Is Chipotle Attractively Priced After a 48% Slide and Modest Valuation Discount?

- If you are wondering whether Chipotle Mexican Grill is finally priced for perfection or quietly offering value again, you are not alone. This stock has been on many watchlists lately.

- After a volatile stretch that includes a 10.3% gain over the last month but a steep 48.0% slide over the past year, Chipotle sits at an intriguing crossroads between recovery story and value trap.

- Recent headlines have focused on Chipotle's continued store expansion, investments in digital ordering, and initiatives to streamline operations. These developments help explain shifting investor sentiment around its long term growth runway. At the same time, analysts and commentators are debating whether competitive pressures and changing consumer spending patterns will limit how much of that growth translates into sustainable shareholder returns.

- Our valuation checks give Chipotle a 3/6 value score, which puts it squarely in the "interesting, but not obviously cheap" camp. In the next sections we will walk through the main valuation approaches investors are using today and introduce a more powerful way to tie them all together by the end of the article.

Find out why Chipotle Mexican Grill's -48.0% return over the last year is lagging behind its peers.

Approach 1: Chipotle Mexican Grill Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future, then discounting those cash flows back to their value in todays dollars.

For Chipotle Mexican Grill, the latest twelve month Free Cash Flow stands at roughly $1.57 Billion. Analysts expect this figure to keep rising, with projections, and Simply Wall St extrapolations beyond the typical analyst horizon, pointing to Free Cash Flow of about $3.51 Billion by 2035. The two stage Free Cash Flow to Equity model uses these cash flow projections, including detailed estimates through 2029 and gradually slowing growth thereafter, to build a long term picture of the companys earning power.

When those future cash flows are discounted back to today, the model produces an intrinsic value that implies the stock is trading at a 4.9% discount to its estimated fair value. In other words, based purely on cash flow projections, Chipotle looks only slightly undervalued and broadly in line with its underlying fundamentals.

Result: ABOUT RIGHT

Chipotle Mexican Grill is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Chipotle Mexican Grill Price vs Earnings

For profitable, established companies like Chipotle, the Price to Earnings ratio is often the cleanest shorthand for how much investors are willing to pay for each dollar of current earnings. It naturally ties today’s share price to the business profits that shareholders ultimately rely on.

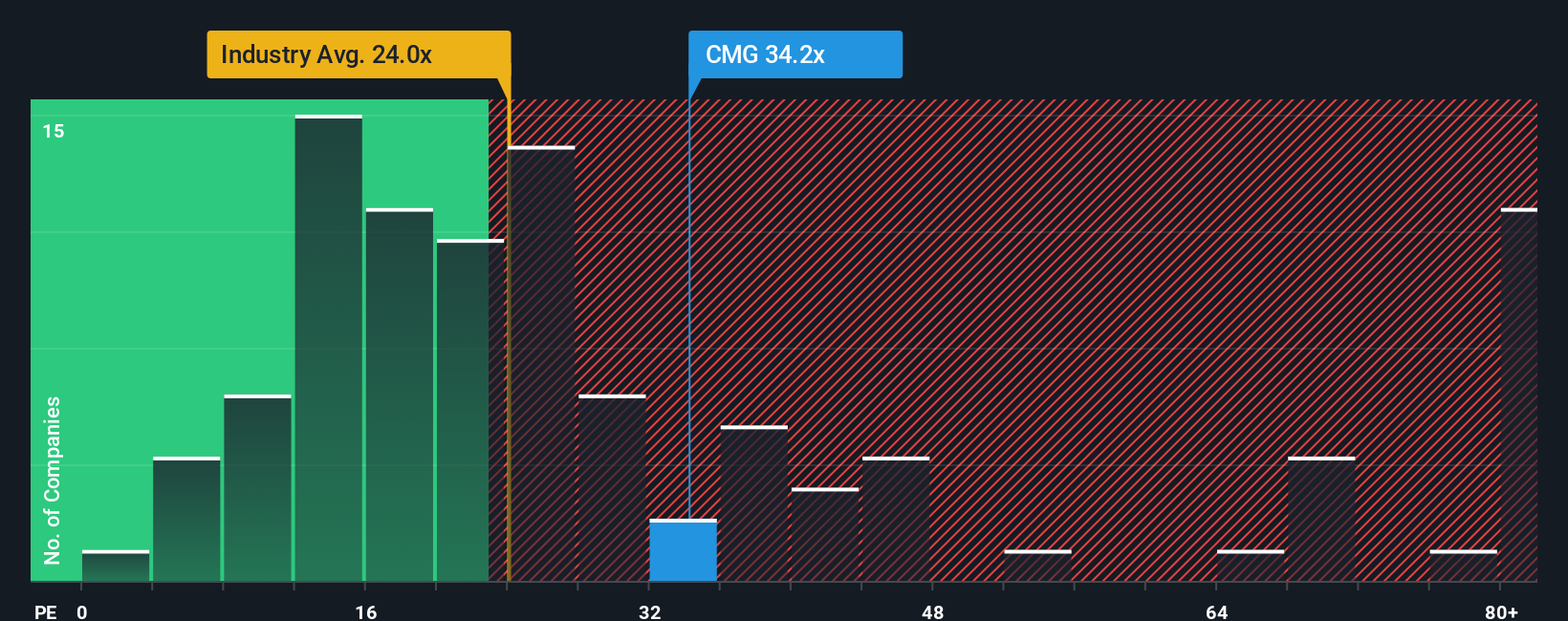

A higher or lower PE ratio usually reflects a mix of growth expectations and perceived risk. Fast growing, resilient businesses can justify a higher normal PE, while slower or riskier names typically trade on a lower multiple. Chipotle currently trades on about 29.0x earnings, above the broader Hospitality industry average of roughly 23.1x, but slightly below its direct peer group, which sits nearer 30.4x.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE you would reasonably expect once you factor in Chipotle’s earnings growth outlook, margins, risk profile, industry and market cap. On this basis, Chipotle’s Fair Ratio is 26.1x, a bit below where the stock trades today. That suggests the market is paying a modest premium to the level implied by its fundamentals, leaving the shares looking slightly expensive on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chipotle Mexican Grill Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you describe the story you believe about Chipotle Mexican Grill. You can then translate that story into assumptions for future revenue, earnings and margins, and connect those assumptions to a concrete fair value that you can compare to today’s price to decide whether to buy, hold or sell. As a bonus, your Narrative automatically updates as new news or earnings arrive and can look very different from other investors. For example, one optimistic Chipotle Narrative on the platform assumes robust 2026 unit expansion, double digit annual revenue growth and a fair value near $65 per share. A more cautious Narrative leans on slower growth, tighter margins and a fair value closer to $46, showing how the same company can look like a bargain or a hold depending on the story and forecast you think is most realistic.

Do you think there's more to the story for Chipotle Mexican Grill? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com