Discovering US Undiscovered Gems December 2025

As the Federal Reserve's anticipated rate cut looms, the U.S. stock market presents a mixed picture with major indices showing varied performances. Amidst this backdrop, small-cap stocks have gained attention for their potential to outperform in a declining interest-rate environment, offering investors opportunities to uncover lesser-known companies poised for growth. In such conditions, identifying stocks with strong fundamentals and resilience becomes crucial for those seeking undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Investar Holding (ISTR)

Simply Wall St Value Rating: ★★★★★★

Overview: Investar Holding Corporation is a bank holding company for Investar Bank, offering a variety of commercial banking products to individuals and businesses in south Louisiana, southeast Texas, and Alabama, with a market cap of $258.80 million.

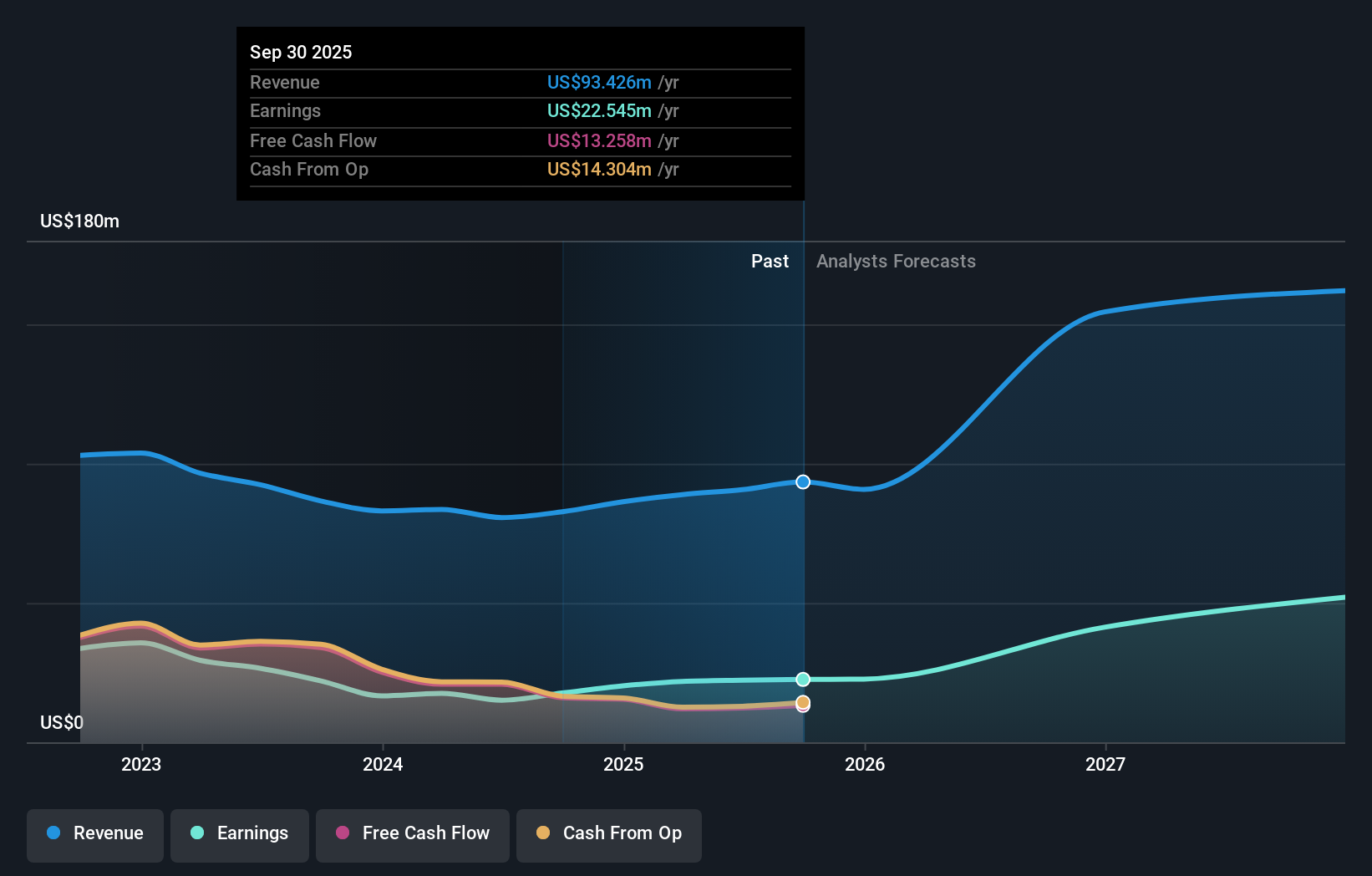

Operations: Investar Holding generates its revenue primarily from its banking segment, amounting to $93.43 million. The company's net profit margin is a key financial metric to consider for evaluating profitability trends over time.

