ASX Penny Stocks To Consider In December 2025

As the Australian market experiences a mixed performance with materials leading and IT and industrials lagging, investors are keenly observing sector shifts. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$121.8M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.605 | A$72.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$439.55M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.21 | A$240.79M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Steadfast Group (ASX:SDF) | A$5.03 | A$5.52B | ✅ 5 ⚠️ 3 View Analysis > |

| West African Resources (ASX:WAF) | A$2.74 | A$3.17B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.90 | A$139.61M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 424 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alfabs Australia (ASX:AAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alfabs Australia Limited operates in the mining equipment and engineering sector within Australia, with a market cap of A$121.80 million.

Operations: The company's revenue is derived from its mining segment, contributing A$45.40 million, and its engineering division, generating A$46.34 million.

Market Cap: A$121.8M

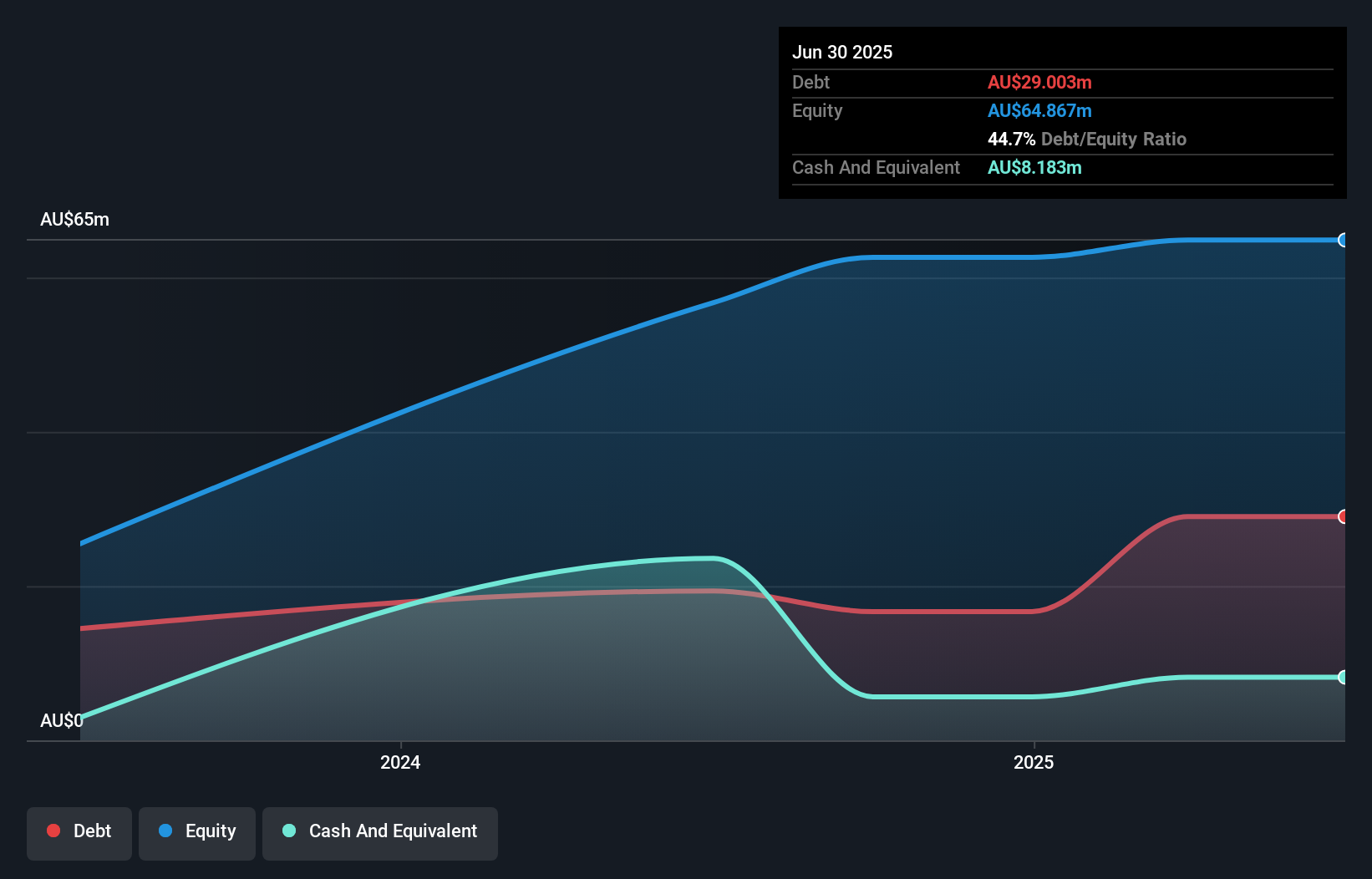

Alfabs Australia Limited operates within the mining equipment and engineering sectors, with a market cap of A$121.80 million. The company has shown strong earnings growth, up 242.5% over the past year, surpassing industry averages. Despite this growth, its Return on Equity remains low at 18.8%. Alfabs' debt is well managed with a net debt to equity ratio of 32.1%, and both short-term and long-term liabilities are covered by assets. Recent executive changes include the appointment of Peter White as CFO in January 2026, bringing extensive experience that could support strategic growth initiatives moving forward.

- Navigate through the intricacies of Alfabs Australia with our comprehensive balance sheet health report here.

