Is Exxon Mobil Still Attractive at $118 After Years of Strong Gains?

- Wondering if Exxon Mobil at around $118 a share is still a buy or if the easy money has already been made? This article will walk through what the current price really implies about its value.

- The stock has been mostly flat over the last month at 0.0%, but it is still up 10.2% year to date and 231.1% over five years. That tells you the longer term trend has been much kinder than the recent trading range.

- Recent moves have been shaped by shifting expectations around global energy demand and oil supply dynamics, from OPEC+ production decisions to evolving US policy on drilling and exports. In addition, Exxon Mobil has stayed in the headlines with its large scale investments into low carbon projects and major upstream developments, which investors see as key to sustaining cash flows over the next decade.

- Right now, Exxon Mobil scores a 4/6 on our valuation checks, meaning it screens as undervalued on four of the six key metrics we track. You can see the breakdown in our valuation score. Next, we will unpack how different valuation approaches view the stock today and introduce an additional way to think about fair value by the end of the article.

Approach 1: Exxon Mobil Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms.

For Exxon Mobil, the latest twelve month Free Cash Flow is about $28.1 billion. Analysts and internal estimates see this growing steadily, with projected Free Cash Flow reaching roughly $52.3 billion by 2035. Near term projections out to 2029, supported by analyst estimates and then extrapolated by Simply Wall St, show Free Cash Flow rising from around $31.6 billion in 2026 to just over $40.9 billion by 2029.

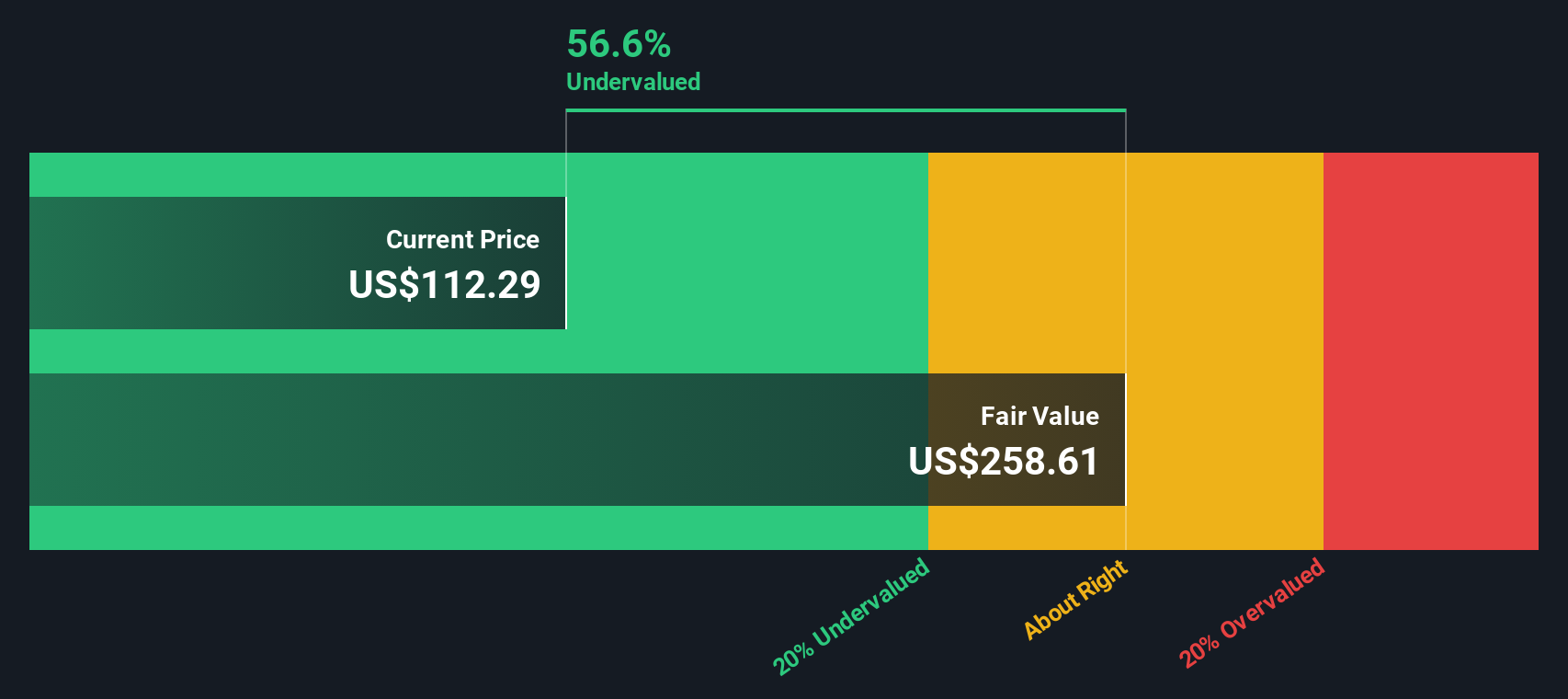

Using a 2 Stage Free Cash Flow to Equity DCF model, these future cash flows are discounted back to a present intrinsic value of about $247.13 per share. Compared with the current price around $118, the model implies Exxon Mobil is trading at roughly a 52.2% discount to its estimated fair value. This suggests potential upside if these cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exxon Mobil is undervalued by 52.2%. Track this in your watchlist or portfolio, or discover 894 more undervalued stocks based on cash flows.

