Is QuidelOrtho A Bargain After Recent 39.1% Price Surge?

- Wondering if QuidelOrtho at around $27 a share is a beaten down opportunity or a value trap? You are not alone. This stock has been on a wild ride and now looks cheap enough to raise eyebrows.

- In the very short term the market has cooled slightly, with a 0.3% dip over the last week. That comes after a sharp 39.1% jump over the past month, even though the stock is still down 39.1% year to date and 33.9% over the last year.

- Those swings are happening against a backdrop of ongoing integration of Quidel and Ortho Clinical Diagnostics, strategic refocusing on core diagnostics platforms, and renewed investor debate about how durable demand will be for its testing portfolio. At the same time, sentiment has been shifting as the market reassesses the company’s role in a post pandemic testing environment and what its long term growth runway really looks like.

- Despite the messy share price history, QuidelOrtho actually scores a 5/6 valuation score on our checks, suggesting it screens as undervalued on most fronts. Next we will unpack what that means across different valuation approaches and hint at an even more powerful way to think about value that we will come back to at the end of the article.

Find out why QuidelOrtho's -33.9% return over the last year is lagging behind its peers.

Approach 1: QuidelOrtho Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in dollar terms.

For QuidelOrtho, the latest twelve month Free Cash Flow is negative at about $154 million, reflecting integration spending and a still normalizing testing environment. Analysts and Simply Wall St projections, using a 2 Stage Free Cash Flow to Equity approach, anticipate a sharp turnaround, with Free Cash Flow expected to rise to roughly $478 million by 2028 and then increase steadily through 2035.

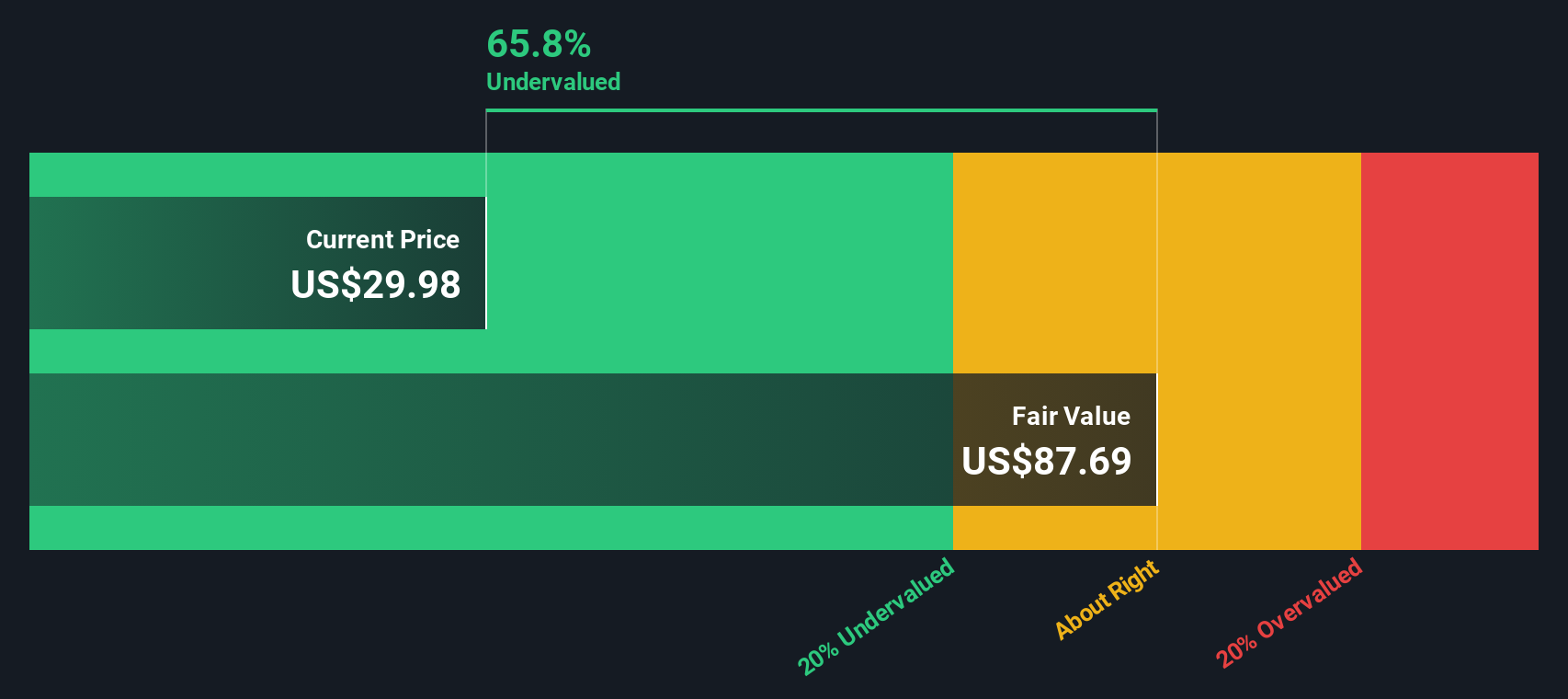

When all those future cash flows are discounted back, the DCF model points to an intrinsic value of about $82.65 per share. Compared with a recent share price around $27, that indicates the stock is trading at roughly a 66.8% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests QuidelOrtho is undervalued by 66.8%. Track this in your watchlist or portfolio, or discover 897 more undervalued stocks based on cash flows.

