Alexander’s (ALX) Valuation After Rego Park II Refinancing and New $175 Million Interest-Only Loan

Alexander's (ALX) just reshaped its balance sheet by refinancing the Rego Park II shopping center with a $175 million interest only loan maturing in 2030, while trimming its prior debt load.

See our latest analysis for Alexander's.

Against that backdrop, Alexander's 10.1% year to date share price return and 9.7% one year total shareholder return suggest steady but not explosive momentum, with the recent refinancing potentially easing some balance sheet risk concerns.

If you are weighing how this kind of balance sheet move compares with other opportunities, it could be worth exploring fast growing stocks with high insider ownership as a curated way to spot the next wave of compelling stories.

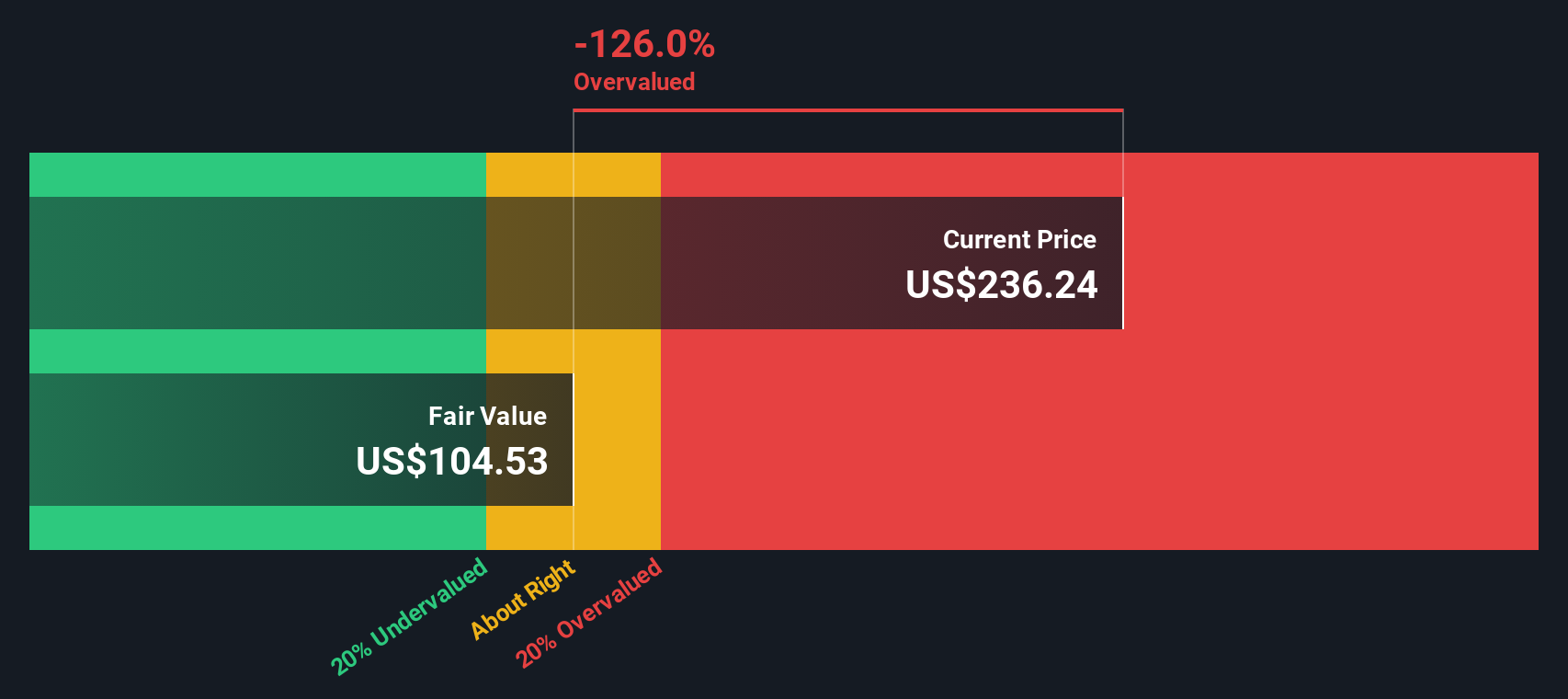

Yet with modest top line growth, weaker earnings and a share price sitting above analyst targets, investors face a dilemma: is Alexander's quietly undervalued after this refinancing, or is the market already pricing in any future upside?

Price-to-Earnings of 30.1x: Is it justified?

Alexander's last closed at $215.99, and on a price-to-earnings ratio of 30.1x it trades at a premium to much of the retail REIT universe.

The price-to-earnings multiple compares the current share price to the company’s earnings per share, giving a quick read on how much investors are paying for each dollar of profit. For a mature, income focused REIT with modest revenue growth and forecast earnings declines, such a rich multiple suggests the market is assigning a high value to its existing portfolio and perceived stability rather than to rapid future expansion.

Compared with the US Retail REITs industry average P/E of 26.4x, Alexander's looks plainly more expensive, and it also screens above the estimated fair price-to-earnings ratio of 26.8x that our models suggest as a more reasonable level. That combination points to investors paying up for exposure here, even relative to sector peers that already tend to command income premium valuations.

Explore the SWS fair ratio for Alexander's

Result: Price-to-Earnings of 30.1x (OVERVALUED)

However, the downside risk is clear, with earnings contracting, the share price above analyst targets, and only modest revenue growth supporting that elevated valuation.

Find out about the key risks to this Alexander's narrative.

Another View: DCF Says the Premium Is Even Richer

While the earnings multiple already looks stretched, our DCF model paints an even tougher picture. It puts fair value around $147.45 versus today’s $215.99, which implies Alexander's may be significantly overvalued. Is the market overpaying for perceived safety, or seeing something models miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alexander's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alexander's Narrative

If this perspective does not fully align with your own view, or you would rather dig into the numbers yourself, you can build a personalised take in just a few minutes, Do it your way.

A great starting point for your Alexander's research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunities with focused stock lists from the Simply Wall Street Screener, built to uncover what most investors overlook.

- Tap into income potential with these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow while others wait on capital gains alone.

- Target mispriced quality by using these 897 undervalued stocks based on cash flows to pinpoint companies where the market has not yet caught up with their cash flow strength.

- Ride structural tailwinds in digital assets through these 80 cryptocurrency and blockchain stocks, so you are positioned ahead of the next wave of blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com