- Assess Alfabs Australia's future earnings estimates with our detailed growth reports.

Bell Financial Group (ASX:BFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bell Financial Group Limited provides full-service and online broking, corporate finance, and financial advisory services to a diverse clientele across Australia, the United States, the United Kingdom, Hong Kong, and Kuala Lumpur with a market cap of A$404.14 million.

Operations: Bell Financial Group's revenue is derived from three primary segments: Broking (A$150.73 million), Products & Services (A$53.21 million), and Technology & Platforms (A$32.15 million).

Market Cap: A$404.14M

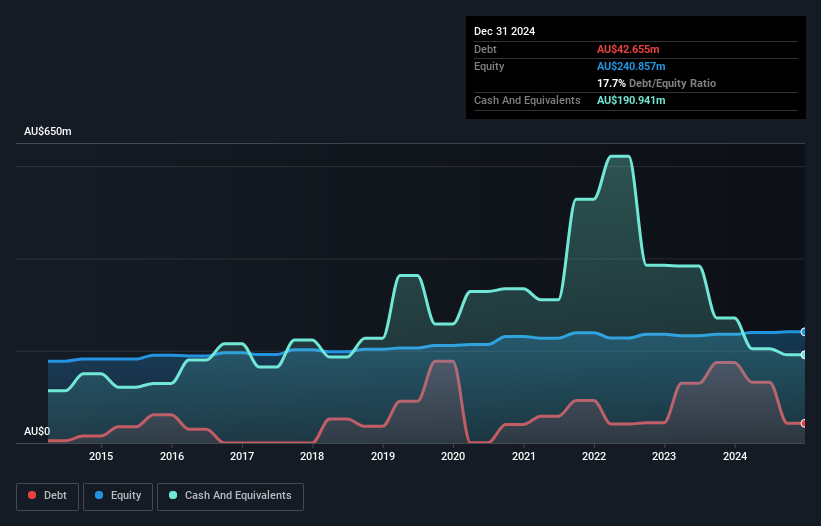

Bell Financial Group, with a market cap of A$404.14 million, offers diversified financial services across several regions. Despite its broad reach, the company has faced challenges with negative earnings growth of 21.4% over the past year and a declining net profit margin from 12.2% to 9.9%. The dividend yield of 6.35% is not adequately covered by earnings, raising sustainability concerns. However, Bell Financial's short-term assets surpass both its short- and long-term liabilities significantly, providing some financial stability. The management team and board are seasoned with average tenures of 3.5 and 5.8 years respectively, supporting operational continuity amidst these challenges.

- Take a closer look at Bell Financial Group's potential here in our financial health report.

- Learn about Bell Financial Group's future growth trajectory here.

Steadfast Group (ASX:SDF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Steadfast Group Limited offers general insurance brokerage services across Australasia, Asia, and Europe, with a market cap of A$5.52 billion.

Operations: The company's revenue is primarily derived from its Insurance Intermediary segment, which generated A$1.68 billion, complemented by A$123.5 million from Premium Funding services.

