Fidelity National Information Services (FIS): Reassessing Valuation After Earnings Beat, Guidance Hike and Larger Buyback

Fidelity National Information Services (FIS) just delivered an earnings beat, raised its full year revenue and EBITDA guidance, and boosted its share buyback plans, a combination that usually forces investors to revisit the stock.

See our latest analysis for Fidelity National Information Services.

Even with the upbeat guidance and larger buyback, sentiment is still resetting. The share price is $65.17 and the year to date share price return is negative 18.63 percent, reinforcing a longer term total shareholder return picture that remains weak and suggests momentum is only just starting to turn.

If this kind of reset has you thinking more broadly about the market, it might be a good moment to explore fast growing stocks with high insider ownership.

With earnings momentum improving, guidance moving higher and the stock still trading at a steep discount to analyst targets and intrinsic value, is FIS now a mispriced recovery story, or has the market already captured that future growth?

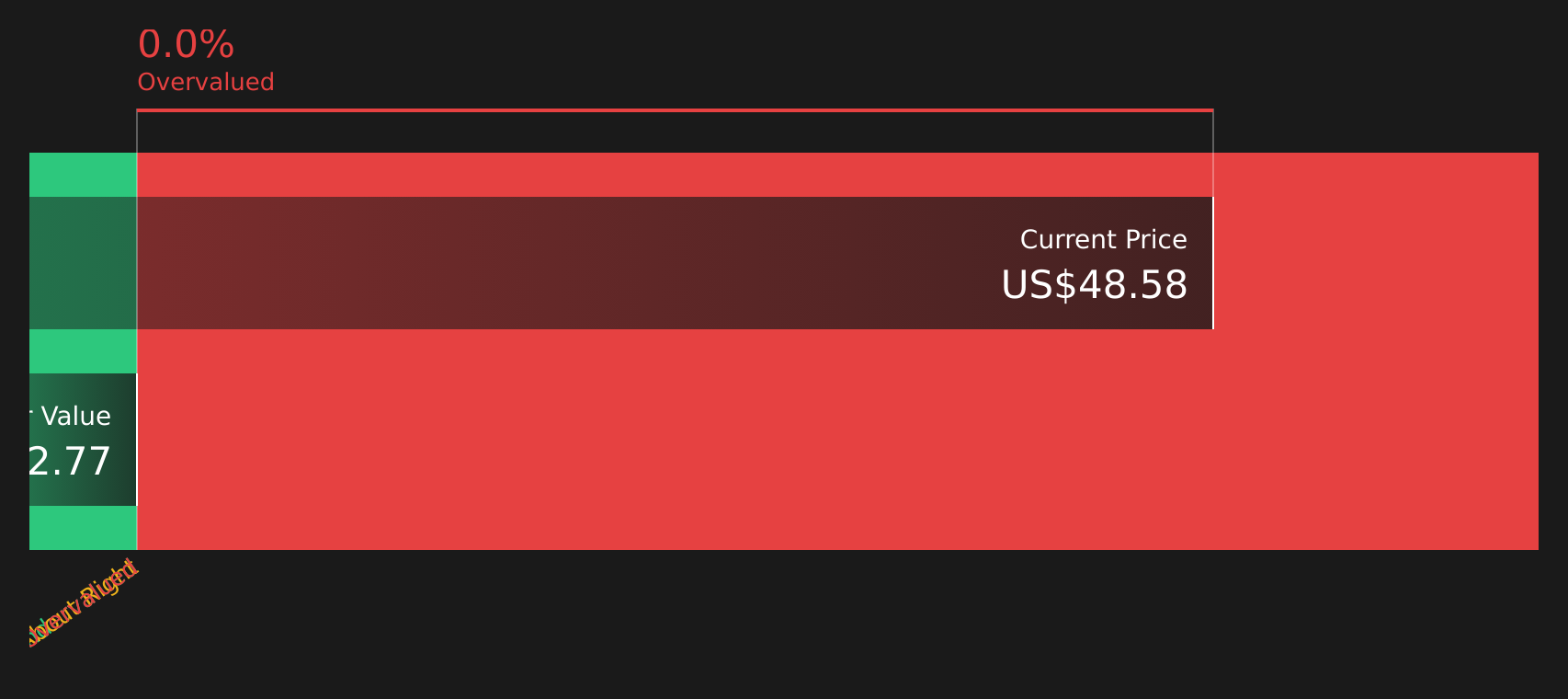

Most Popular Narrative: 19.6% Undervalued

With the narrative fair value sitting well above FIS's last close of $65.17, the focus shifts to whether the long term cash engine is being underestimated.

Execution of operational simplification (e.g., Worldpay divestiture, focused acquisitions like Everlink and Global Payments Issuer), strong cost reduction programs, and improved working capital management are expected to lower operating expenses and drive EBITDA margin expansion, supporting higher future earnings.

Want to see how modest top line growth translates into outsized profit expansion and a richer earnings multiple than the sector norm? The narrative leans on a sharp margin reset, aggressive buybacks, and a future valuation framework that assumes FIS earns a premium usually reserved for faster growing platforms. Curious which specific profitability step change underpins that premium and drives the fair value gap? Read on to unpack the full playbook behind this pricing thesis.

Result: Fair Value of $81.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fintech competition and ongoing integration challenges could derail margin expansion and undermine the premium multiple baked into this recovery thesis.

Find out about the key risks to this Fidelity National Information Services narrative.

Another Lens on Valuation

While the narrative and analyst targets point to upside, our SWS DCF model is far more generous, suggesting fair value around $114.13, meaning FIS trades at a steep discount. If the cash flow story plays out, is the market underestimating how quickly sentiment can flip?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fidelity National Information Services Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a personalized thesis in minutes: Do it your way.

A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the next big move, use the Simply Wall Street Screener to uncover targeted opportunities that most investors never even notice.

- Target consistent cash generators by reviewing these 15 dividend stocks with yields > 3% that can strengthen your portfolio income while markets stay unpredictable.

- Capitalize on structural tech shifts with these 27 AI penny stocks positioned at the heart of real world AI adoption and data driven business models.

- Upgrade your value hunting by scanning these 895 undervalued stocks based on cash flows where market pessimism may have pushed prices well below realistic cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com