Assessing FTI Consulting’s Valuation After Recent Share Price Weakness and Long-Term Return Track Record

FTI Consulting (FCN) has quietly lagged the broader market this year, even as revenue and earnings keep creeping higher. That disconnect is drawing fresh attention from investors looking for steady, less cyclical business services exposure.

See our latest analysis for FTI Consulting.

Despite the latest share price of $166.6 and a solid operational backdrop, FTI Consulting’s year to date share price return of minus 12.24 percent and one year total shareholder return of minus 16.26 percent suggest momentum has cooled. However, the five year total shareholder return of 52.54 percent still points to a business that has rewarded patient holders over time.

If steady advisers like FTI are on your radar, it could also be worth exploring fast growing stocks with high insider ownership for ideas where growth and insider conviction are both working in investors’ favor.

With growth chugging along but the share price treading water, the key question now is whether FTI Consulting is an underappreciated compounder, or if the market has already priced in the next leg of its expansion.

Most Popular Narrative Narrative: 0% Overvalued

With FTI Consulting trading almost exactly in line with the narrative fair value of $166, investors are effectively endorsing a tightly balanced outlook.

The analysts have a consensus price target of $185.0 for FTI Consulting based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $358.3 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 7.2%.

Want to see how modest growth, slowly rising margins, and a compressed future earnings multiple can still justify upside from today’s price? The full narrative reveals the math behind that balancing act.

Result: Fair Value of $166 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid advances in automation and fierce competition on pricing could compress margins faster than expected and undermine the steady compounder narrative around FTI.

Find out about the key risks to this FTI Consulting narrative.

Another Lens on Value

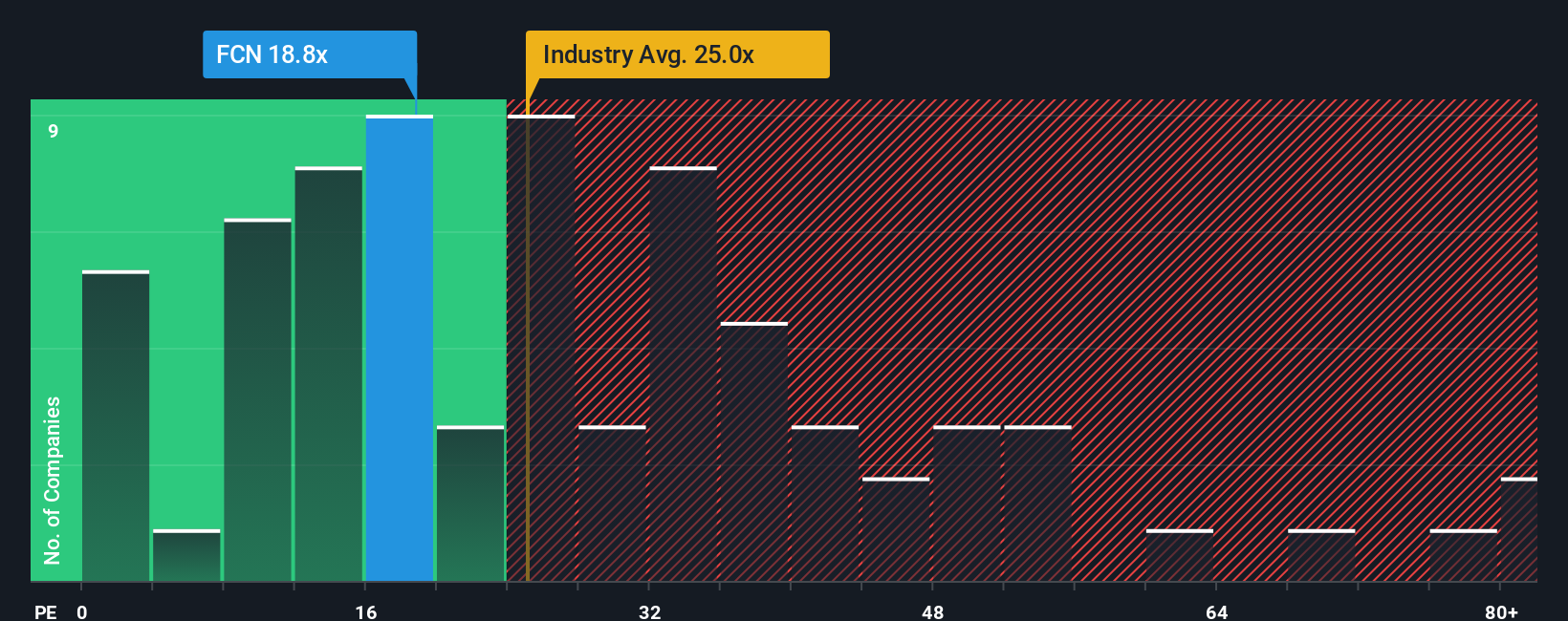

On simple price to earnings, FTI Consulting looks inexpensive, trading at 19 times earnings versus both the industry average of 24.9 times and a fair ratio of 23.8 times implied by our work. That gap hints at mispricing, but is it a margin of safety or a warning signal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTI Consulting Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding FTI Consulting.

Ready for your next investing move?

Before the market’s next big shift, consider putting your cash to work with focused ideas from the Simply Wall St screener, rather than watching opportunities pass by.

- Capture potential mispricing by targeting companies trading below intrinsic value through these 895 undervalued stocks based on cash flows and position yourself ahead of a possible rerating.

- Explore structural trends by focusing on innovation leaders using these 27 AI penny stocks that are involved in how technology and automation reshape entire industries.

- Strengthen your income stream by pinpointing reliable payers via these 15 dividend stocks with yields > 3% and identify yields that could help you manage inflation and market volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com