Market Cap: A$5.52B

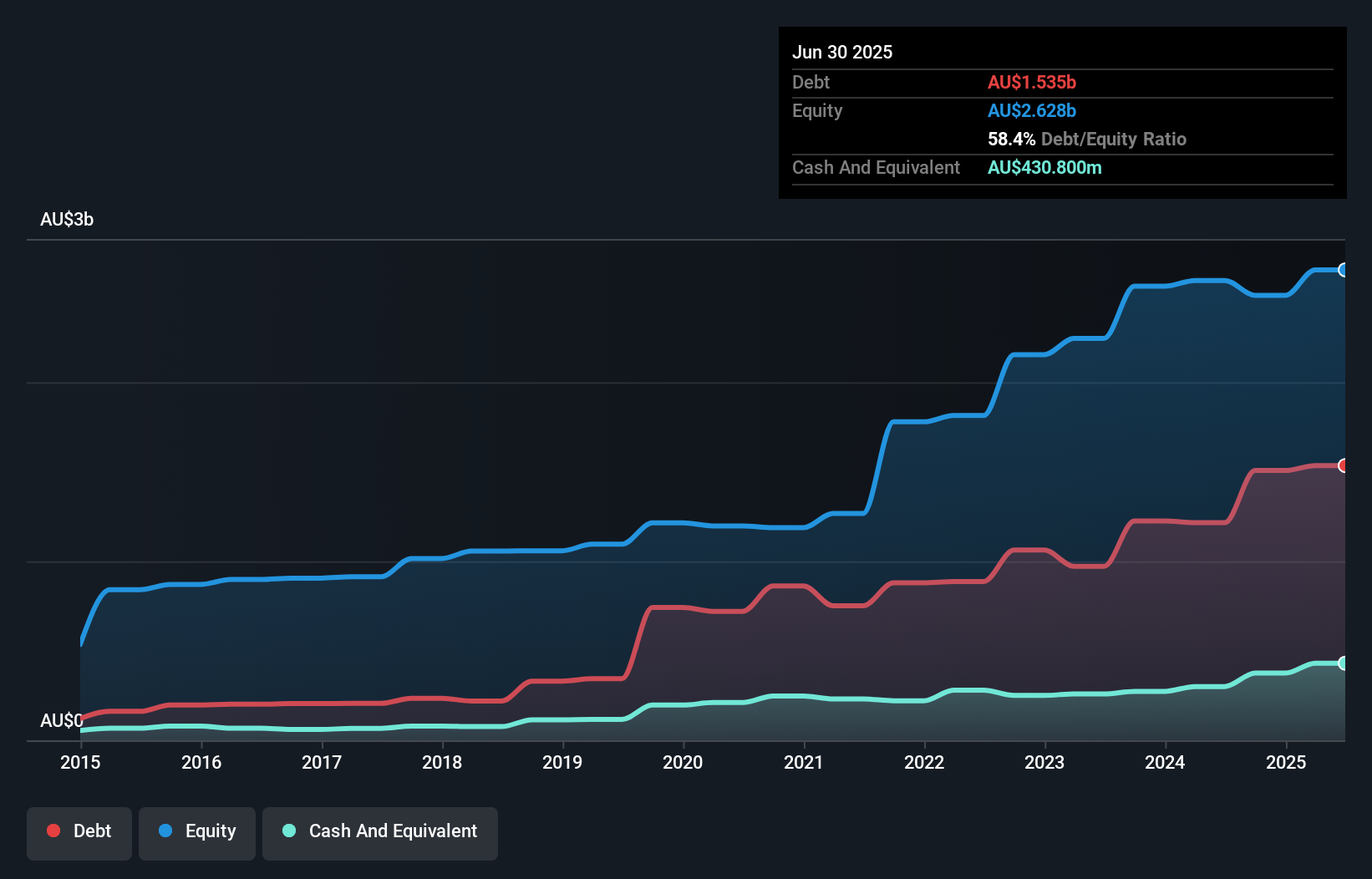

Steadfast Group, with a market cap of A$5.52 billion, demonstrates strong financial performance despite recent challenges. The company has shown significant earnings growth over the past year at 46.9%, surpassing industry averages, and maintains a net profit margin improvement from 13% to 16.2%. While its debt level remains high with a net debt to equity ratio of 42%, it is well covered by operating cash flow at 32.5%. Recent executive changes saw Robert Kelly AM return as Managing Director & CEO following an investigation, potentially stabilizing leadership dynamics amidst ongoing strategic developments.

- Unlock comprehensive insights into our analysis of Steadfast Group stock in this financial health report.

- Gain insights into Steadfast Group's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Click this link to deep-dive into the 424 companies within our ASX Penny Stocks screener.

- Interested In Other Possibilities? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com