Is It Too Late To Invest In Sea After Its Recent Share Price Pullback?

- If you are wondering whether Sea's latest share price still offers value or if you have already missed the boat, you are in the right place.

- The stock has pulled back recently, down 4.7% over the last week and 17.0% over the past month, but it is still up 22.7% year to date and 10.3% over the last year, with a striking 98.0% gain over three years even after a 33.3% slide over five years.

- Recent headlines have focused on Sea's efforts to streamline operations and sharpen its focus on profitable growth in its core digital entertainment, e commerce, and fintech segments. Investors are reassessing what those strategic moves might mean for long term growth, which helps explain some of the volatility in the share price.

- On our valuation framework, Sea scores a 3/6 on the undervaluation checks. You can dig into this in more detail via our valuation score. Next, we will walk through the main valuation approaches we use and hint at a more powerful way to judge the stock's value that we will get to at the end.

Approach 1: Sea Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back to today’s dollars to estimate what the business is worth right now. For Sea, this analysis starts with last twelve month free cash flow of about $3.6 billion and uses analyst forecasts for the next few years, then extends those trends further into the future.

On this basis, Sea’s free cash flow is projected to grow steadily, reaching around $7.8 billion by 2029 and continuing to rise into the mid 2030s using Simply Wall St’s extrapolated estimates. All of these future cash flows are then discounted back to today using a required rate of return in a 2 Stage Free Cash Flow to Equity model.

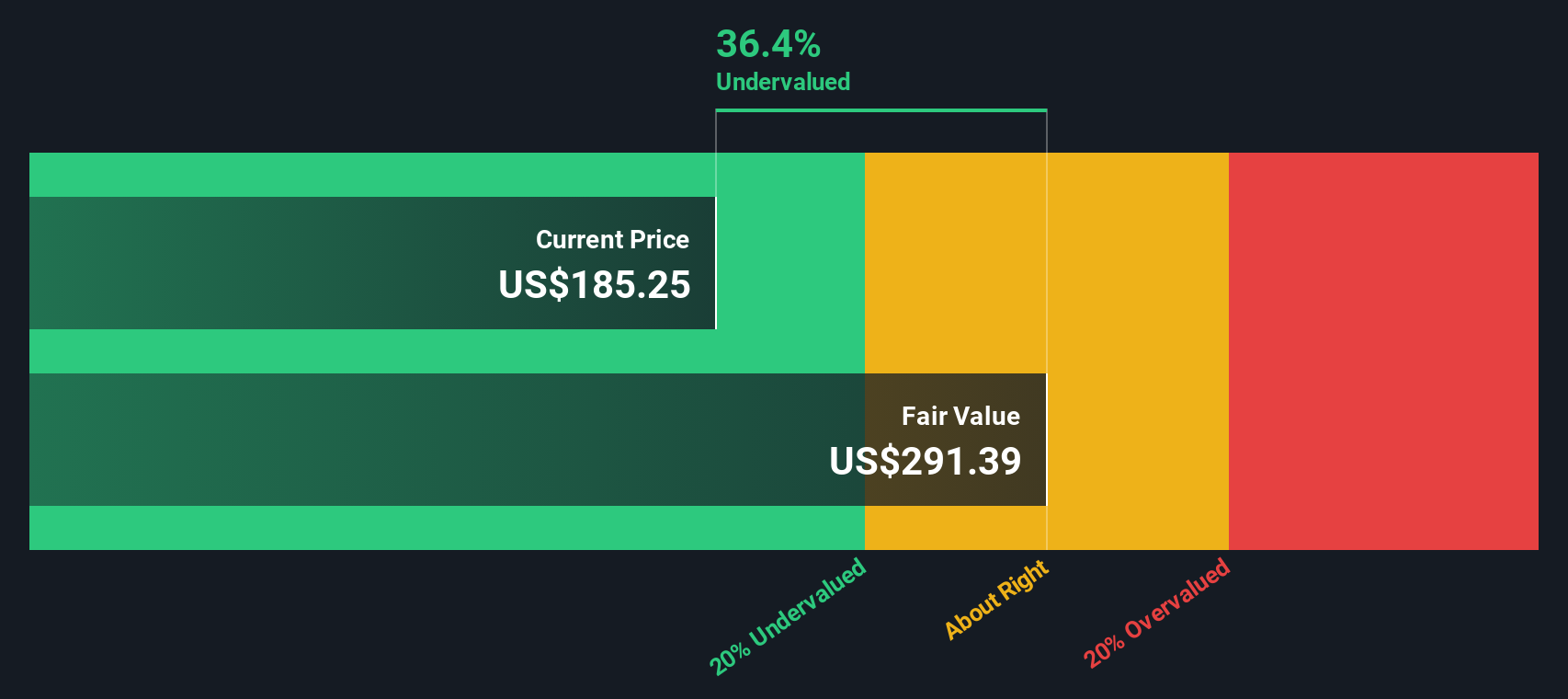

The outcome is an estimated intrinsic value of about $316 per share. This implies Sea is trading at roughly a 59.3% discount to its calculated fair value. In other words, the DCF indicates that the market price for Sea is below the value suggested by its long term cash generation potential in this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sea is undervalued by 59.3%. Track this in your watchlist or portfolio, or discover 895 more undervalued stocks based on cash flows.

