Assessing Artemis Gold (TSXV:ARTG)’s Valuation After Strong 21% ROCE and Reinvestment-Driven Growth Momentum

Artemis Gold (TSXV:ARTG) has just crossed an important milestone by delivering a 21% return on capital employed while reinvesting those new profits back into the business, a combination that is drawing fresh investor attention.

See our latest analysis for Artemis Gold.

That improving 21% ROCE is showing up in the market too, with a strong year to date share price return of 156.22% and a powerful three year total shareholder return of 758.33%. This suggests momentum is still building rather than fading.

If Artemis Gold's trajectory has caught your eye, this is also a good moment to explore other materials names with strong growth stories and management skin in the game through fast growing stocks with high insider ownership.

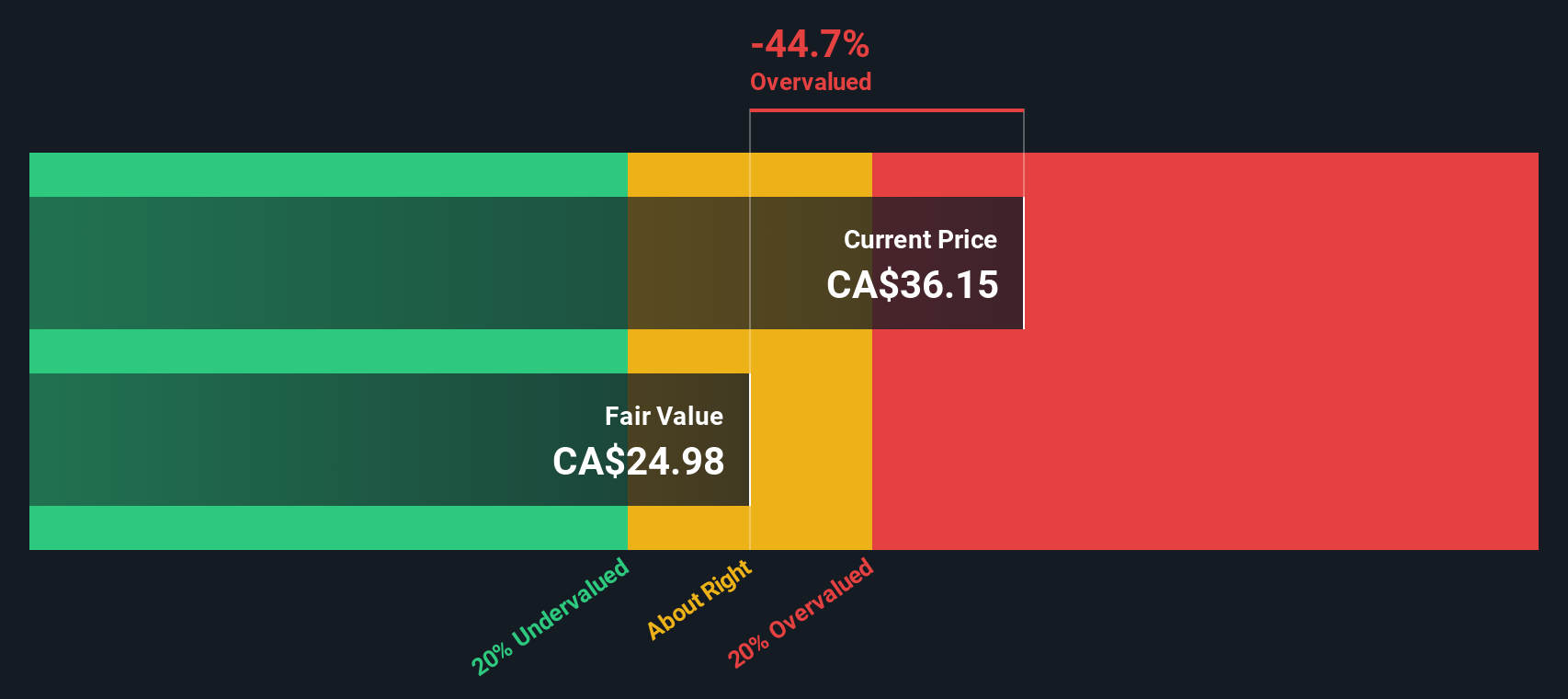

With analysts still seeing upside to their price targets and profitability only recently breaking through, the key question now is whether Artemis Gold remains undervalued or if the market has already priced in years of future growth.

Price-to-Earnings of 40.2x: Is it justified?

On a price-to-earnings basis, Artemis Gold trades at 40.2 times earnings, a rich valuation against its CA$36.05 share price and mining peers.

The price-to-earnings ratio compares the current share price with the company’s earnings, essentially showing how much investors are willing to pay for each dollar of profit.

For Artemis Gold, the market is paying a premium multiple that reflects expectations of strong earnings expansion. The stock also screens as good value versus our estimated fair P/E of 47.8 times and sits around 9% below our DCF fair value of CA$39.61.

Compared with the broader Canadian metals and mining industry average of 21.1 times earnings, Artemis Gold’s 40.2 times stands out as substantially higher. This underlines how aggressively investors are pricing in its forecast growth and profitability.

Explore the SWS fair ratio for Artemis Gold

Result: Price-to-Earnings of 40.2x (ABOUT RIGHT)

However, investors should still watch for construction or permitting delays at Blackwater, and any pullback in gold prices that could quickly compress Artemis Gold’s premium valuation.

Find out about the key risks to this Artemis Gold narrative.

Another View: DCF Says There Is Still Room

Our DCF model takes a longer term view of Artemis Gold's future cash flows and suggests a fair value of CA$39.61 per share, around 9% above the current CA$36.05 price. If the market leans back toward cash flow fundamentals, that premium multiple may still have some support.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Artemis Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Artemis Gold Narrative

If you have a different view, or prefer digging into the numbers yourself, you can build a personalized thesis in just a few minutes with Do it your way.

A great starting point for your Artemis Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more compelling ideas?

Artemis Gold might be a standout, but you could miss other opportunities the Simply Wall St screener is surfacing right now if you focus on just one stock.

- Capture potential multi baggers early by scanning these 3590 penny stocks with strong financials that already back their stories with improving fundamentals and real business traction.

- Explore powerful secular trends through these 27 AI penny stocks at the intersection of innovation, scalable business models, and evolving earnings potential.

- Seek mispriced quality by targeting these 895 undervalued stocks based on cash flows that trade below their cash flow potential before the rest of the market reassesses them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com