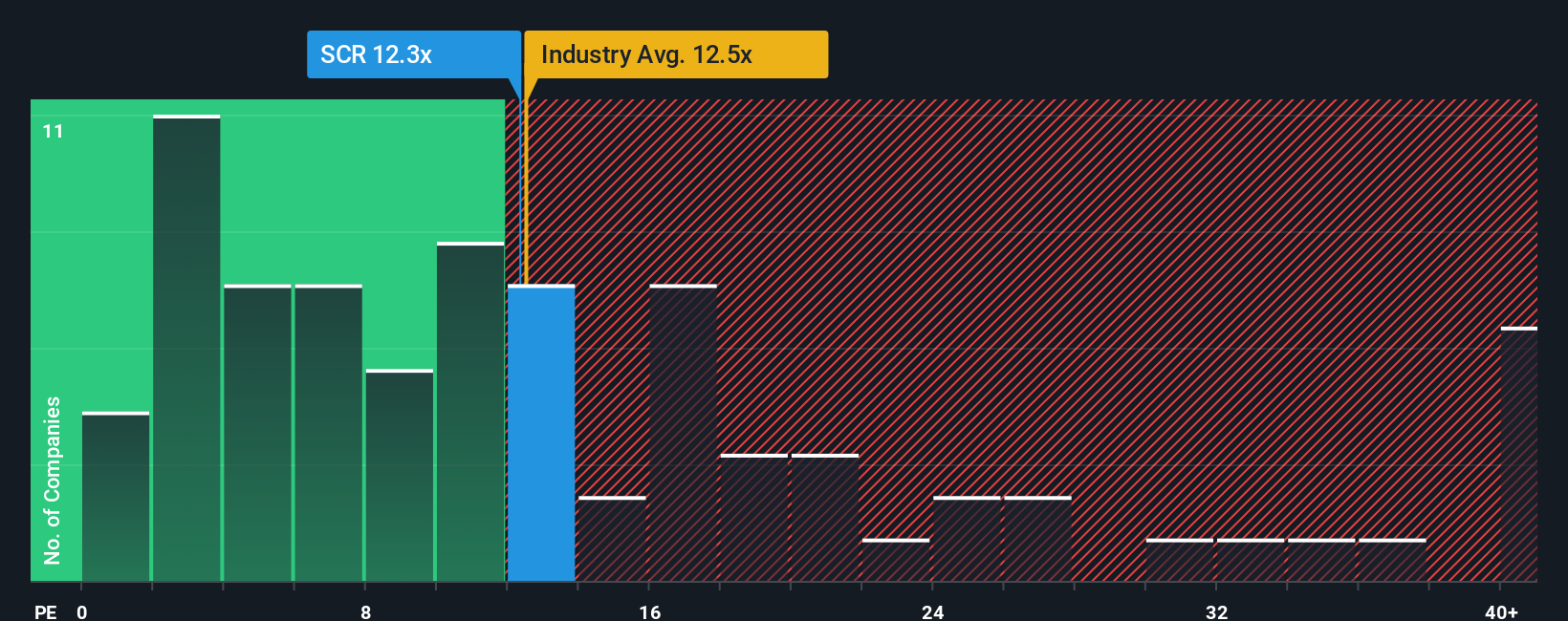

On simple earnings math, Strathcona looks more stretched than the narrative suggests. Its 14.9x P/E sits just below the Canadian market at 16.1x and the oil and gas industry at 15x, but above its 10.9x fair ratio. This hints the market may be paying up for execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Strathcona Resources Narrative

If you see the numbers differently or want to stress test your own view using the same tools and forecasts, you can build a personalized narrative in just a few minutes, Do it your way.

A great starting point for your Strathcona Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one stock when the market is full of overlooked opportunities. Tailor your next move with targeted screens that match your strategy and risk appetite.

- Capitalize on mispriced quality by scanning these 894 undervalued stocks based on cash flows that look cheap on cash flow yet still carry solid fundamentals.

- Ride structural growth trends by zeroing in on these 30 healthcare AI stocks that blend medical innovation with intelligent software.

- Supercharge potential upside by focusing on these 3590 penny stocks with strong financials that already show strong balance sheets and financial discipline.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com