Approach 2: Sea Price vs Earnings

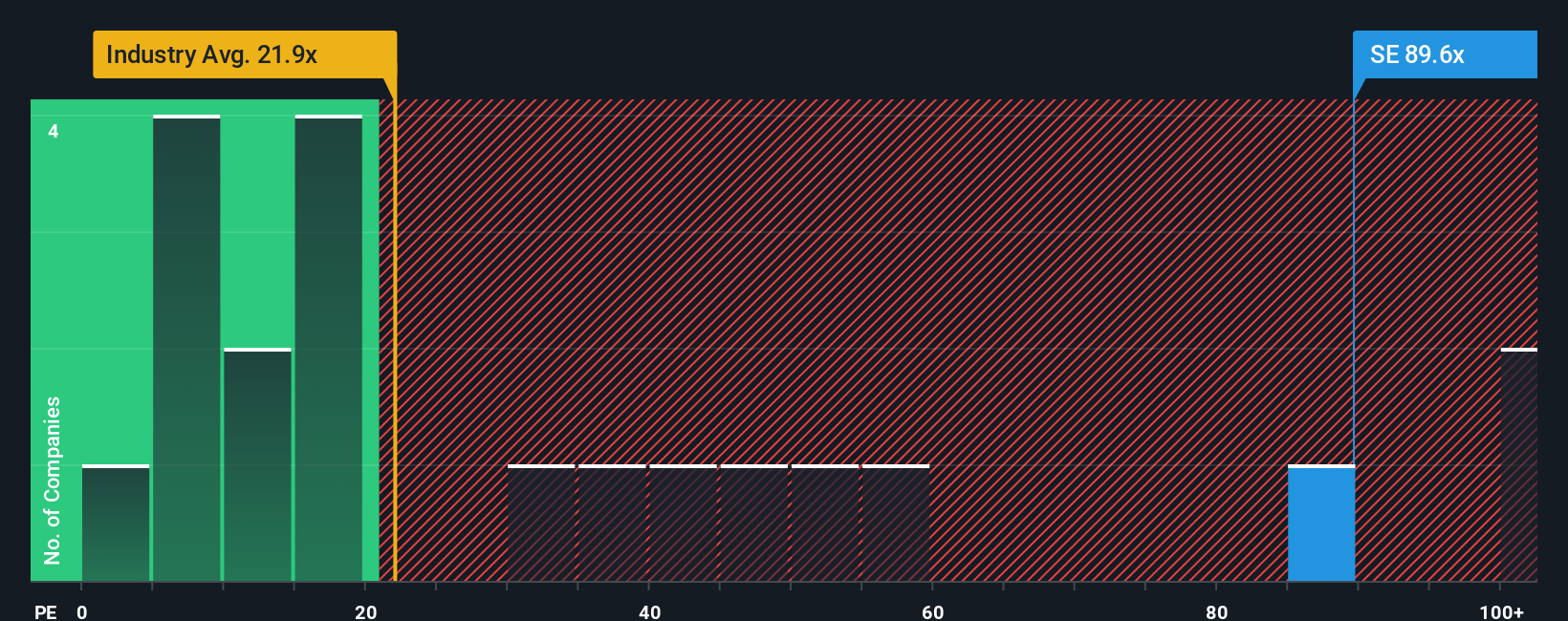

For a profitable business like Sea, the price to earnings (PE) ratio is a practical way to gauge valuation because it links what investors pay directly to the company’s current earnings power. A higher PE can be justified when the market expects stronger growth or sees the business as less risky, while slower growth or higher risk usually demands a lower, more conservative PE multiple.

Sea currently trades on a PE of about 53.7x, which is well above the Multiline Retail industry average of around 19.9x and slightly above its peer group average of roughly 50.9x. On the surface, that premium suggests the market is already baking in strong growth expectations for Sea compared to many competitors.

Simply Wall St’s Fair Ratio framework estimates that, given Sea’s earnings growth profile, margins, industry, market cap, and risk characteristics, a more appropriate PE for the stock would be closer to 36.9x. This Fair Ratio is more nuanced than a simple comparison to peers or the industry because it adjusts for company specific strengths and risks rather than assuming all retailers deserve similar multiples. With the current PE well above the Fair Ratio, Sea appears expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sea Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you tell the story behind your numbers by linking your view of a company’s future revenue, earnings, and margins to a financial forecast, a fair value estimate, and ultimately a buy or sell decision based on how that fair value compares to today’s price. Narratives are dynamic, updating as new news or earnings arrive, and they make it easy to see how different investors can reasonably disagree. For example, one Sea Narrative might assume stronger e commerce and fintech growth and land on a fair value near the bullish 241 dollar target, while another might factor in tougher competition and margin pressure and arrive closer to the 165 dollar bearish target.

Do you think there's more to the story for Sea? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com