Approach 2: QuidelOrtho Price vs Sales

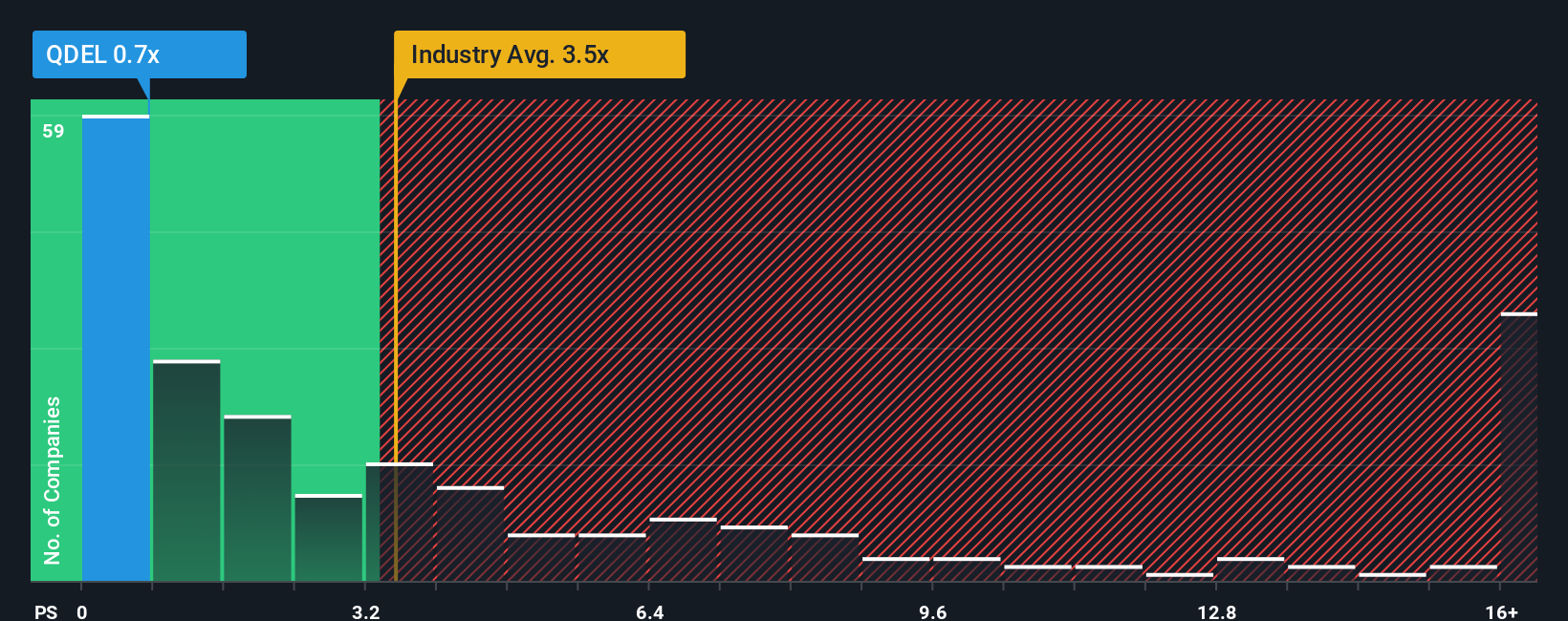

For companies where earnings are volatile or temporarily depressed, the Price to Sales, or P S, ratio is often a more reliable yardstick because revenue tends to be more stable and less affected by one off items or integration noise.

In general, higher growth and lower risk justify a higher normal multiple, while slower growth or higher uncertainty should pull that multiple down. QuidelOrtho currently trades at about 0.69x sales, which is dramatically below both the Medical Equipment industry average of roughly 3.45x and a broader peer group that averages around 8.37x.

Simply Wall St’s Fair Ratio is a proprietary estimate of what QuidelOrtho’s P S should be, given its growth outlook, profit margins, risk profile, industry and market cap. This tailored benchmark is more informative than a simple peer or industry comparison because it adjusts for the company’s specific fundamentals rather than assuming it deserves the same multiple as everyone else. For QuidelOrtho, the Fair Ratio is about 1.33x, still well above the current 0.69x, which indicates that the market is currently pricing the shares below the level implied by those fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your QuidelOrtho Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where millions of investors connect the story they believe about a company, such as QuidelOrtho’s new cardiac and respiratory test approvals or lingering post pandemic pressures, to their own assumptions for future revenue, earnings and margins. These inputs then flow into a fair value estimate that they can compare with today’s share price to help decide whether to buy, hold or sell. The platform automatically keeps each Narrative up to date as fresh news or earnings arrive. This means that a highly optimistic view, for example expecting QuidelOrtho to compound revenue above 3 percent annually with margins above 13 percent and a future PE near 9 times, can sit right alongside a more cautious view anchored closer to flat growth, lower profitability and a fair value nearer 26 dollars. As an investor, this gives you a clear and dynamic way to see where you stand on the spectrum before you act.

Do you think there's more to the story for QuidelOrtho? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com