Chubb (CB): Reassessing Valuation After SuretyBind Tech Collaboration With Major Industry Peers

Chubb (CB) has partnered with The Hartford, Liberty Mutual and Travelers to launch SuretyBind, LLC, a shared tech platform designed to modernize how surety bonds are transmitted, executed and verified across the industry.

See our latest analysis for Chubb.

Investors seem to be rewarding Chubb for initiatives like SuretyBind, with the share price now at $301.22 and a solid 30 day share price return of 4.75 percent helping extend a strong multi year total shareholder return trend.

If this kind of industry collaboration has you rethinking your portfolio, it might be a good time to explore fast growing stocks with high insider ownership for other interesting ideas beyond the big insurers.

Yet with Chubb trading just below analyst targets, but at a steep premium to some intrinsic value estimates, investors have to ask whether recent gains leave limited upside or if the market is still underestimating future growth potential.

Most Popular Narrative Narrative: 2.2% Undervalued

With Chubb closing at 301 dollars 22 cents versus a narrative fair value near 308 dollars, the story hinges on steady earnings power rather than breakneck growth.

Capital deployment through ongoing share repurchases (new $5B authorization), growing dividends, and selective M&A is creating upward pressure on earnings per share (EPS). At the same time, robust cash flow and the capital position provide flexibility for further shareholder returns. • Growth in specialized insurance demand, such as cyber and high-net-worth personal lines, driven by macro trends (digitalization, greater risk exposures, climate-driven catastrophes), positions Chubb to leverage expertise and scale for above-industry-average topline and earnings growth.

Want to see what kind of earnings path and margin profile can justify this valuation while revenue is projected to shrink, and which future multiple ties it all together?

Result: Fair Value of $307.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent catastrophe losses and intensifying competition in large commercial lines could squeeze margins and derail the modest undervaluation thesis investors are leaning on.

Find out about the key risks to this Chubb narrative.

Another Lens On Value

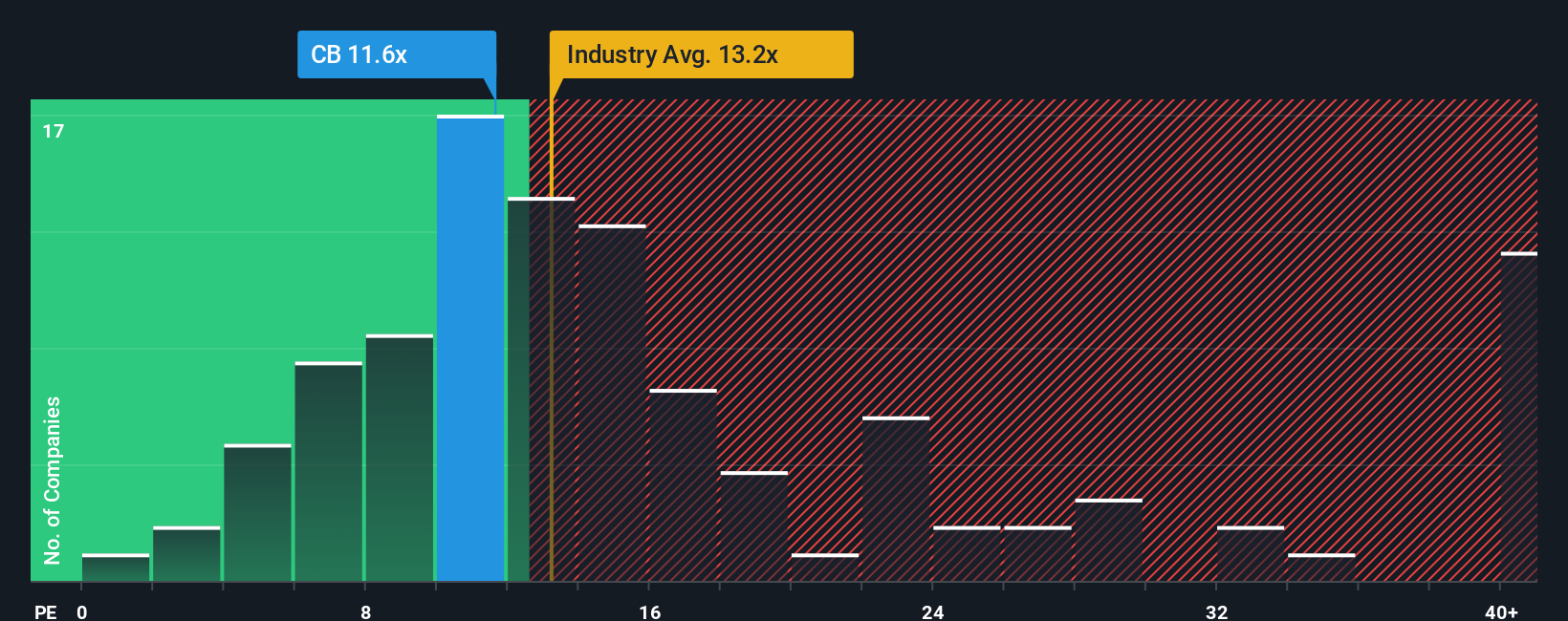

Step away from fair value models and Chubb suddenly looks less forgiving, with its 12.3 times price to earnings sitting above peers at 9.9 times, yet below a fair ratio of 13.7 times. This leaves investors to weigh quality against the risk of a multiple squeeze.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chubb Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Chubb research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in an edge by scanning focused stock ideas on Simply Wall St, where data backed screens can uncover opportunities you might otherwise miss.

- Capture early stage potential by checking out these 3590 penny stocks with strong financials that pair tiny price tags with surprisingly solid balance sheets and improving fundamentals.

- Position for the next wave of innovation by targeting these 27 AI penny stocks building real businesses around artificial intelligence, automation, and data driven platforms.

- Strengthen your portfolio’s income stream using these 15 dividend stocks with yields > 3% to uncover companies offering robust yields supported by sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com