HKR International (SEHK:480) Loss Deepens, Challenging Turnaround Narrative Despite Higher H1 2026 Revenue

HKR International (SEHK:480) has posted its H1 2026 numbers with revenue of HK$1.9 billion and a basic EPS loss of HK$0.32, underscoring another period of negative earnings. The company has seen revenue move from HK$852.5 million in H1 2025 to HK$900.9 million in H2 2025 and then to HK$1.9 billion in H1 2026, while basic EPS stayed in the red between a loss of HK$0.32 and HK$0.21 over the same stretch, keeping pressure on margins even as the top line scaled up. With losses still weighing on profitability, investors will be watching closely to see whether an earnings recovery can translate into a more sustainable margin profile.

See our full analysis for HKR International.With the headline figures on the table, the next step is to line these results up against the prevailing market narratives to see which story really fits HKR International right now and which assumptions might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen To HK$478.6 Million Despite Higher Sales

- Net income from ongoing operations came in at a loss of HK$478.6 million for H1 2026, slightly worse than the HK$474.3 million loss in H1 2025 despite revenue more than doubling versus H2 2025 to HK$1,925.5 million.

- What stands out for a bearish view is that loss trends remain heavy even as analysts expect earnings to swing sharply higher, with losses having grown at an annualised 61.7% over five years while forecasts call for about 159.46% annual earnings growth over the next three years.

