Denison Mines (TSX:DML): Valuation Check After New Community Agreements for Wheeler River Project

Denison Mines (TSX:DML) just took an important step at Wheeler River, signing Impact Benefit and Exploration Agreements that secure formal consent and long term cooperation from Métis Nation Saskatchewan and multiple local communities.

See our latest analysis for Denison Mines.

Those agreements land at a time when momentum is clearly building, with the share price at $3.82 after a strong year to date share price return and a standout multi year total shareholder return that suggests investors increasingly see Wheeler River as a de risked growth story.

If this kind of project progress has your attention, it could be worth seeing what else is moving in energy and resources via fast growing stocks with high insider ownership.

With Denison still trading at a sizeable discount to consensus targets despite multi year returns and pivotal de risking agreements now in place, should investors see current levels as a fresh entry point, or assume the market is already pricing in future growth?

Price-to-Book of 8.5x: Is it justified?

On a price-to-book basis, Denison Mines looks expensive at CA$3.82 per share, trading at a materially richer valuation than the wider Canadian oil and gas group.

The price-to-book ratio compares the market value of the equity to its net asset value. This measure is particularly relevant for asset heavy, resource focused businesses like uranium developers. At 8.5 times book value, investors are effectively paying a substantial premium to the accounting value of Denison's assets, implying strong expectations for Wheeler River and the broader project pipeline.

Set against the Canadian oil and gas industry average multiple of 1.6 times book, Denison's valuation stands out as aggressively higher. This reflects both sector specific uranium optimism and company specific growth expectations. However, relative to a narrower group of peers with similar growth profiles, the stock screens as good value on the same 8.5 times book basis versus a peer average of 52.3 times, underlining just how widely valuations can vary within the space.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 8.5x (OVERVALUED)

However, substantial execution and permitting risks remain, and any prolonged uranium price weakness could quickly challenge the optimistic growth narrative around Wheeler River.

Find out about the key risks to this Denison Mines narrative.

Another view: our DCF estimate

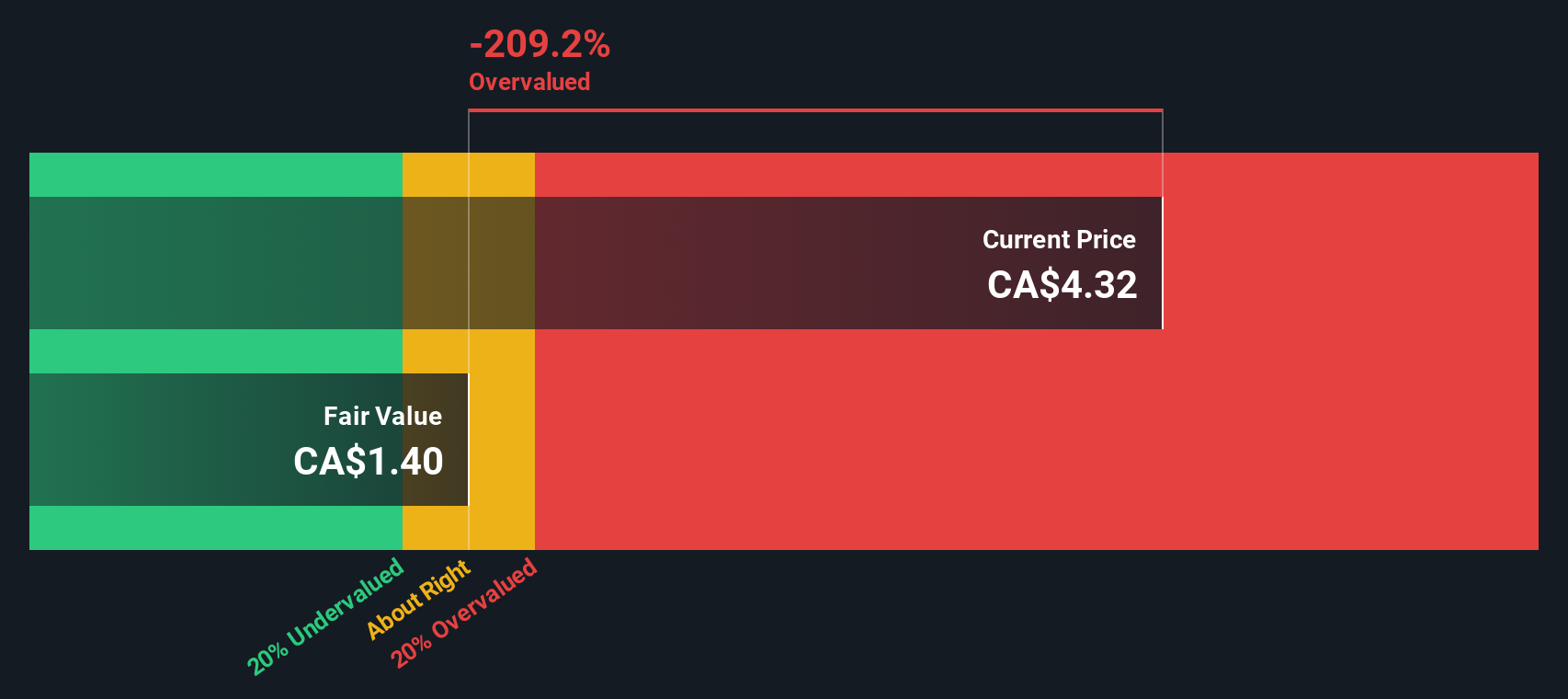

Our DCF model paints a starker picture, suggesting fair value sits closer to CA$1.39, well below the current CA$3.82 share price. That implies Denison could be materially overvalued on cash flow assumptions, so are investors leaning too heavily on long term uranium optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denison Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 895 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denison Mines Narrative

If you see the story differently or want to stress test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Denison Mines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with one uranium name, sharpen your edge by using the Simply Wall St Screener to hunt fresh opportunities before the market catches on.

- Capture mispriced potential by scanning these 895 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Ride powerful sector trends by targeting income opportunities across these 15 dividend stocks with yields > 3% offering yields that can boost total returns.

- Position early in transformative themes by focusing on these 27 AI penny stocks shaping the next era of intelligent technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com