TSX Penny Stock Gems: Homerun Resources Among 3 Compelling Picks

As 2025 draws to a close, Canadian markets have experienced robust growth, with the TSX delivering impressive double-digit gains. In such a thriving market landscape, investors often look beyond established giants to uncover hidden opportunities in lesser-known areas. Penny stocks, though an outdated term, still represent intriguing prospects for those seeking growth potential at lower price points. In this article, we explore three compelling penny stocks that stand out for their strong fundamentals and potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.35M | ✅ 3 ⚠️ 3 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.11 | CA$21.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.33 | CA$251.96M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.22 | CA$122.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.445 | CA$3.72M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.33 | CA$49.57M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.22 | CA$811.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.16 | CA$160.29M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.10 | CA$198.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 393 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Homerun Resources (TSXV:HMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Homerun Resources Inc. is involved in the exploration and development of mineral properties in Canada and Brazil, with a market cap of CA$73.71 million.

Operations: No revenue segments have been reported for Homerun Resources Inc.

Market Cap: CA$73.71M

Homerun Resources Inc., with a market cap of CA$73.71 million, is pre-revenue and currently unprofitable, reporting minimal sales of CA$727K for the past year. The company has improved its financial position by raising additional capital recently through private placements, although its short-term assets (CA$1.2M) fall short of covering short-term liabilities (CA$1.6M). Despite having more cash than total debt, Homerun faces challenges with a negative return on equity and increasing losses over the past five years at 61.1% annually. Management's inexperience may impact strategic direction as they navigate these hurdles.

- Navigate through the intricacies of Homerun Resources with our comprehensive balance sheet health report here.

- Learn about Homerun Resources' historical performance here.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China with a market cap of CA$172.04 million.

Operations: The company generates $82.65 million from its activities in exploring, developing, and operating mining properties.

Market Cap: CA$172.04M

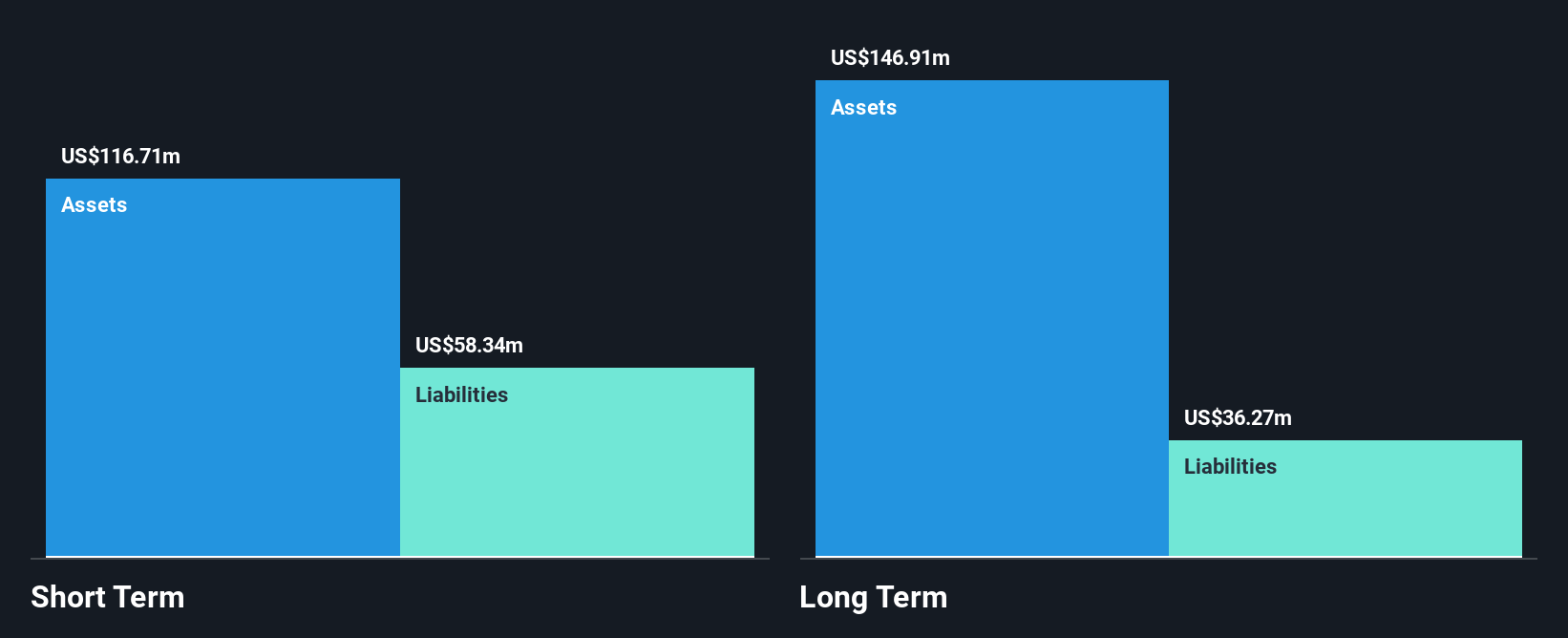

Majestic Gold Corp., with a market cap of CA$172.04 million, has shown resilience despite operational challenges. The company reported sales of US$63.66 million for the first nine months of 2025, reflecting growth from the previous year, although net income declined to US$6.89 million from US$8.58 million due to increased costs and temporary mine suspensions in China for safety permit renewals and regulatory compliance after an accident. Despite these hurdles, Majestic maintains a strong financial position with more cash than debt and sufficient short-term assets to cover liabilities, offering some stability amidst its volatile mining operations environment.

