Microsoft (MSFT): Taking Stock of Valuation After New $17.5B India and CAD 7.5B Canada AI Investments

Microsoft (MSFT) just doubled down on its AI future, committing $17.5 billion to new AI infrastructure in India and more than CAD 7.5 billion in Canada, a capital intensive bet that directly shapes the stock’s longer term growth story.

See our latest analysis for Microsoft.

Despite a modest pullback recently, with the 30 day share price return at minus 2.76 percent and the 90 day share price return at minus 1.79 percent, Microsoft’s longer term picture remains strong. This includes a 3 year total shareholder return of 95.86 percent that underlines how these fresh AI investments fit into an ongoing growth story rather than a sudden pivot.

If this kind of AI capex race has your attention, it is a good moment to see what other innovators are doing across cloud and software by exploring high growth tech and AI stocks.

Yet with shares still up double digits this year and trading at a premium to the market, the real question now is whether Microsoft’s AI supercycle is underappreciated in the price or if Wall Street has already baked in the next leg of growth.

Most Popular Narrative Narrative: 17.1% Overvalued

Compared to the last close near $492, the most followed narrative anchors fair value much lower, framing Microsoft as richly priced despite its AI momentum.

Microsoft is currently digging away the foundation that makes it different. It is trapped in a perfect storm, losing the AI tech war to Google, burning cash on infrastructure without guaranteed ROI, cannibalizing its own seat-based revenue, and antagonizing users with a buggy, bloatware filled operating system.

Want to see how this story gets to a lower fair value? The key is a sharp reset in growth, profitability, and future earnings multiples. Curious which assumptions matter most?

Result: Fair Value of $420.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained AI driven revenue beats or clear improvement in Windows user satisfaction could undermine this bearish thesis and force investors to reprice upside.

Find out about the key risks to this Microsoft narrative.

Another Lens On Value

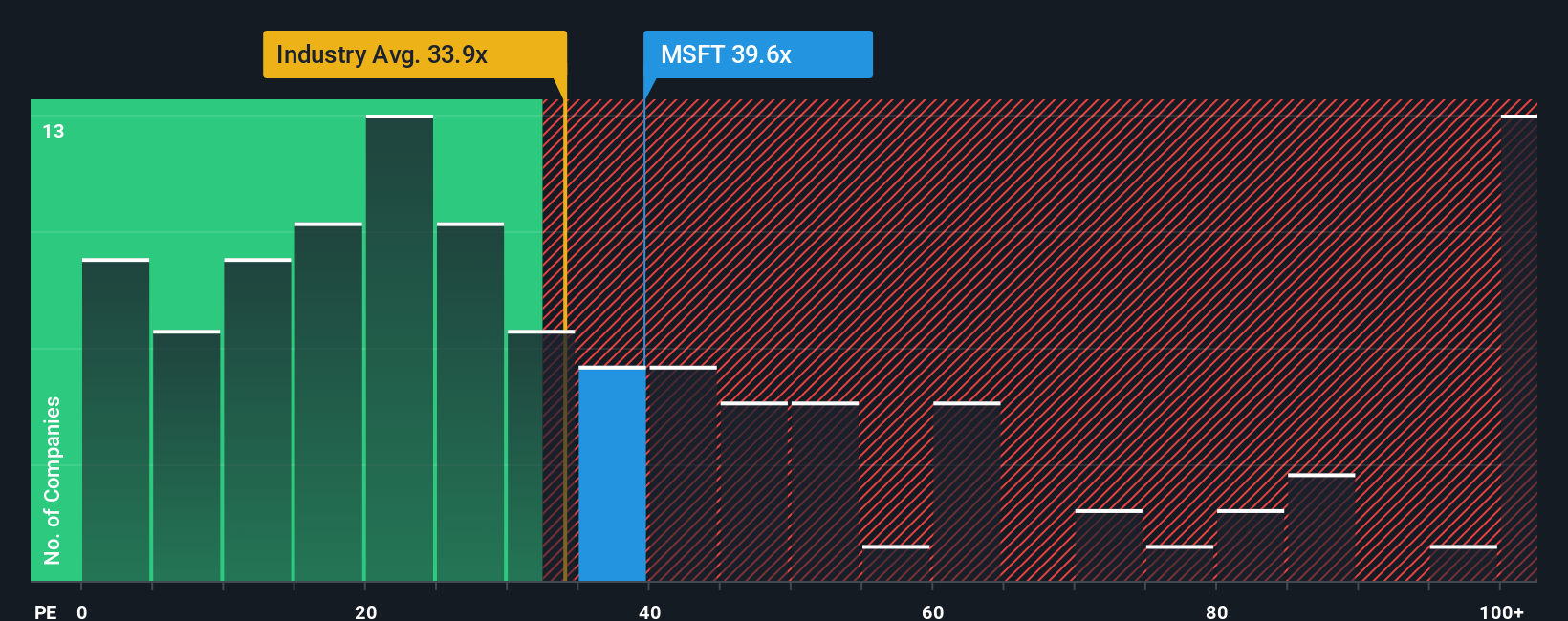

That 17.1 percent overvalued narrative clashes with how the market is actually pricing Microsoft today. On a 34.9 times earnings multiple, shares sit slightly cheaper than direct peers at 36.6 times, even if they are richer than the broader US software group at 32.7 times.

Given our estimated fair ratio of 52.8 times earnings, investors are effectively paying a discount for a business still growing double digits. This raises the question: is this a safety buffer against AI risks, or a sign that expectations are already stretched?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microsoft Narrative

If this framing does not fully align with your view, or you would rather test your own assumptions directly, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready For Your Next Investing Move?

Do not stop at one great story when the market is full of potential. Use the Simply Wall Street Screener to uncover your next edge.

- Capitalize on mispriced quality by targeting companies trading below intrinsic value with these 894 undervalued stocks based on cash flows before the crowd catches on.

- Ride structural growth in automation and machine learning by focusing on cutting edge innovators through these 27 AI penny stocks while the trend is still building.

- Strengthen your portfolio’s income engine by zeroing in on reliable payers with these 15 dividend stocks with yields > 3% so you are not missing out on steady cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com