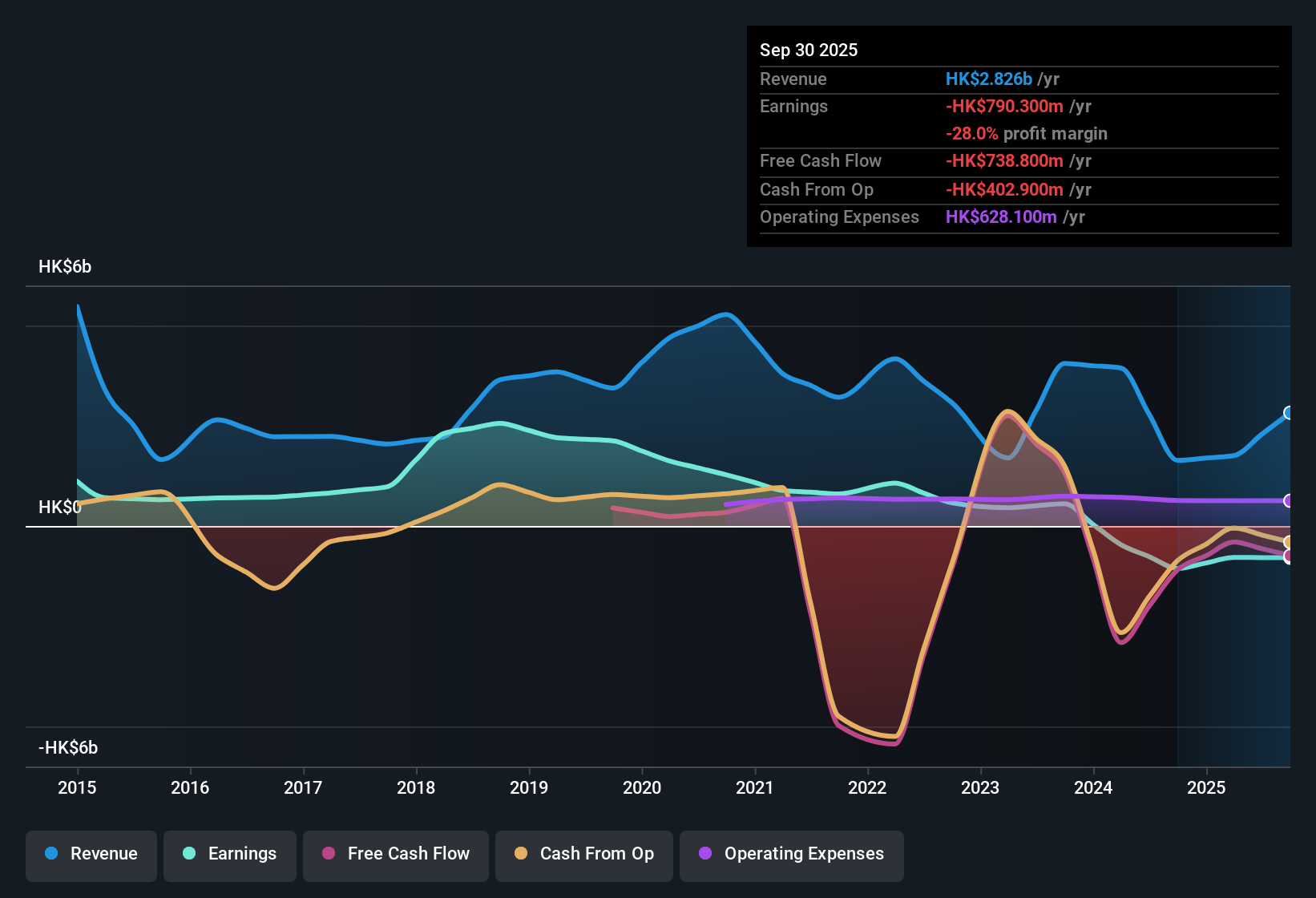

- This history of deepening losses contrasts with the projected move into profitability, so bears may question how quickly operations can actually absorb costs and interest when net income is still negative HK$790.3 million on a trailing twelve month basis.

- Yet the trajectory from a TTM loss of HK$1,060 million a year ago to HK$790.3 million now shows that, while the company is still unprofitable, the scale of the loss has narrowed alongside higher revenue of HK$2,826.4 million over the same span.

TTM Revenue At HK$2.8 Billion, But Profit Still Negative

- Over the last twelve months, total revenue reached about HK$2,826.4 million, up from HK$1,636.1 million in the prior comparable twelve month period, yet basic EPS over the latest twelve months was still a loss of HK$0.53 per share.

- For a bullish angle, the idea is that stronger top line and shrinking annual losses lay the groundwork for the forecast earnings recovery, and the recent data partly supports that story.

- Trailing net loss narrowed from HK$1,060 million to HK$790.3 million as revenue increased by roughly HK$1,190.3 million. This aligns with expectations that operating performance is moving closer to break even, even though it has not crossed into profit yet.

- However, interest payments are still described as not well covered by earnings, so even with higher revenue and a lower loss, bulls need that projected 159.46% annual earnings growth to materialise quickly enough to ease this financing pressure.

Cheap 0.5x Sales Multiple Carries Debt-Service Risk

- The shares trade around HK$0.99, implying a price to sales multiple of roughly 0.5 times, below the Hong Kong real estate industry average of 0.7 times and far below a peer average of 13.7 times.

- From a valuation focused, generally optimistic narrative, this discount can look attractive, but the numbers show a clear trade off between cheapness and balance sheet strain.

- On one side, investors are paying a lower multiple of revenue than typical industry peers, while analysts still expect revenue to slip about 2.7% per year over the next three years. This means the upside case relies almost entirely on the projected earnings swing rather than on sales growth.

- On the other, interest coverage is flagged as a major risk, with current earnings not covering interest, so if the move into profitability does not arrive as quickly as the forecasts suggest, that low multiple could be reflecting genuine financial stress rather than a simple bargain.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on HKR International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

HKR International is still wrestling with deep losses, weak interest coverage and a stretched balance sheet, even as revenue grows and forecasts point to a potential turnaround.

If those vulnerabilities make you uneasy, use our solid balance sheet and fundamentals stocks screener (1937 results) to quickly focus on financially sturdier businesses designed to handle debt, protect margins and support more reliable shareholder outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com