Three Dividend Stocks To Enhance Your Portfolio

As the U.S. market navigates mixed signals ahead of a crucial Federal Reserve decision on interest rates, investors are keenly observing how these changes might impact their portfolios. In such an environment, dividend stocks can offer a stable income stream and potential for growth, making them a valuable consideration for those looking to enhance their investment strategy amidst fluctuating economic conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.75% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.42% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.81% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.52% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.50% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.86% | ★★★★★★ |

| Ennis (EBF) | 5.66% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.12% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.45% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.55% | ★★★★★☆ |

Click here to see the full list of 121 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Timberland Bancorp (TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $277.67 million.

Operations: Timberland Bancorp generates revenue of $81.62 million from its community banking services in Washington.

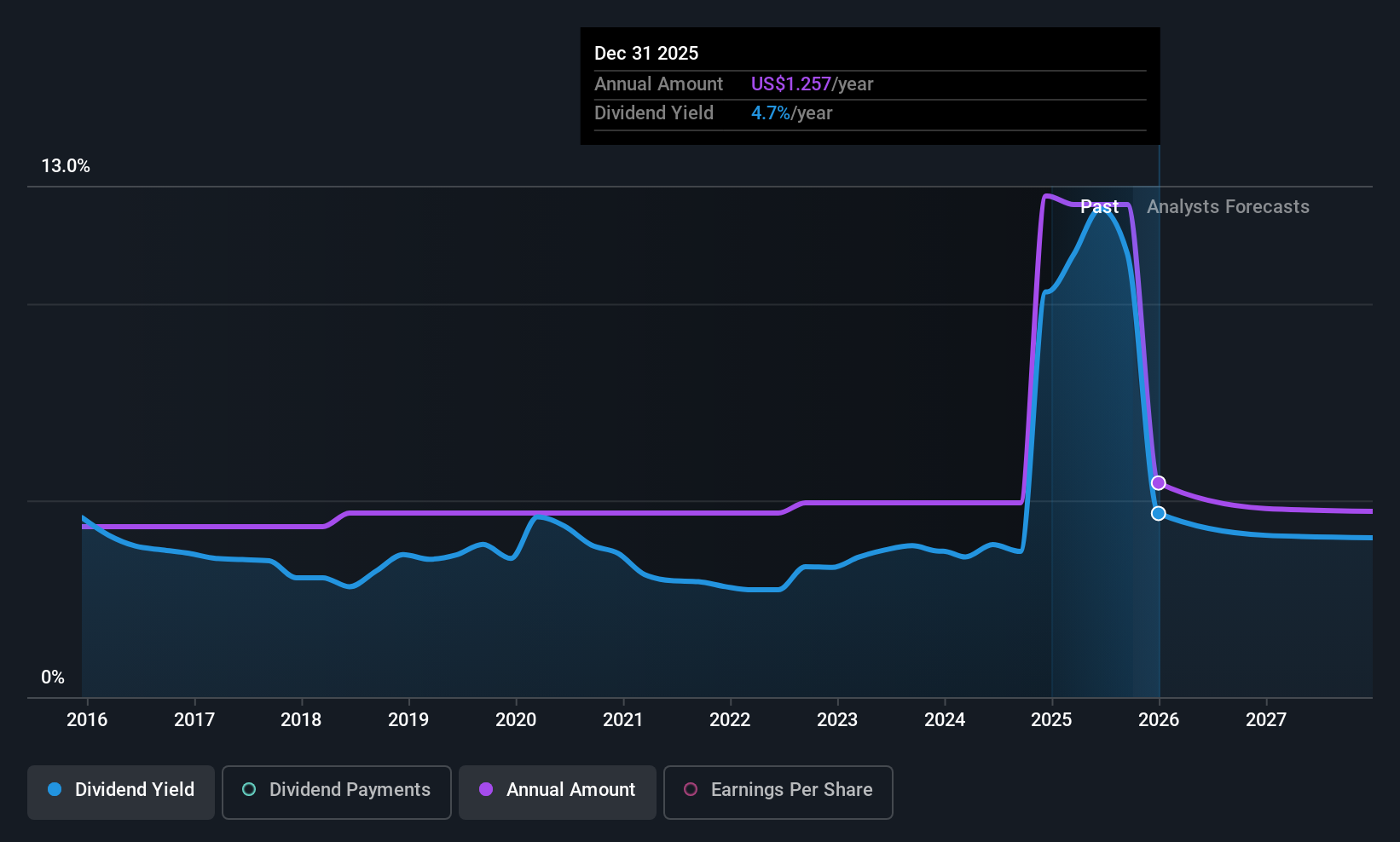

Dividend Yield: 3.2%

Timberland Bancorp has shown consistent dividend growth over the past decade, recently increasing its quarterly cash dividend by 8% to $0.28 per share. Despite a lower yield of 3.18% compared to top-tier US dividend payers, its dividends are well-covered with a payout ratio of 27.7%. The company reported strong earnings growth for the year ending September 2025, with net income rising to $29.16 million from $24.28 million in the prior year, supporting its stable and reliable dividend track record.

