Yext (YEXT) Earnings: Sustained Profitability Challenges Skeptics of Margin-Driven Growth Story

Yext (YEXT) has just posted its Q3 2026 numbers, with revenue of about $112 million and basic EPS of roughly $0.05 as the company continues to build on the profitability it achieved over the last year. The company has seen quarterly revenue hover around the low $100 million mark over recent periods, from $113.1 million in Q4 2025 to $109.5 million in Q1 2026 and $113.1 million in Q2 2026. EPS has swung from a loss of about $0.06 in Q4 2025 to positive $0.22 in Q2 2026 and stayed in the black through Q3 2026, pointing to healthier margins that give investors more room to focus on what is driving the next leg of profit growth.

See our full analysis for Yext.With the latest quarter on the books, the next step is to see how these revenue and EPS trends line up with the prevailing narratives around Yext's growth, profitability, and execution.

See what the community is saying about Yext

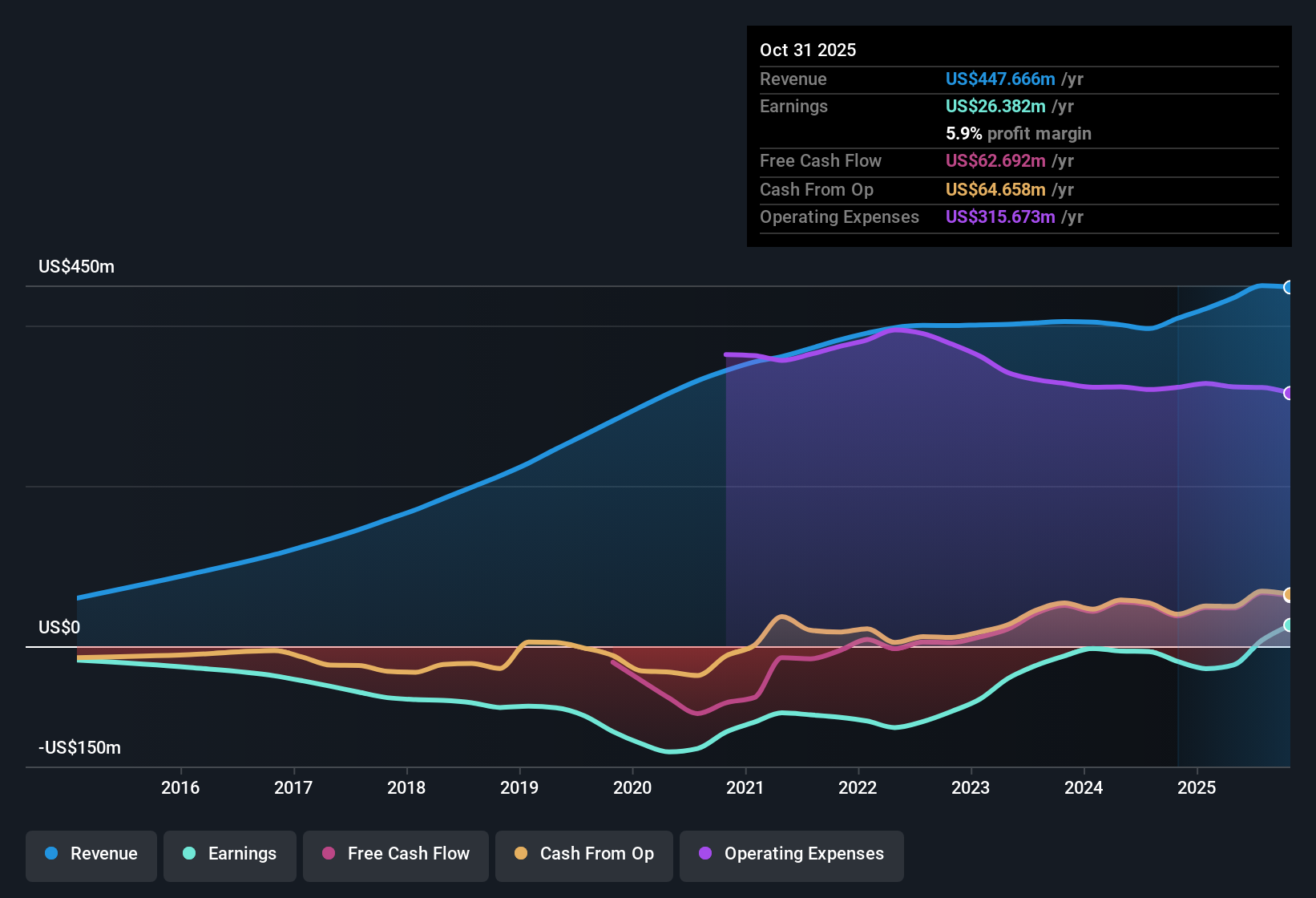

TTM Profit Swings From Loss to $26.4 Million

- Over the last 12 months, net income moved from a loss of $27.9 million in Q4 2025 to a profit of $26.4 million on $447.7 million of revenue by Q3 2026. This shows that the business is now generating positive earnings on a full year basis rather than just in a single quarter.

- Consensus narrative supporters point to this shift to sustained profitability as a sign the platform is becoming more mission critical. Within that view:

- the move from a trailing loss of $27.9 million to a profit of $26.4 million supports the idea that operating leverage is starting to show up in the numbers,

- while the relatively flat quarterly revenue range around $110 million suggests that bulls still need earnings growth to come more from margins than from a large acceleration in sales.

18.5% Earnings Growth Target vs 3.6% Sales Pace

- Analysts are projecting earnings to grow about 18.5% per year while revenue is expected to rise only about 3.6% annually. This means most of the forecast improvement is coming from better margins rather than rapid top line expansion.

- Bears highlight that this gap leaves little room for error if upselling and new AI products underperform. Their concerns include:

- modest revenue growth of 3.6% per year, which is below the broader US market’s 10.7% pace and limits how much scale can help if costs increase,

- and the reliance on higher value use cases and renewals to drive that 18.5% earnings growth, since any slowdown in contract expansions could quickly show up in the profit line.

High 39.3x P/E Against DCF Upside

- Shares trade on a trailing P/E of 39.3 times, above both the US software industry at 32 times and the peer average at 25.7 times. At the same time, a DCF fair value of about $12.20 sits roughly 45% above the current $8.42 share price.

- What stands out for bullish investors is the combination of relatively high multiples and modelled upside, because:

- the higher than peer P/E suggests the market is already paying a premium for Yext’s recent $26.4 million in trailing net income and the projected 18.5% earnings growth,

- while the DCF fair value of $12.20 versus $8.42 indicates there could still be room for rerating if those earnings forecasts and improving margins occur as expected.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Yext on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on Yext’s results, shape the story in just a few minutes, and Do it your way.

A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Yext’s premium valuation, modest revenue growth, and reliance on further margin gains leave little room for execution missteps or slower product uptake.

If you want faster growth supported by stronger fundamentals instead of stretching for a rerating, use our high growth potential stocks screener (46 results) today and target companies built for more decisive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com