Assessing AbbVie’s Valuation After Its Strong 2025 Run and Immunology Expansion

- Wondering if AbbVie at $222.99 is still a buy after such a strong run, or if most of the upside is already priced in? This article is going to unpack that in plain English.

- The stock has slipped a modest 0.6% over the last week but is still up 1.7% over the past month, 24.3% year to date and 31.4% over the last year, reinforcing its longer term momentum story.

- Recent headlines have focused on AbbVie’s expanding immunology and aesthetics franchises and continued progress in replenishing revenue beyond Humira. This helps explain why investors have been willing to rerate the shares. Ongoing pipeline updates, regulatory milestones and strategic portfolio moves have kept sentiment constructive even as the stock takes short term breathers.

- Right now AbbVie scores a 4/6 valuation check score, suggesting it screens as undervalued on most, but not all, of our yardsticks. We will break down what that means across different valuation approaches before finishing with a more holistic way to judge whether the stock offers good value.

Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, using a rate that reflects risk and the time value of money.

AbbVie generated about $19.9 billion in free cash flow over the last twelve months, a strong base from which to grow. Analyst forecasts and Simply Wall St extrapolations suggest this could rise to around $42.0 billion in annual free cash flow by 2035, with steady growth along the way as newer drugs and indications offset Humira erosion.

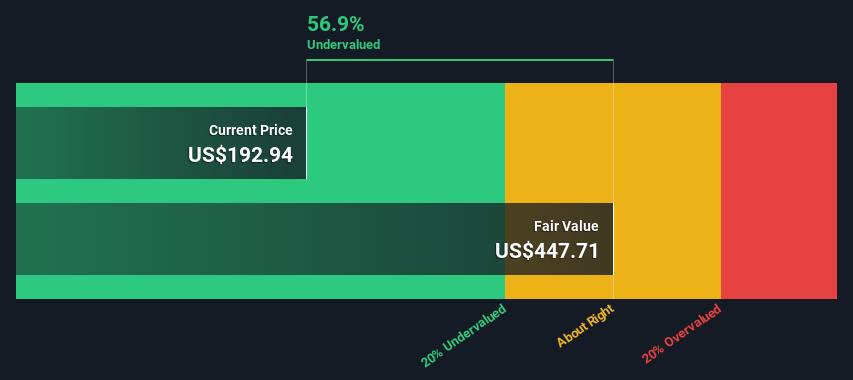

When those projected cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value comes out to roughly $426.09 per share. Compared with the current share price of about $222.99, the DCF output indicates the stock is trading at roughly a 47.7% discount, which would represent meaningful upside if the cash flow projections are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AbbVie is undervalued by 47.7%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: AbbVie Price vs Sales

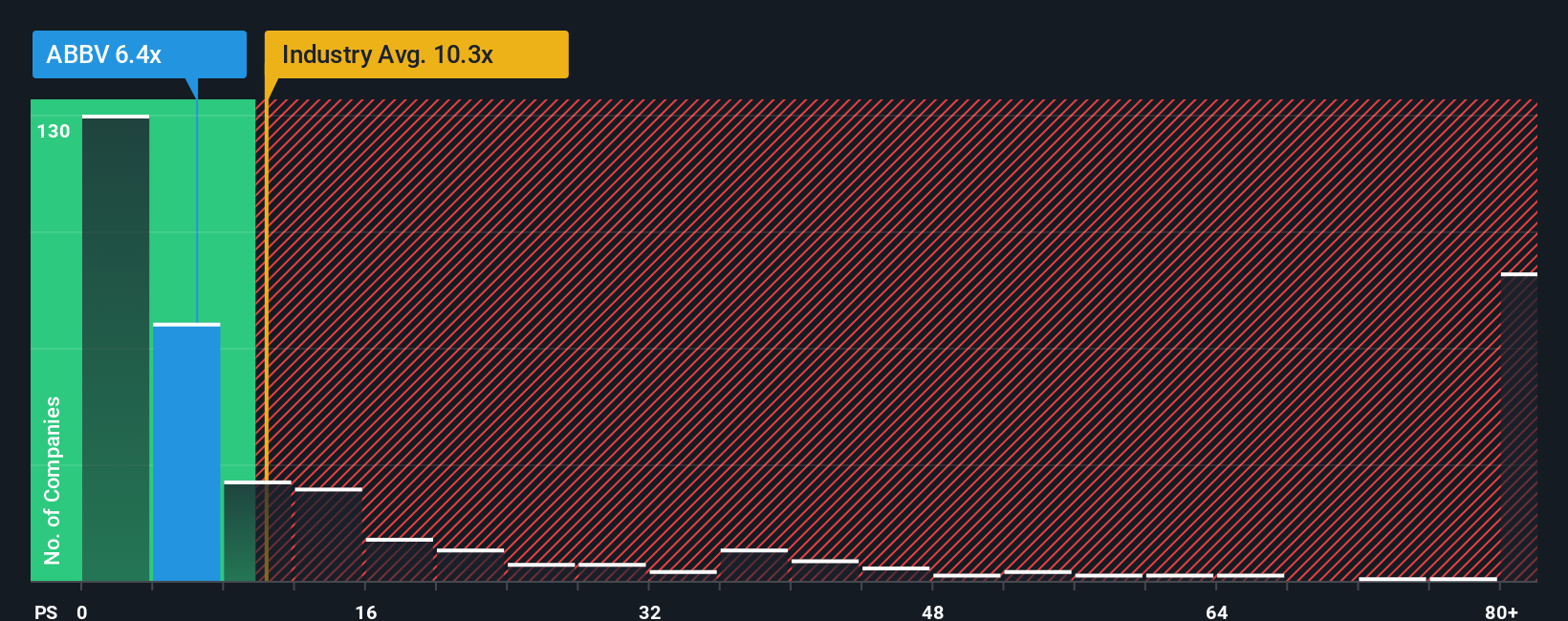

For a large, profitable pharma company like AbbVie, Price to Sales is a useful way to value the business because it looks at what investors are paying for each dollar of revenue, a relatively stable metric that is less affected by one off items in earnings.

In general, companies with faster growth and lower risk can justify a higher sales multiple, while slower or riskier businesses usually deserve a lower one. AbbVie currently trades on a Price to Sales ratio of about 6.61x. That is slightly above the peer average of around 6.06x, but well below the broader Biotechs industry average of about 11.99x. This suggests the market is giving AbbVie a moderate premium to close peers but not an aggressive one.

Simply Wall St’s Fair Ratio framework estimates AbbVie’s “normal” Price to Sales multiple at roughly 11.18x, based on its growth outlook, profitability, risk profile, industry and market cap. This tailored yardstick is more informative than simple peer or industry comparisons because it bakes in AbbVie’s specific fundamentals rather than assuming all drug makers deserve the same multiple. With the stock trading at 6.61x, well below the 11.18x Fair Ratio, AbbVie appears attractively valued on a sales basis under this framework.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AbbVie Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you turn your view of AbbVie’s story into concrete revenue, earnings and margin forecasts. You can then link those forecasts to a Fair Value, and compare that Fair Value to today’s price to decide if you want to buy, hold or sell. The Narrative updates automatically as fresh news and earnings arrive. For example, one investor might build a bullish AbbVie Narrative that assumes extended exclusivity, strong execution in immunology and neuroscience and a Fair Value closer to 255 dollars. Another might create a more cautious Narrative that leans into patent, pricing and pipeline risks and lands nearer 170 dollars. This gives you a clear, dynamic range of story driven valuations to benchmark your own decision against.

Do you think there's more to the story for AbbVie? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com