- Click to explore a detailed breakdown of our findings in Timberland Bancorp's dividend report.

- The analysis detailed in our Timberland Bancorp valuation report hints at an deflated share price compared to its estimated value.

Coterra Energy (CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company focused on the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States with a market cap of $20.23 billion.

Operations: Coterra Energy Inc. generates revenue of $6.67 billion from its activities in natural gas and oil development, exploitation, exploration, and production within the United States.

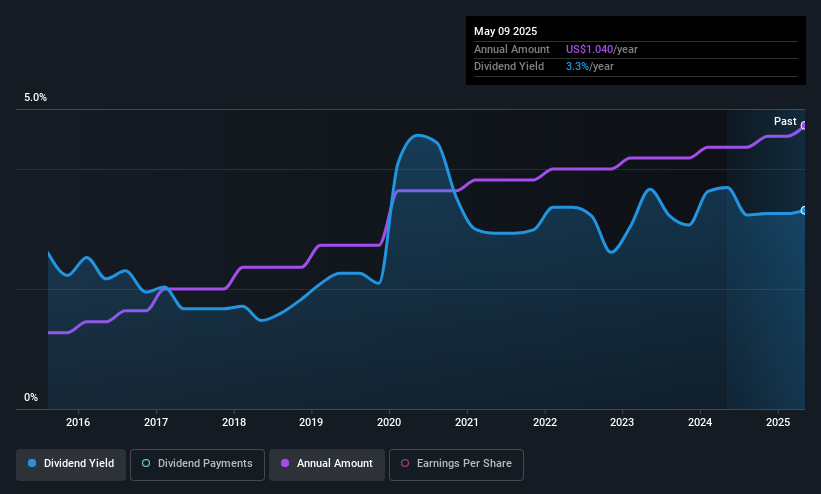

Dividend Yield: 3.3%

Coterra Energy's dividend payments have been volatile over the past decade, yet they are well-covered by earnings and cash flows, with a payout ratio of 39.9% and a cash payout ratio of 46.3%. The company recently affirmed its quarterly dividend at $0.22 per share, yielding an annualized rate of 3.8%. Despite governance concerns raised by Kimmeridge Energy Management, Coterra's production guidance has improved for 2025, indicating potential operational strength amidst strategic challenges.

- Delve into the full analysis dividend report here for a deeper understanding of Coterra Energy.

- The valuation report we've compiled suggests that Coterra Energy's current price could be quite moderate.

Rayonier (RYN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rayonier is a leading timberland real estate investment trust with assets in productive softwood timber regions in the United States, and it has a market cap of approximately $3.34 billion.

Operations: Rayonier's revenue is primarily derived from its Real Estate segment at $713.03 million, Southern Timber at $228.98 million, and Pacific Northwest Timber at $82.51 million.