Approach 2: Exxon Mobil Price vs Earnings

For a mature, consistently profitable business like Exxon Mobil, the Price to Earnings (PE) ratio is a useful way to gauge valuation because it directly links what investors pay today to the profits the company is generating right now.

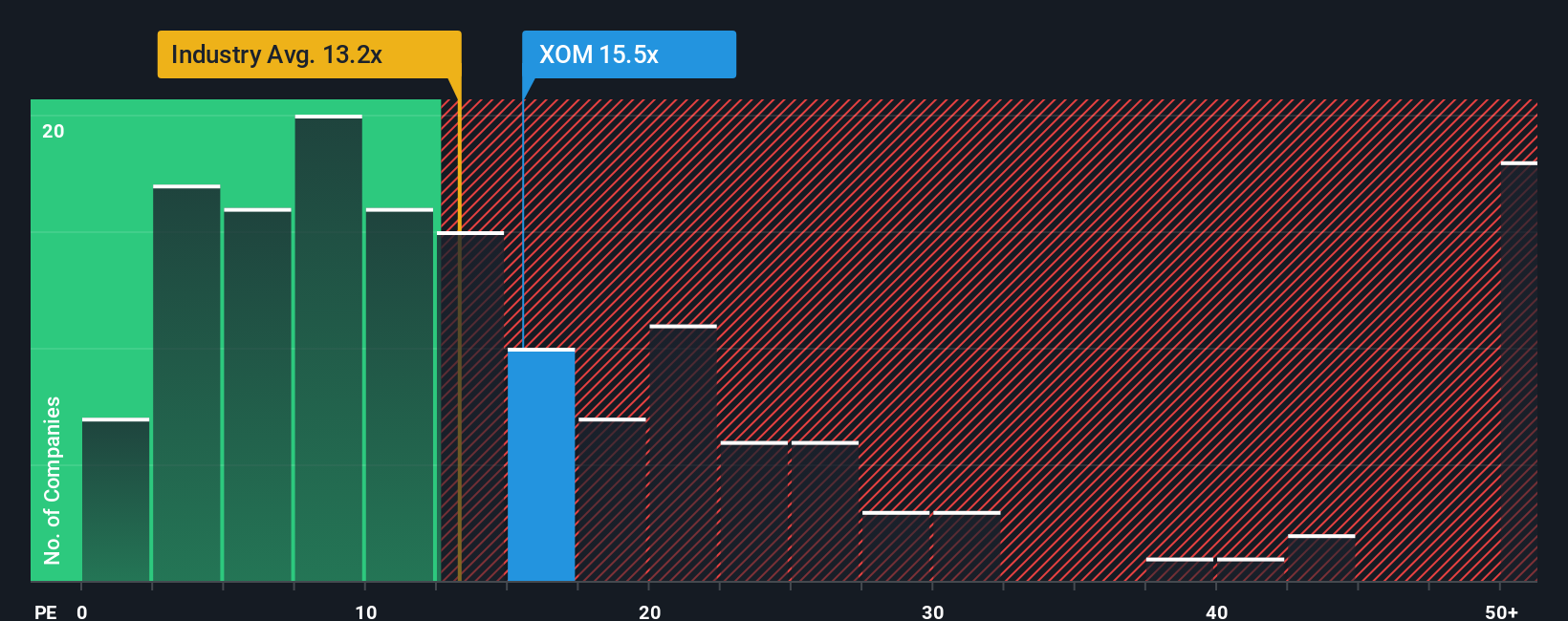

In general, companies with higher expected growth and lower perceived risk tend to justify a higher PE, while slower growing or riskier businesses usually deserve a lower PE. Exxon Mobil currently trades on a PE of about 16.65x, which is above the Oil and Gas industry average of roughly 13.55x but below the broader peer group average of around 24.07x. This suggests investors are assigning it a premium to the sector, but not an aggressive one.

Simply Wall St also calculates a proprietary “Fair Ratio” for the PE, which is the multiple a company should trade on given its earnings growth outlook, industry, profit margins, market cap and risk profile. This Fair Ratio is 24.43x for Exxon Mobil, implying the market is valuing the stock at a discount to what those fundamentals might warrant. Because the Fair Ratio builds in company specific strengths and risks, it is a more tailored benchmark than simply comparing against peers or industry averages.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exxon Mobil Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where you turn your view of Exxon Mobil into a clear story that connects assumptions about future revenue, earnings and margins to a financial forecast, a fair value, and ultimately a buy or sell decision as that fair value is compared to today’s price and automatically updated when new information like earnings or major news lands. One investor might build a more cautious Exxon Mobil Narrative that arrives at a fair value of about $128.72 per share, while another, more optimistic on Guyana, low carbon solutions and long term oil prices, might land closer to $174 per share. This illustrates how two different but structured stories can sit side by side and give you a dynamic, numbers backed way to decide if the stock still fits your thesis at its current price.

Do you think there's more to the story for Exxon Mobil? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com