Will Contract Wins And Rising EPS Quality Change Clover Health Investments' (CLOV) Technology-Led Narrative?

- Clover Health Investments recently reported winning new contracts, supported by an average 10.3% increase in its customer base over the past two years.

- Earnings per share have compounded at a very large annual rate while cash burn has steadily reduced, pointing to improving operational self-sufficiency.

- Now we’ll explore how these contract wins and improving earnings quality might reshape Clover Health’s existing technology-focused investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Clover Health Investments Investment Narrative Recap

To own Clover Health, you need to believe its technology-centered Medicare Advantage model can translate membership growth and improving earnings into sustainable profitability, despite regulatory and utilization pressures. The latest contract wins reinforce the near term growth catalyst of rising insurance revenue, but they do not remove the key risk that elevated medical and pharmacy costs could still squeeze margins and delay a clear break into consistent profits.

The recent update raising 2025 insurance revenue guidance to US$1.850 to US$1.880 billion, implying 39% year on year growth at the midpoint, is especially relevant here. It ties the contract momentum directly to higher expected top line, which supports the bullish case that Clover Assistant and related offerings can scale, though investors still need to weigh this against the company’s ongoing GAAP net losses and the challenge of bringing its benefit expense ratios under tighter control.

Yet behind the revenue momentum, investors should be aware of how persistent medical cost inflation could still...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments’ narrative projects $3.0 billion revenue and $10.7 million earnings by 2028.

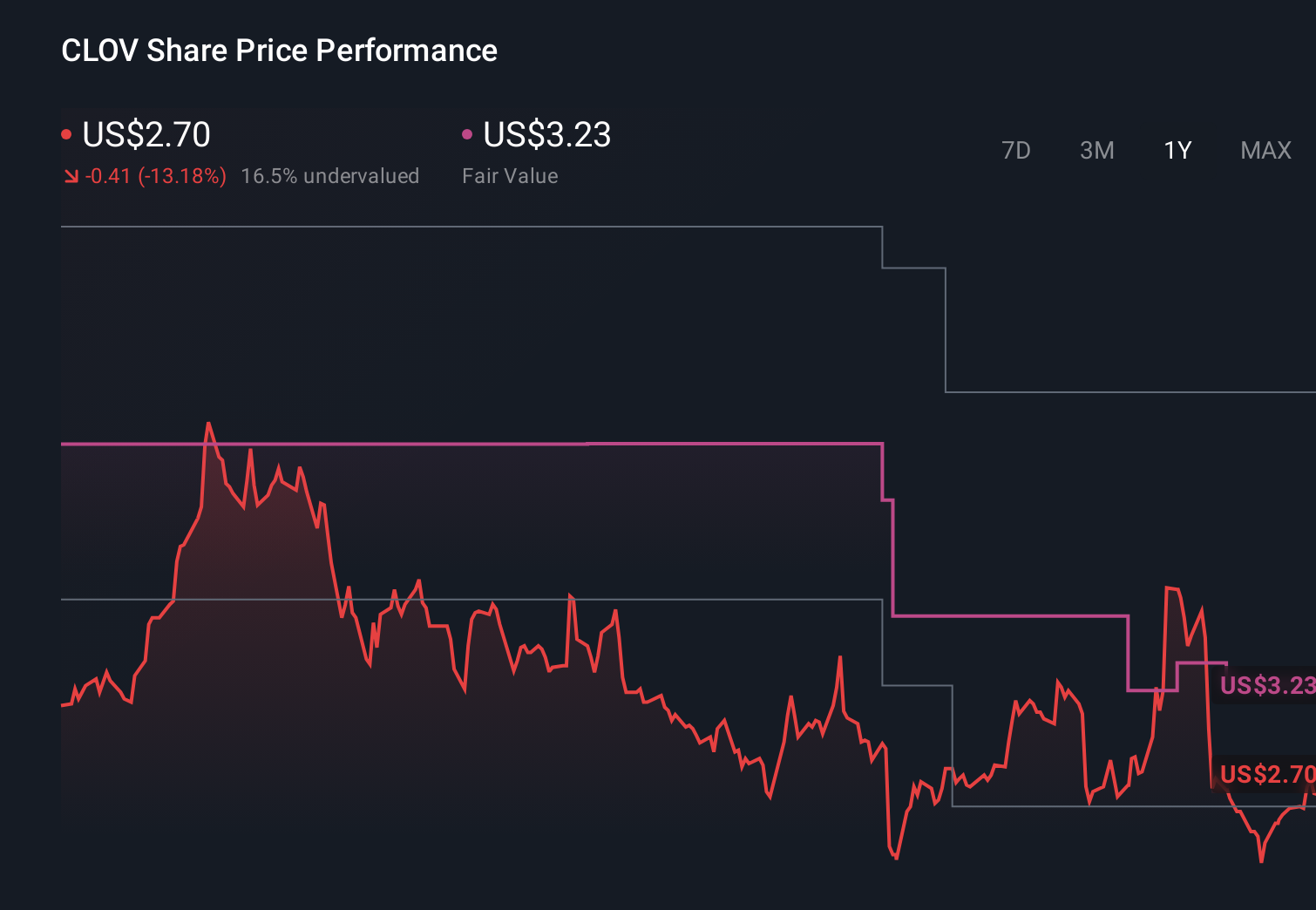

Uncover how Clover Health Investments' forecasts yield a $3.23 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community span from US$3.23 to US$36.92 per share, showing how widely opinions can differ. When you set this spread against Clover Health’s reliance on managing medical and pharmacy utilization to improve margins, it underlines why reviewing several alternative viewpoints can be useful before forming a view on the company’s performance.

Explore 12 other fair value estimates on Clover Health Investments - why the stock might be worth just $3.23!

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com