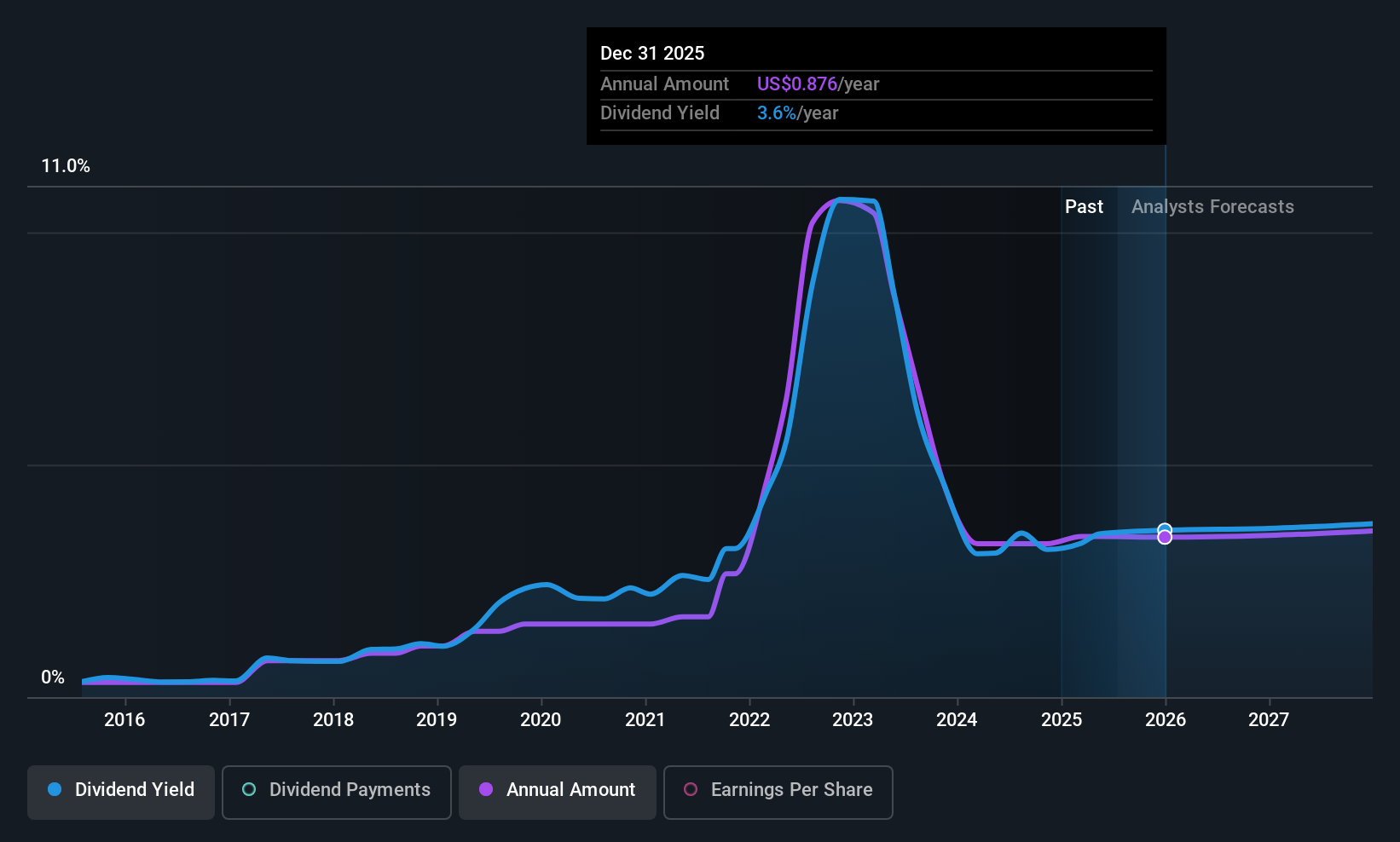

Dividend Yield: 13.4%

Rayonier's dividends have been stable and growing over the past decade, but their high yield of 13.44% is not well covered by earnings or cash flows, with a cash payout ratio of 225.8%. Recent events include a merger agreement with PotlatchDeltic Corporation and a special dividend of $1.40 per share. Despite significant insider selling, Rayonier has been actively repurchasing shares and trading below estimated fair value by 53.3%, suggesting potential undervaluation.

- Get an in-depth perspective on Rayonier's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Rayonier is trading behind its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 118 Top US Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com