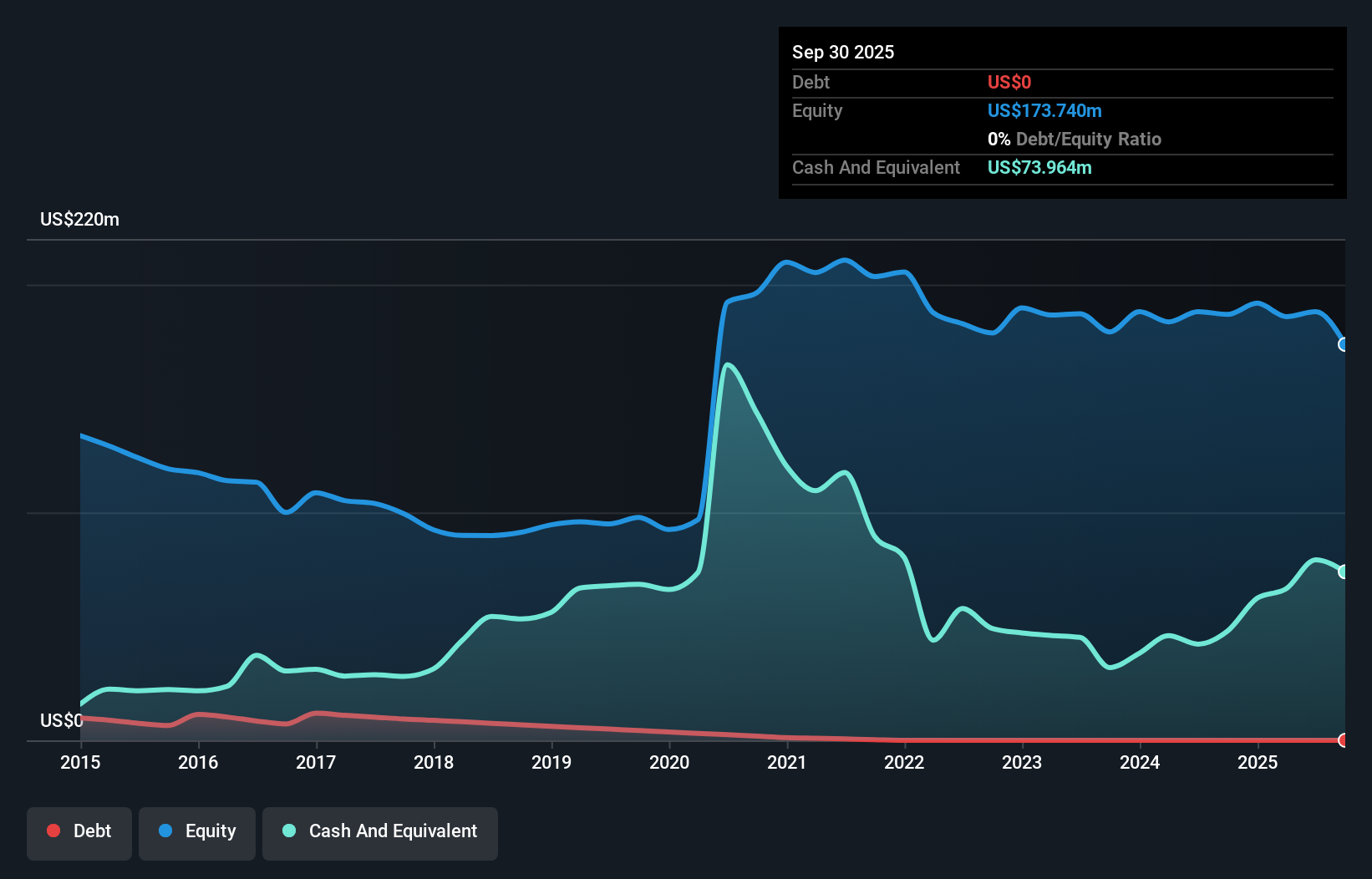

Investar Holding, with assets totaling US$2.8 billion and equity of US$295.3 million, stands out for its robust financial health. The company has total deposits of US$2.4 billion and loans amounting to US$2.1 billion, supported by a net interest margin of 2.6%. It maintains a sufficient allowance for bad loans at 0.4% of total loans, indicating prudent risk management practices. Earnings growth over the past year was an impressive 27.5%, outpacing the banks industry average of 18.2%. Additionally, it trades at nearly half its estimated fair value while relying on low-risk funding sources like customer deposits for stability and growth potential.

AudioCodes (AUDC)

Simply Wall St Value Rating: ★★★★★★

Overview: AudioCodes Ltd. specializes in advanced communications software, products, and productivity solutions for the digital workplace globally, with a market cap of approximately $262.41 million.

Operations: The company generates revenue primarily from its Communications Equipment segment, totaling $244.55 million.

AudioCodes is making strategic moves to strengthen its position in the AI-powered voice services market, with initiatives like joining Cisco Webex Calling's Cloud Connect Enablement program, potentially adding US$5 million in contract value over three years. The company is also relocating manufacturing from China to lower-tariff countries, aiming for savings between US$7 million and US$9 million. Despite these efforts, challenges such as increased R&D costs and macroeconomic uncertainties could impact profitability. Recent buyback activity saw 1.27 million shares repurchased for US$12.7 million, representing 4.39% of outstanding shares, reflecting confidence in its valuation at a consensus price target of $10.75 per share amidst varied analyst opinions on future earnings projections.

Luxfer Holdings (LXFR)

Simply Wall St Value Rating: ★★★★★★

Overview: Luxfer Holdings PLC, with a market cap of $353.53 million, specializes in producing high-performance materials and components, as well as high-pressure gas containment devices for sectors such as defense, healthcare, transportation, and general industrial applications.

Operations: Luxfer Holdings generates revenue primarily from its Elektron segment ($197 million) and Gas Cylinders segment ($179.50 million), with a smaller contribution from Graphic Arts ($20.80 million). The company's gross profit margin is 24%, reflecting the efficiency of its production processes in these segments.

