Raymond James Downgrade After Sandy Spring Deal Might Change The Case For Investing In Atlantic Union (AUB)

- Raymond James recently downgraded Atlantic Union Bankshares from Strong Buy to Market Perform after the Sandy Spring acquisition, citing lower yields on new loans and revised expectations for loan accretion that has trailed projections since April 1.

- This shift in analyst stance highlights how quickly assumptions about acquired loan portfolios and prepayments can affect earnings outlooks and investor confidence ahead of Atlantic Union’s upcoming analyst day.

- Next, we’ll explore how the Raymond James downgrade tied to lower loan yields and accretion updates could reshape Atlantic Union’s investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Atlantic Union Bankshares Investment Narrative Recap

To own Atlantic Union Bankshares, you need to believe in its ability to turn the Sandy Spring deal and Mid-Atlantic footprint into profitable growth while managing integration and credit risk. The Raymond James downgrade around lower loan yields and weaker accretion affects near term earnings optics, but does not fundamentally alter the key short term catalyst: clear guidance at the upcoming analyst day on returns from Sandy Spring and the North Carolina expansion. The biggest risk remains that acquired portfolios underperform expectations.

The Raymond James move sits alongside Atlantic Union’s plan to outline its post Sandy Spring strategy and North Carolina build out at the December 10 analyst day, which could clarify how management expects to balance growth with disciplined credit and cost control. That update now carries more weight, as investors will be watching closely for detailed loan yield, accretion, and integration metrics to refocus the story on execution.

Yet behind the growth story, investors should be aware of how integration risk across multiple acquisitions could...

Read the full narrative on Atlantic Union Bankshares (it's free!)

Atlantic Union Bankshares’ narrative projects $1.9 billion revenue and $806.7 million earnings by 2028.

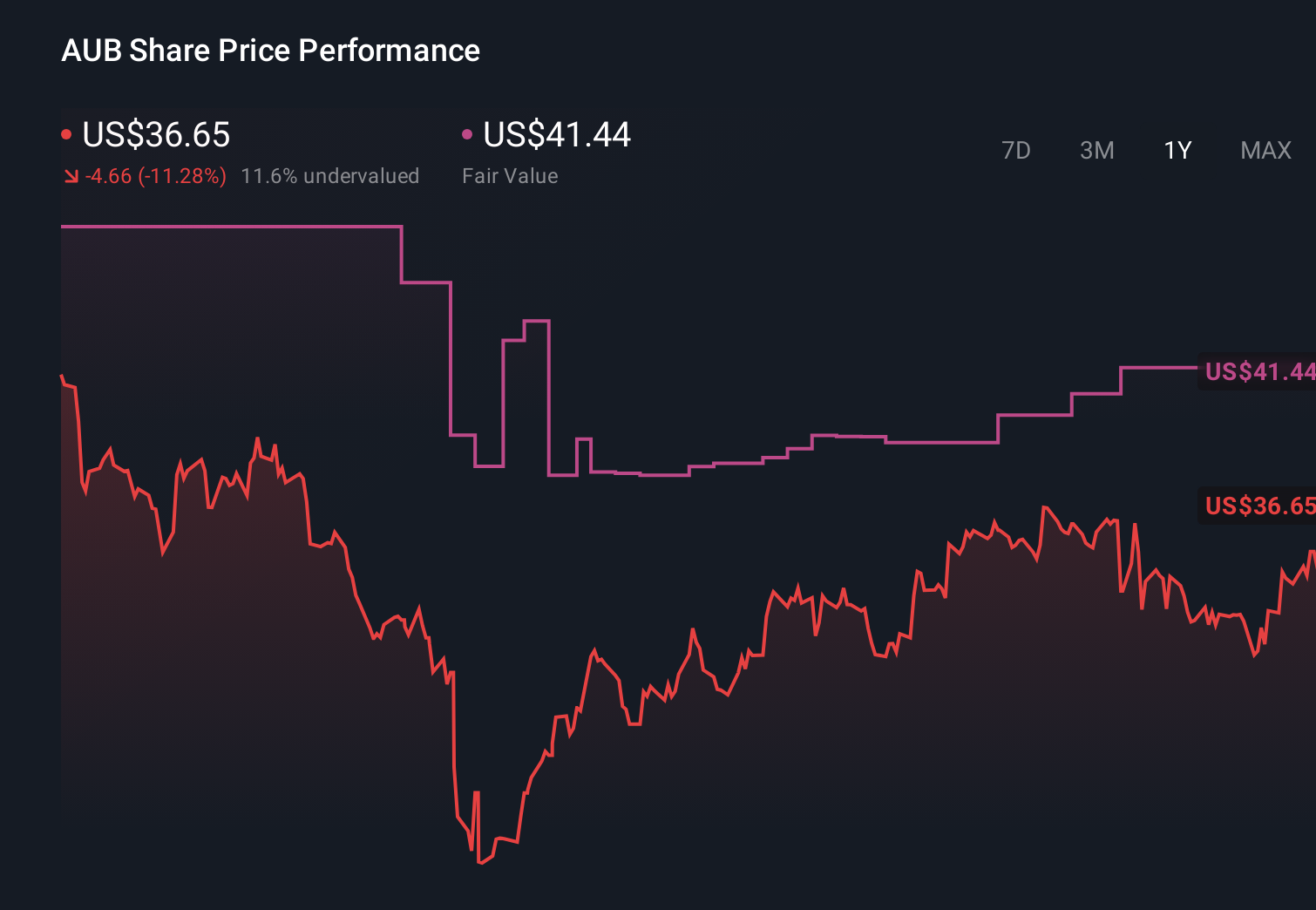

Uncover how Atlantic Union Bankshares' forecasts yield a $41.56 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Atlantic Union Bankshares span roughly US$30.79 to US$46.78, underscoring how far apart individual views can be. When you weigh those opinions against the recent downgrade tied to lower loan yields and accretion assumptions, it becomes clear that understanding the earnings sensitivity of the Sandy Spring acquisition could be critical for how the story plays out.

Explore 3 other fair value estimates on Atlantic Union Bankshares - why the stock might be worth as much as 35% more than the current price!

Build Your Own Atlantic Union Bankshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlantic Union Bankshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Atlantic Union Bankshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlantic Union Bankshares' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com