- Jump into the full analysis health report here for a deeper understanding of Majestic Gold.

- Understand Majestic Gold's track record by examining our performance history report.

Viscount Mining (TSXV:VML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Viscount Mining Corp. is involved in the evaluation and exploration of mineral properties in the United States, with a market cap of CA$104.74 million.

Operations: Viscount Mining Corp. does not have any reported revenue segments.

Market Cap: CA$104.74M

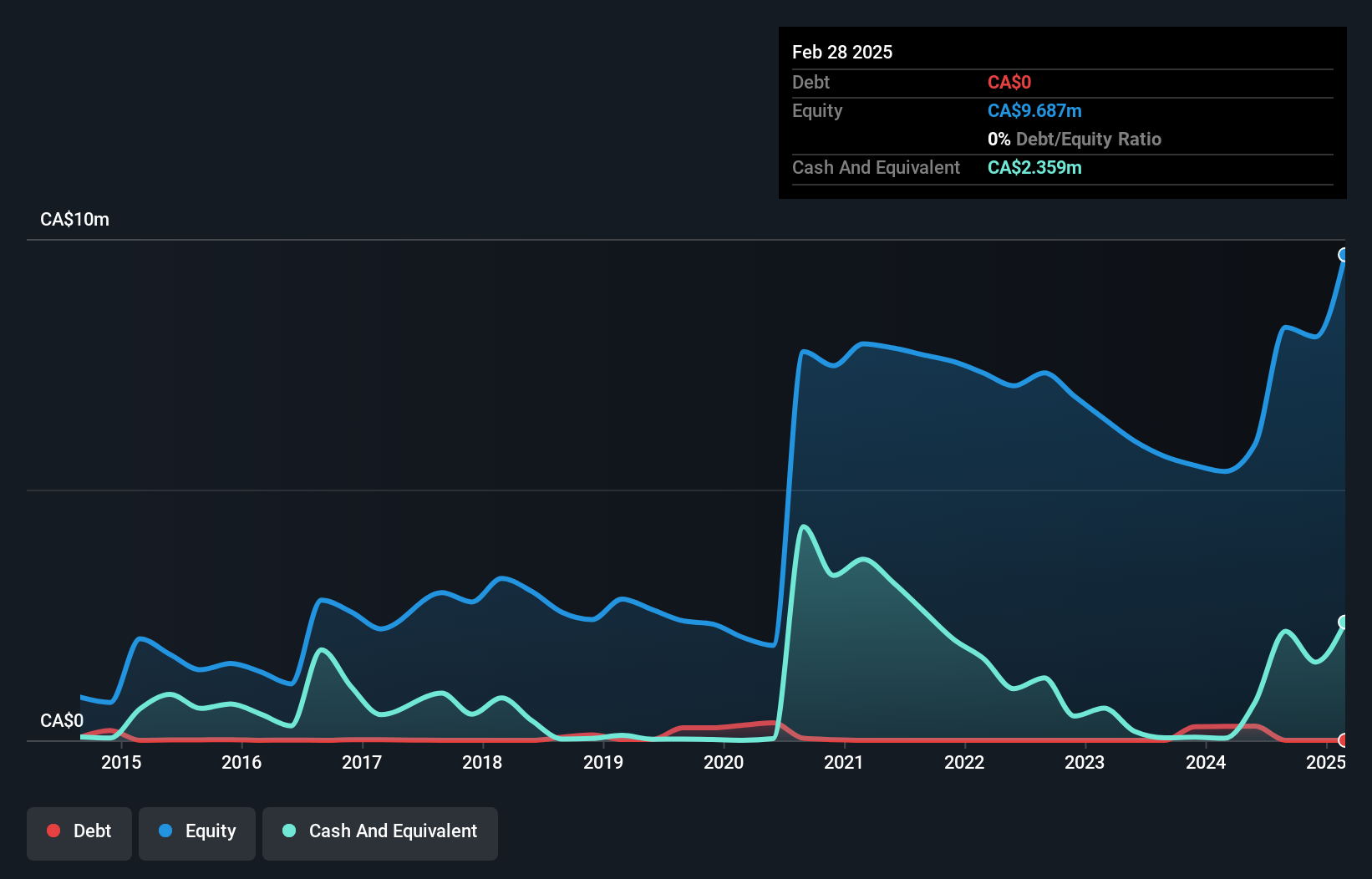

Viscount Mining Corp., with a market cap of CA$104.74 million, is currently pre-revenue and unprofitable but has managed to reduce its losses by 9.4% annually over the past five years. The company is debt-free and maintains more short-term assets (CA$1.7 million) than liabilities (CA$544,100), although it faces less than a year of cash runway based on current free cash flow trends. Despite being dropped from the S&P/TSX Venture Composite Index in October 2025, Viscount benefits from an experienced board and management team, with no significant shareholder dilution occurring in the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Viscount Mining.

- Examine Viscount Mining's past performance report to understand how it has performed in prior years.

Make It Happen

- Get an in-depth perspective on all 393 TSX Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com