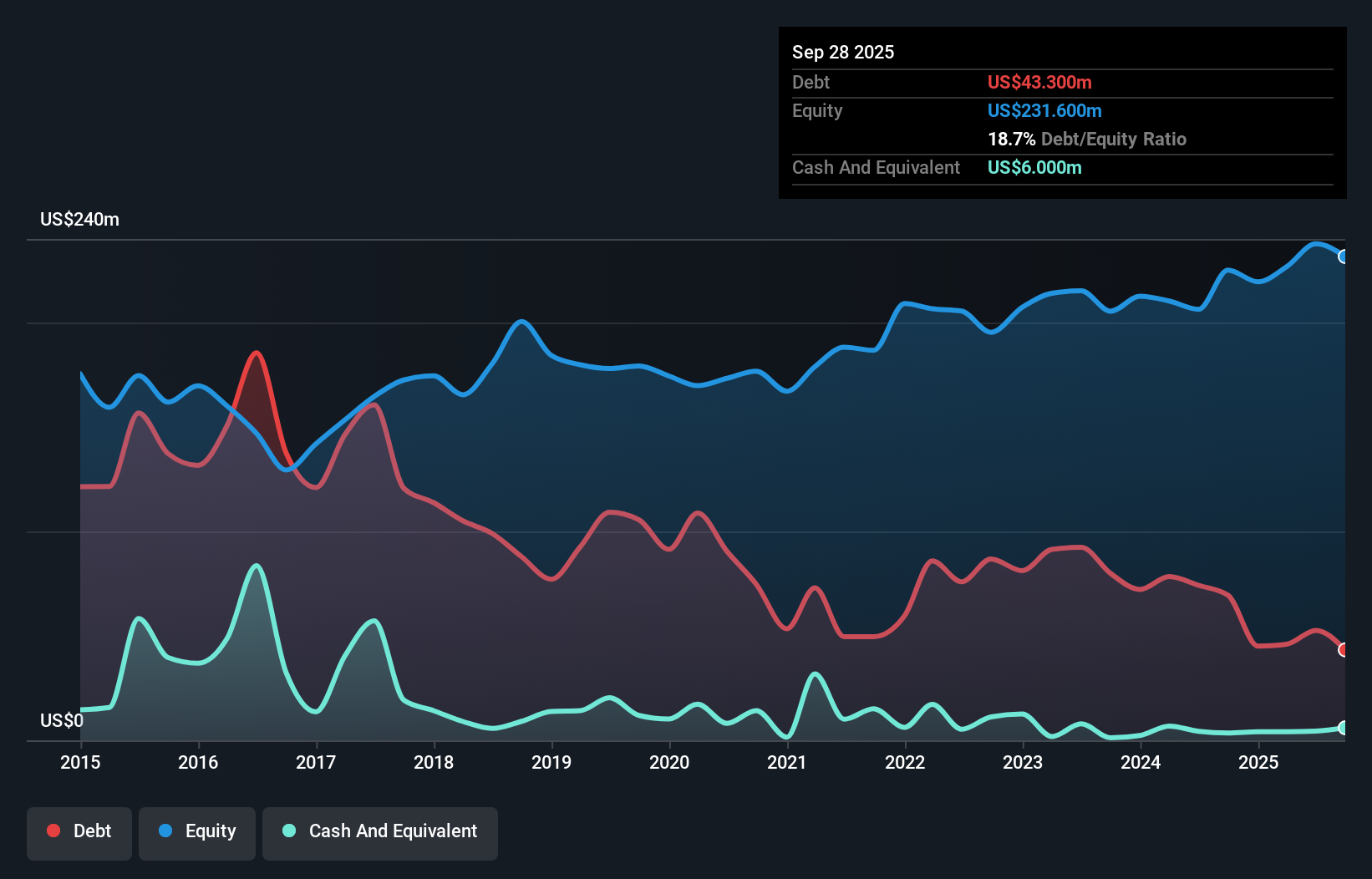

Luxfer Holdings, a smaller player in the machinery sector, has shown resilience with its earnings growing by 95% over the past year, surpassing industry averages. The company's net debt to equity ratio stands at a satisfactory 16%, indicating prudent financial management. Despite facing a one-off loss of US$11.4 million recently, Luxfer's interest payments are well covered by EBIT at 11 times coverage. They have also completed share buybacks worth US$25.54 million, representing over 6% of shares since their announcement in July 2021. While recent quarterly sales dipped to US$92.9 million from US$99.4 million last year, Luxfer continues to offer dividends and projects modest sales growth for the full year of 2025.

- Delve into the full analysis health report here for a deeper understanding of Luxfer Holdings.

Evaluate Luxfer Holdings' historical performance by accessing our past performance report.

Where To Now?

- Discover the full array of 300 US Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com