Reassessing General Motors’ Valuation After Morgan Stanley’s Upgrade and Enhanced Growth Outlook

Morgan Stanley’s latest upgrade put General Motors (GM) back in the spotlight, as the bank highlighted GM’s execution, capital discipline, and truck heavy strategy to support a more optimistic stance.

See our latest analysis for General Motors.

The upgrade lands on top of a powerful run, with GM’s 90 day share price return of about 31 percent and 1 year total shareholder return near 50 percent. This signals that momentum is clearly building as investors warm to its revamped strategy and capital returns.

If GM’s rally has you rethinking the whole auto space, this is also a good moment to explore other opportunities among auto manufacturers that might fit your playbook.

With the stock now edging past many analyst targets and GM touting stronger profits and capital returns, investors face a key question: is there still mispriced upside here, or are markets already baking in the next leg of growth?

Most Popular Narrative Narrative: 1.4% Overvalued

With GM last closing at $77.16 against a most popular narrative fair value of about $76, the valuation gap is slim but telling.

Analysts expect earnings to reach $8.0 billion (and earnings per share of $8.55) by about September 2028, up from $6.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $12.2 billion in earnings, and the most bearish expecting $6.8 billion.

Curious how modest revenue pressure can still coexist with rising margins and a richer future earnings multiple? The narrative hinges on that tension. Want the full playbook behind it?

Result: Fair Value of $76.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and stubbornly high warranty costs could still derail margin gains and challenge the case for a richer valuation in the future.

Find out about the key risks to this General Motors narrative.

Another View: Market Ratios Point to Underpriced Earnings Power

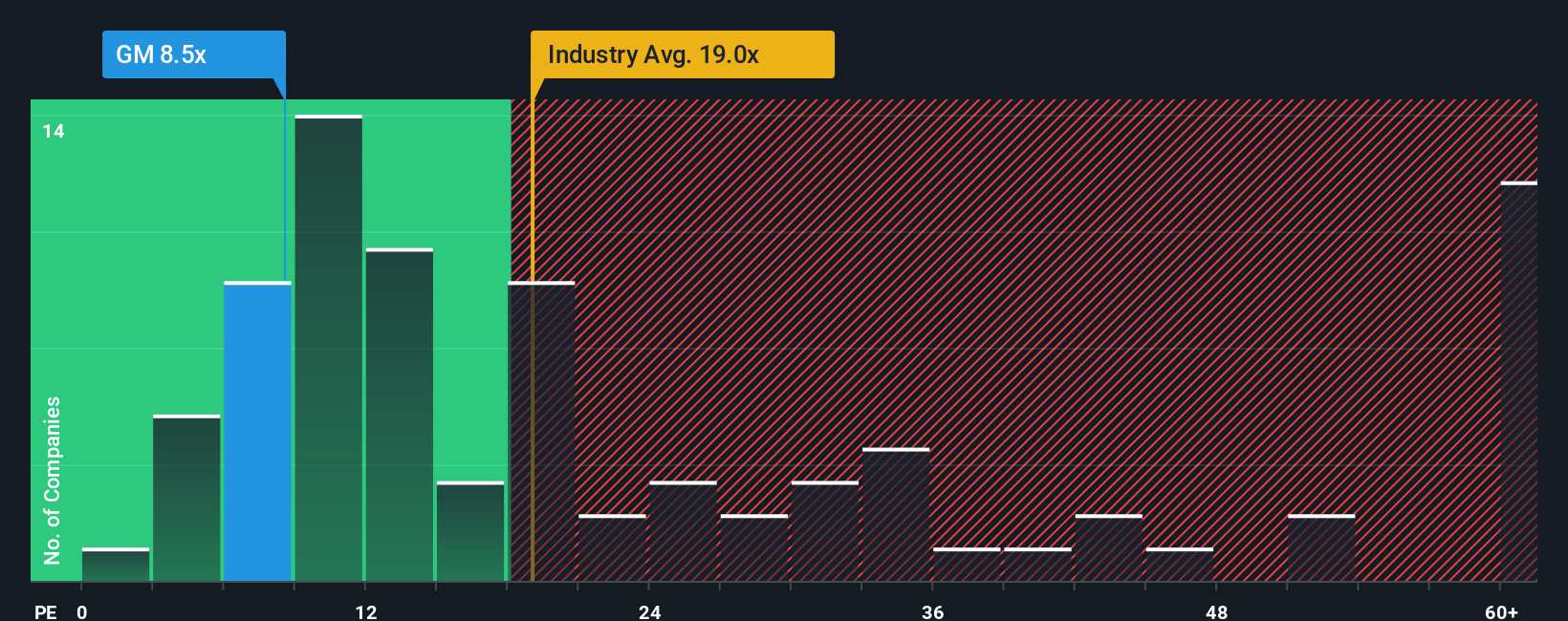

While the narrative fair value suggests GM is slightly overvalued, its current price to earnings ratio of 15.1 times sits well below the peer average of 24.9 times and a fair ratio of 20.9 times. That discount hints at either real upside or risks the story is not fully capturing.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Motors Narrative

If you think the story should look different or want to dive into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your General Motors research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s Screener to work, or you risk missing focused, high potential opportunities that could reshape your portfolio’s next leg of growth.

- Capture potential bargains early by scanning these 895 undervalued stocks based on cash flows that the market may be mispricing relative to their future cash flows and growth prospects.

- Ride structural tech shifts by targeting these 27 AI penny stocks positioned at the forefront of automation, machine learning, and real world AI adoption.

- Strengthen your income stream by zeroing in on these 15 dividend stocks with yields > 3% that can help support reliable cash returns alongside capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com