Pacira BioSciences (PCRX): Valuation Check After New Iovera Clinical Data and Smart Tip FDA Clearance

Pacira BioSciences (PCRX) just shared new pilot study data on its ioveradeg cryoneurolysis system in chronic low back pain, alongside fresh FDA clearance for a Smart tip designed for deeper lumbar nerve access.

See our latest analysis for Pacira BioSciences.

That backdrop helps explain why the share price has climbed to around $24.77, with a strong year to date share price return but a weak five year total shareholder return. This suggests recent momentum is rebuilding after a tough few years.

If this kind of pain focused innovation interests you, it is worth also exploring other potential opportunities among healthcare stocks to see what else might fit your portfolio.

Yet with Pacira shares still trading below analyst targets despite steady revenue and earnings growth, investors now face a key question: is this renewed momentum a genuine buying opportunity, or has the market already priced in future gains?

Most Popular Narrative: 14.6% Undervalued

With Pacira BioSciences last closing at $24.77 against a narrative fair value of $29, the market sits below what forward assumptions imply.

The analysts have a consensus price target of $29.0 for Pacira BioSciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $23.0.

Want to see what kind of revenue trajectory and margin reset could justify this gap, and how a future earnings multiple ties it all together? Dive in.

Result: Fair Value of $29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if EXPAREL adoption stalls, or if pricing pressure and slower formulary wins curb the expected revenue and margin expansion.

Find out about the key risks to this Pacira BioSciences narrative.

Another View: Rich on Earnings

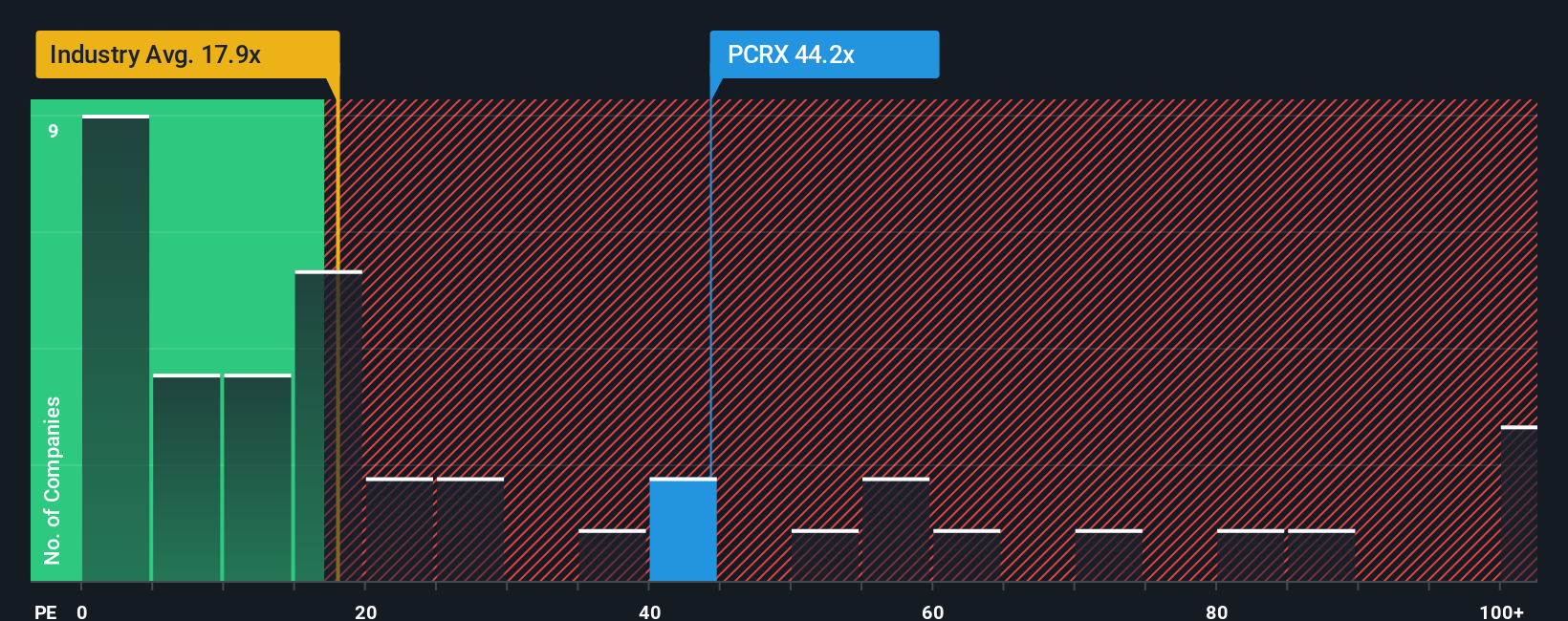

On earnings, Pacira looks far less cheap. The stock trades at about 49.7 times earnings, versus 19.5 times for the US pharma industry and a fair ratio of 21.7 times. If sentiment cools and that gap closes, could multiple compression offset the upside from growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pacira BioSciences Narrative

If your view differs or you would rather dig into the numbers yourself, you can build a complete Pacira story in just minutes: Do it your way.

A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing angles?

Do not stop at a single stock when you can quickly scan entire markets using the Simply Wall St Screener, built to surface fresh, data driven opportunities.

- Capitalize on mispriced businesses by running through these 897 undervalued stocks based on cash flows, which pair solid fundamentals with attractive entry points.

- Catch the next wave of market innovation as you assess these 26 AI penny stocks, transforming industries with automation, machine learning, and scalable digital platforms.

- Secure potential long term income streams by reviewing these 15 dividend stocks with yields > 3%, which combine meaningful yields with the balance sheets to back them up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com