Reassessing Olav Thon Eiendomsselskap (OB:OLT): Is a 14x P/E Multiple Still Undervaluing the Stock?

Olav Thon Eiendomsselskap (OB:OLT) has been quietly rewarding patient investors, with the share price climbing about 24 % over the past month and more than 55 % in the past year.

See our latest analysis for Olav Thon Eiendomsselskap.

That strong 1 year total shareholder return of 55.79 % and a solid 3 year total shareholder return of 113.43 % suggest momentum is building as investors reprice the risk reward balance for its Nordic property portfolio.

If this kind of rerating has you curious about what else is out there, it could be a good time to explore fast growing stocks with high insider ownership.

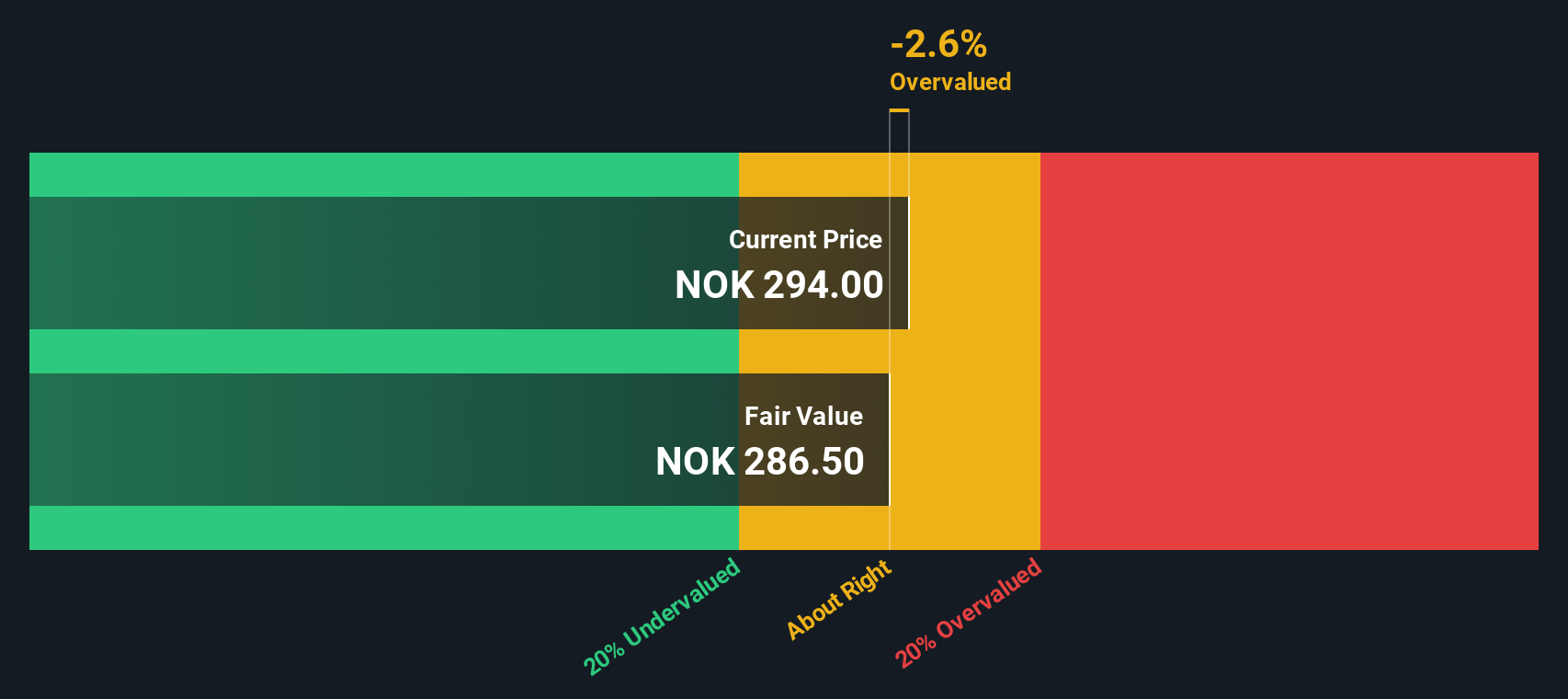

But with the share price now hovering just below analyst targets and recent earnings growth looking subdued, investors face a key question: is Olav Thon Eiendomsselskap still undervalued, or is the market already pricing in future gains?

Price-to-Earnings of 14x: Is it justified?

On a price-to-earnings ratio of 14x at the last close of NOK333, Olav Thon Eiendomsselskap screens as attractively valued against both peers and the wider European real estate sector.

The price-to-earnings multiple compares the company’s current share price to its per share earnings. It is a key gauge of how much investors are willing to pay for today’s profits. For a mature Nordic property landlord, it is a useful shorthand for how the market is balancing stable rental income against modest growth expectations.

Here, the 14x multiple sits below both the European real estate industry average of 14.5x and the broader sector average of 16.7x. This implies investors are paying a relative discount for each krone of earnings. It is also well under the estimated fair price-to-earnings ratio of 19.4x, a level the market could move toward if confidence in cash flows and earnings durability continues to build.

Against peer and industry benchmarks, that discount is hard to ignore. Trading below a 17x peer average and the 19.4x fair ratio suggests the market has not fully repriced the company’s improving profitability.

Explore the SWS fair ratio for Olav Thon Eiendomsselskap

Result: Price-to-Earnings of 14x (UNDERVALUED)

However, subdued earnings growth and the shares already trading near analyst targets could limit further upside if rental markets or interest rates deteriorate.

Find out about the key risks to this Olav Thon Eiendomsselskap narrative.

Another Lens on Value

Our DCF model tells a different story, suggesting Olav Thon Eiendomsselskap is trading well above its estimated fair value of NOK215.09 at the current NOK333 share price, pointing to potential overvaluation rather than a bargain on cash flow terms.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Olav Thon Eiendomsselskap for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Olav Thon Eiendomsselskap Narrative

If you see the outlook differently or want to dig into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Olav Thon Eiendomsselskap research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall Street Screener to uncover fresh stocks that match your strategy before the market catches on.

- Capture potential mispricings early by reviewing these 894 undervalued stocks based on cash flows that may offer stronger upside than widely followed names.

- Ride structural growth trends by scanning these 30 healthcare AI stocks shaping the future of diagnostics, treatment, and medical efficiency.

- Amplify your passive income strategy by targeting these 15 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com