Coursera (COUR): Reassessing Valuation After Lower Customer Spending and Slower Growth Outlook

Shifting spending patterns put Coursera under the spotlight

Coursera (COUR) just flagged a 7% slide in average customer spending even as it pushes to onboard more learners, a shift that helps explain why sales growth is expected to cool from recent years.

See our latest analysis for Coursera.

At a share price of $8.22, Coursera’s recent share price return of negative 21.6% over 90 days and three year total shareholder return of negative 37.0% suggest momentum has clearly faded as investors reassess growth in the context of rising competitive and marketing risks.

If this shift in sentiment has you rethinking your exposure to education and tech enabled platforms, it could be a good moment to explore high growth tech and AI stocks for other growth stories and risk profiles.

With spending per learner falling, growth forecasts cooling, and the stock trading at a steep discount to analyst targets, is Coursera now mispriced value or simply a fair reflection of its slower and more competitive future?

Most Popular Narrative Narrative: 32.8% Undervalued

With Coursera last closing at $8.22 versus a narrative fair value near $12.23, the gap reflects ambitious expectations for margin expansion and scalable growth.

The accelerating global need for technology driven upskilling and reskilling continues to fuel new user growth and broadens Coursera's addressable market, as evidenced by record new learner additions and surging demand for AI, tech, and industry specific credentials, this is likely to directly impact future top line revenue expansion.

Curious how modest revenue growth, rising margins, and a premium future earnings multiple can still add up to a higher fair value? Dig into the full narrative.

Result: Fair Value of $12.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and potential skepticism toward online credentials could compress pricing power, pressure margins, and ultimately challenge the bullish undervaluation narrative.

Find out about the key risks to this Coursera narrative.

Another Angle On Valuation

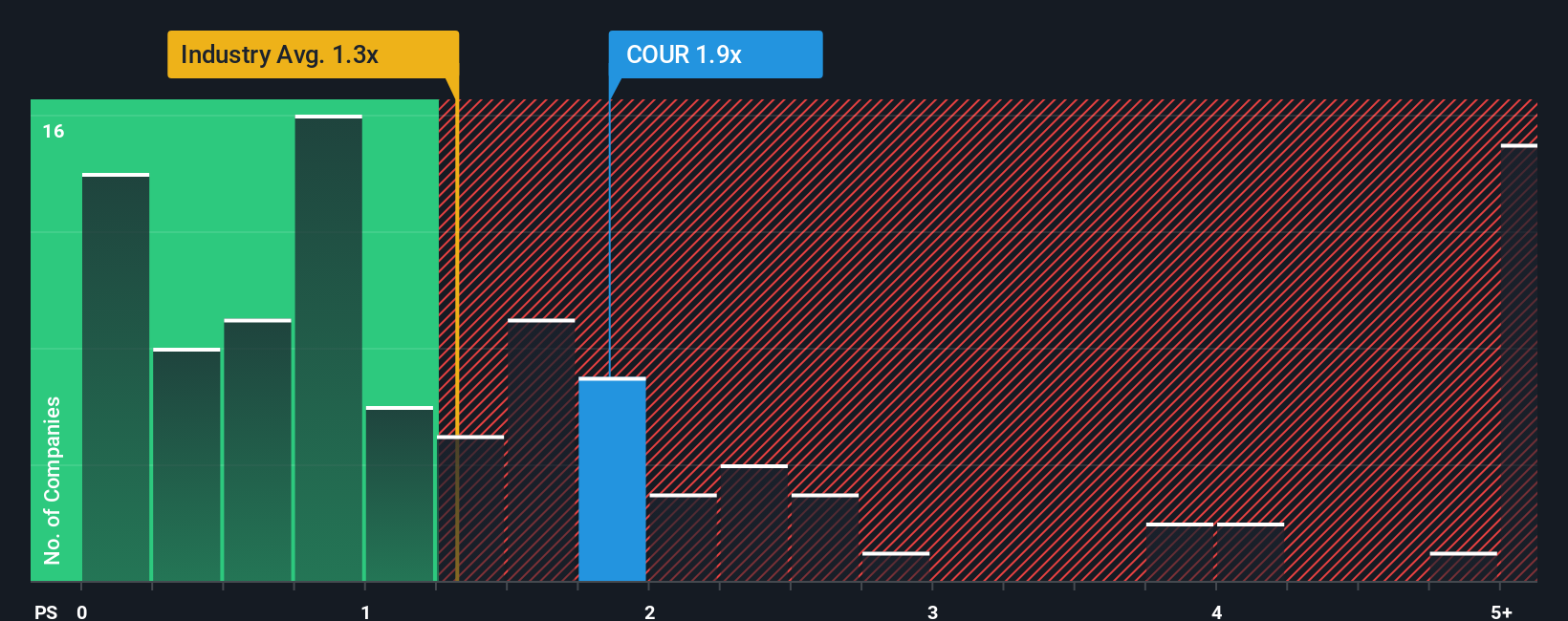

While narrative fair value suggests Coursera is undervalued, its price to sales ratio of 1.8 times looks stretched against peers at 1.5 times and a fair ratio near 1.2 times. This implies the market may still be pricing in execution risk, not hidden upside. Which view do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coursera Narrative

If you see Coursera’s story differently or want to stress test the assumptions with your own research, you can build a custom view in minutes using Do it your way.

A great starting point for your Coursera research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before Coursera’s story moves on without you, put your research to work and uncover fresh opportunities with targeted screeners built to surface strong, actionable ideas.

- Explore potential opportunities by targeting mispriced quality using these 895 undervalued stocks based on cash flows that spotlight companies trading below their cash flow value.

- Track innovation by monitoring cutting edge opportunities through these 27 AI penny stocks focused on artificial intelligence growth.

- Strengthen your income stream by zeroing in on reliable payers with these 15 dividend stocks with yields > 3% offering yields above 3% supported by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com