Assessing Endeavour Silver (TSX:EDR) After Its $300 Million Convertible Notes Offering and Recent Share Price Surge

Endeavour Silver (TSX:EDR) just closed a $300 million offering of senior unsecured convertible notes due 2031, a material financing move that gives the miner fresh flexibility to fund growth or tidy up its balance sheet.

See our latest analysis for Endeavour Silver.

The $300 million notes come after a powerful run, with a roughly 45% 90 day share price return and a near doubling of one year total shareholder return. This suggests momentum investors are leaning into Endeavour Silver’s growth story despite recent volatility.

If this kind of financing driven move has your attention, it might be a good moment to explore fast growing stocks with high insider ownership for other fast moving opportunities backed by committed insiders.

With the share price already up sharply and trading about 25 percent below consensus targets despite ongoing losses, investors now face a key question: is Endeavour Silver still undervalued or is the market already pricing in its future growth?

Most Popular Narrative: 16.7% Undervalued

With Endeavour Silver last closing at CA$12.28 versus a narrative fair value of CA$14.75, the story leans toward upside if growth unfolds as projected.

The global shift toward renewable energy and electrification is accelerating structural demand for silver in key markets like solar and EVs, supporting a robust price environment that could improve Endeavour's average realized prices and top line growth. Recent operational improvements and a clear pathway to production scale mean Endeavour's margins and profitability stand to benefit further from ongoing industry wide silver supply deficits, potentially increasing earnings as supply demand imbalances persist.

Want to unpack why a mid tier miner is being priced like a fast grower, with margins and earnings more typical of premium names, not laggards? The narrative hinges on a dramatic shift in profitability, rapid revenue expansion, and a richer future earnings multiple than many peers. Curious which specific financial levers have to fire perfectly for this upside case to hold together? Dive in to see the exact assumptions driving that fair value call.

Result: Fair Value of $14.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays ramping up Terronera, or cost overruns and permitting setbacks at Kolpa, could quickly challenge the bullish profitability and valuation assumptions underpinning this story.

Find out about the key risks to this Endeavour Silver narrative.

Another Take on Valuation

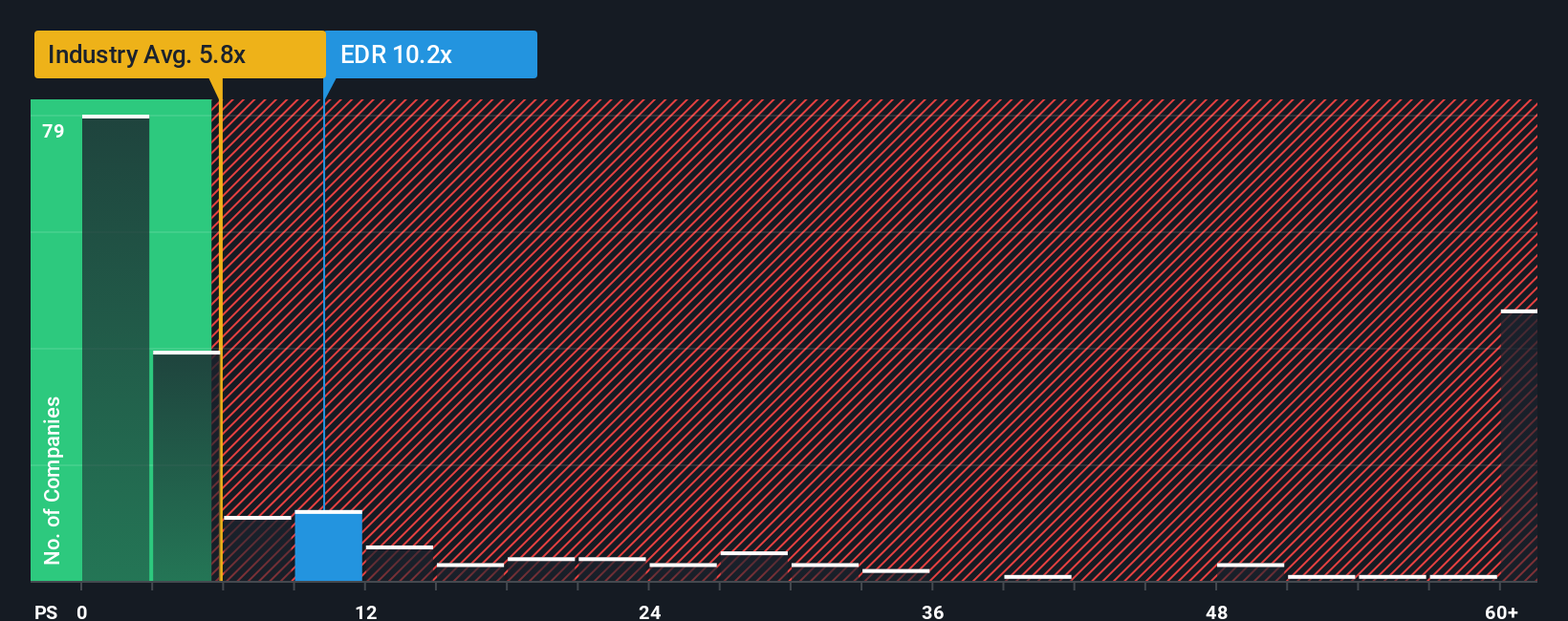

While the narrative fair value points to roughly 17 percent upside, the price to sales lens is more cautious. Endeavour trades at 7.7 times sales versus a 3.8 times fair ratio and 6.5 times for the wider Canadian metals and mining group, which hints the stock may already be richly priced. Which story do you trust when sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Endeavour Silver Narrative

If you see things differently or would rather test the numbers yourself, you can build a personalized Endeavour Silver story in just a few minutes: Do it your way.

A great starting point for your Endeavour Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, tap into fresh opportunities beyond Endeavour Silver by using our powerful stock screeners tailored to different themes, risks, and return profiles.

- Capture potential mispricings early by scanning these 895 undervalued stocks based on cash flows that may be trading below what their cash flows suggest they are worth.

- Capitalize on structural tech shifts by targeting innovation focused names through these 27 AI penny stocks shaping the future of automation and intelligence.

- Strengthen your income strategy by filtering for reliable payers with these 15 dividend stocks with yields > 3% that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com